Arnold Schneider's Largest Sells of the 2nd Quarter

- By Tiziano Frateschi

Arnold Schneider (Trades, Portfolio), founder of Schneider Capital Management Corp., sold shares of the following stocks during the second quarter:

Warning! GuruFocus has detected 3 Warning Signs with STI. Click here to check it out.

The intrinsic value of STI

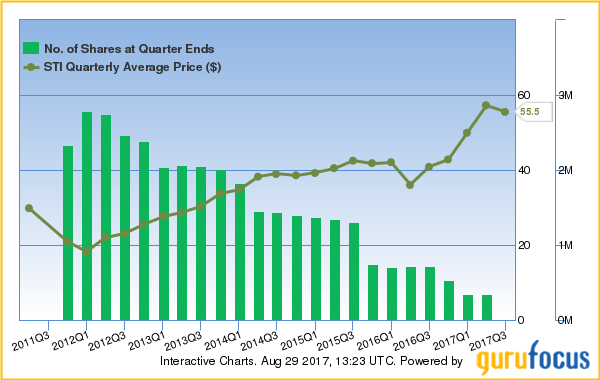

Schneider exited his holding of SunTrust Banks Inc. (STI) with an impact of -3.19% on the portfolio.

The company provides financial services to consumers, businesses and corporate clients.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. While the return on equity (ROE) of 8% is underperforming the sector, the return on assets (ROA) of 0.95% is outperforming 52% of companies in the Global Banks - Regional - U.S. industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.53 is below industry median of 2.09.

The largest shareholder among the gurus is Dodge & Cox with 0.11% of outstanding shares, followed by Hotchkis & Wiley with 0.06%, Steven Cohen (Trades, Portfolio) with 0.06% and David Dreman (Trades, Portfolio) with 0.01%.

The guru's KeyCorp (KEY) holding was reduced by 37.19%. The transaction had an impact of -2.69% on the portfolio.

The financial services company provides retail and commercial banking, investment management and consumer finance services.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The ROE of 7.45% and ROA of 0.88% are underperforming 67% of companies in the Global Banks - Regional - U.S. industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.04 is above the industry median of 2.09.

The T Rowe Price Equity Income Fund (Trades, Portfolio) is the company's largest shareholder among the gurus with 0.84% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.01%, Third Avenue Management (Trades, Portfolio) with 0.08%, Martin Whitman (Trades, Portfolio) with 0.07% and Manning & Napier Advisors Inc. with 0.01%.

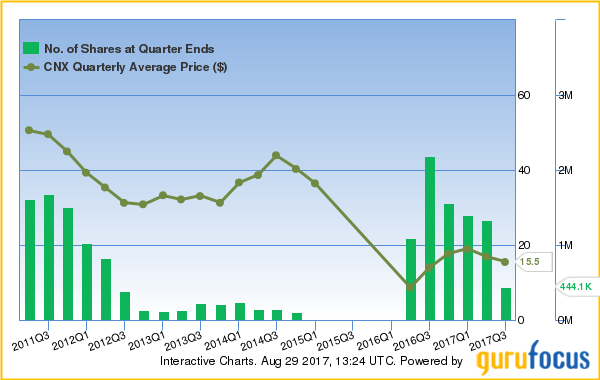

Schneider's Consol Energy Inc. (CNX) stake was reduced 66.62%, impacting the portfolio by -2.48%.

The company's core business is the production of coal and natural gas.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The ROE of -3.80% and ROA of -1.61% are underperforming 63% of companies in the Global Oil and Gas Exploration and Production industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.11 is below the industry median of 0.64.

Mason Hawkins (Trades, Portfolio) is the company's largest guru shareholder with 22.13% of outstanding shares, followed by David Einhorn (Trades, Portfolio) with 9.85%, Cohen with 0.38%, Mario Gabelli (Trades, Portfolio) with 0.3% and Greenblatt with 0.06%.

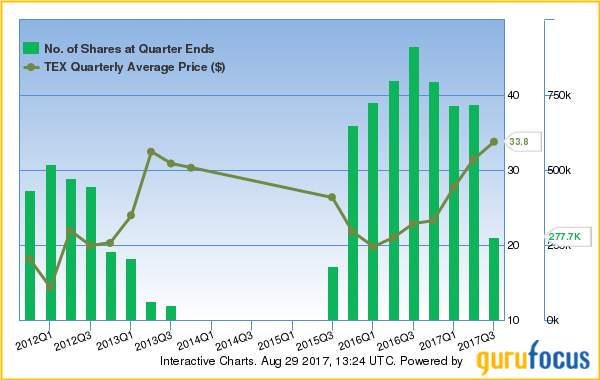

Schneider reduced his holding of Terex Corp. (TEX) by 61.47%, which had an impact of -2.32% on the portfolio.

