Bank earnings, inflation — What you need to know for the week ahead

The labor market is still growing and the trade war has begun.

A holiday-shortened trading week for investors ended up bringing markets two of the biggest pieces of news this month, as the June jobs report showed the U.S. job-creating machine isn’t slowing down while the Trump administration formally imposed tariffs on $34 billion worth of Chinese imports.

“In our view, the healthy rate of hiring suggests that labor markets are, as of now, resilient to the protectionist trade policies put in place by the Trump administration,” said Michael Gapen, an economist at Barclays. “This may not be the case going forward, and we will remain watchful for signs that business confidence is waning and hiring and spending plans are being postponed.”

In the weeks ahead, second quarter earnings season will begin to ramp up and economic data reflecting a broader picture of the economy in May and June will roll in. How trade did or did not effect the economy in the rearview will be tracked by the investors closely, but with Trump’s trade war appearing to be picking up steam rather than winding down, the months ahead will be full of uncertainty.

Turning to the calendar for the week ahead, on the economics side the biggest report of the week will be Thursday’s reading on consumer prices. This report should show that when stripping out the cost of food and energy, consumer prices were up 2.3% against last year in June, above the Fed’s 2% inflation target.

Other notable economic reports due out include the NFIB’s reading on small business optimism, the May report on job openings, and Friday’s reading on consumer sentiment from the University of Michigan.

Corporate earnings will also make a return after a week off, with big U.S. banks getting in the mix as second quarter earnings season gets underway. On Friday, JP Morgan (JPM), Citi (C), Wells Fargo (WFC), and PNC Financial (PNC) will all report results before the market open. Other S&P 500 members set to report earnings this week include PepsiCo (PEP) and Delta Air Lines (DAL).

Economic calendar

Monday: Consumer credit balances, May (+$12 billion expected; $9.26 billion previously)

Tuesday: NFIB small business optimism, June (105.8 expected; 107.8 previously); Job openings and labor turnover survey, May (6.66 million job open expected; 6.7 million jobs open previously)

Wednesday: Producer prices, June (+0.2% expected; +0.5% previously)

Thursday: Initial jobless claims (226,000 expected; 231,000 previously); Consumer price index, June (+0.2% month-on-month change expected; +0.2% previously); “Core” consumer price index, June (+2.3% year-on-year change expected; +2.2% previously)

Friday: Import price index, June (+0.1% expected; +0.6% previously); University of Michigan consumer sentiment, preliminary reading (98.0 expected; 98.2 previously)

Where are all the truck drivers?

There is a truck driver shortage in the U.S.

At least according to multiple media reports, the American Trucking Association, and the cost of shipping goods on trucks.

Jobs data released Friday, however, doesn’t tell quite the same story of an industry in crisis.

Employment in the sector only just topped the pace of overall job growth in the economy last month — employment in the trucking business rose 1.7% over last year in June while the overall economy saw a 1.6% increase in workers.

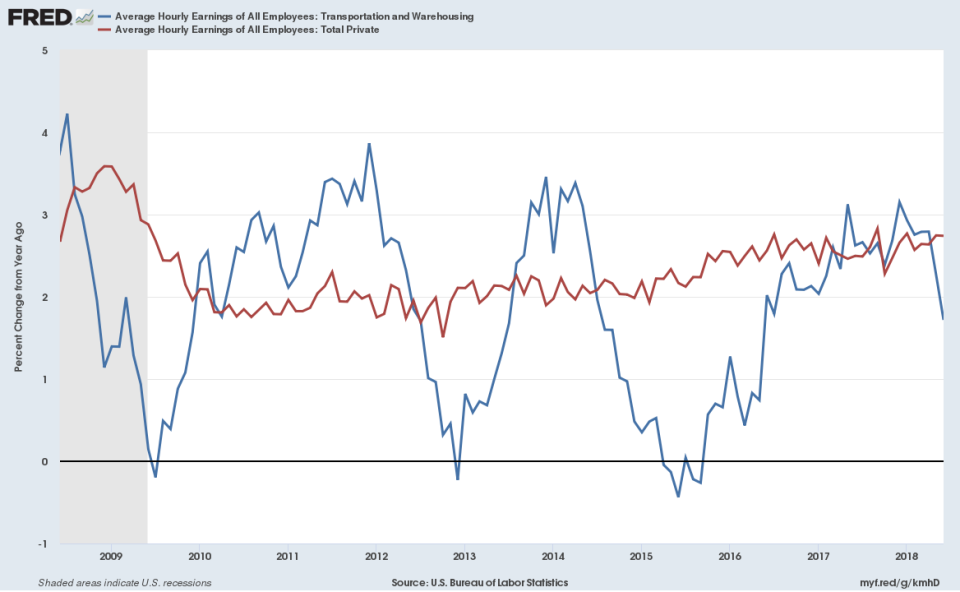

Meanwhile, wage increases in the transportation and warehousing industry have risen less than the rest of the private sector in the last two months. And though this broader sector-level read on wages doesn’t isolate truck drivers the way employment data do, one would still expect to see the industry outperforming the rest of the labor market.

In a note to clients following Friday’s jobs report, Michael Feroli, an economist at JP Morgan, wrote that as wage growth disappointed expectations in June, “the contrast with common anecdotes about pay growth is striking, particularly when one digs down and sees wages in industries like long-haul freight trucking up only 1.4% over a year ago.”

We’ve highlighted how economic data that hinges on qualitative evaluations of the economy like the Fed’s Beige Book and the NFIB’s small business optimism index have indicated that labor is scarce and wages are likely to go up.

The actual data, then, are either lagging this anecdotal assessment of the economy or the anecdotes are biased in favor of employers who always want the same thing — cheap, available, skilled labor.

Cardiff Garcia, a reporter with NPR’s Planet Money, earlier this week highlighted a series of news articles from 2009, ’10, ’11, and ’12 which suggested that employers wanted to hire more but couldn’t find good workers. In these post-crisis years, no one was talking about an economy overheating.

In recent months, the drop in the unemployment rate, the Fed’s clear desire to raise interest rates, and suggestions that a tight labor market was just on the cusp of causing an acceleration in wages and inflation led to some discussion around whether the economy overheating.

But coming off a month in which an industry reportedly starved for workers raises wages less than the national average and 601,000 people joined the labor force, it seems there is still plenty of slack to take out of a labor market clearly still recovering from the post-crisis recession.

And it’s a reminder to take suggestions that America’s economic culture which made the country the world’s most prosperous in the post World War II-era just magically disappeared with a grain of salt.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Harley-Davidson shows the unintended consequences of Trump’s tariffs

Oil prices won’t hurt the economy until they hit $120 a barrel