Terex manufactures construction and materials processing equipment, including cranes, aerial work platforms and rock crushers.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The ROE of -4.39% and ROA of -1.54% are underperforming 85% of companies in the Global Farm and Construction Equipment industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.56 is above the industry median of 0.55.

With 5.31% of outstanding shares, t he company's largest guru shareholder is Richard Pzena (Trades, Portfolio), followed by Barrow, Hanley, Mewhinney & Strauss with 2.66%, Greenblatt with 0.47%, Ken Fisher (Trades, Portfolio) with 0.4%, NWQ Managers (Trades, Portfolio) with 0.29% and Caxton Associates (Trades, Portfolio) with 0.15%.

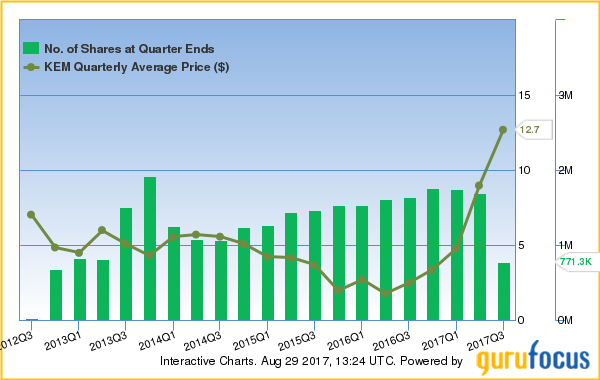

Schneider curbed his Kemet Corp. (KEM) position by 54.28%. The trade an impact of -1.83% on the portfolio.

The company manufactures various types of capacitors that store electricity.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The ROE of 175.12% and ROA of 36.41% are outperforming 76% of companies in the Global Electronic Components industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.67 is below the industry median of 1.52.

Jim Simons (Trades, Portfolio) is the company's largest guru shareholder with 7.95% of outstanding shares, followed by Chuck Royce (Trades, Portfolio) with 4.12% and Greenblatt with 0.14%.

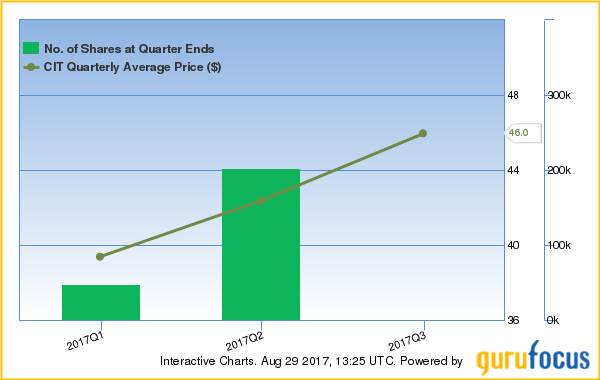

The CIT Group Inc. (CIT) stake was closed. The transaction had an impact of -1.45% on the portfolio.

The bank holding company provides financing, leasing and advisory services to various industries.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The ROE of -6.78% and ROA of -1.08% are underperforming 96% of companies in the Global Banks - Regional - U.S. industry. Financial strength has a rating of 5 out of 10. The cash-debt ratio of 0.60 is below the industry median of 2.09.

The company's largest guru shareholder is First Pacific Advisors (Trades, Portfolio) with 8.08% of outstanding shares, followed by Steven Romick (Trades, Portfolio) with 6.71%, NWQ Managers with 3.02%, Hotchkis & Wiley with 2.49%, Michael Price (Trades, Portfolio) with 0.34% and Howard Marks (Trades, Portfolio) with 0.25%.

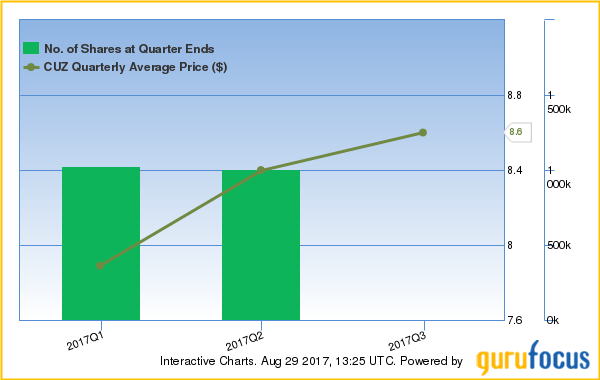

Schneider also sold his Cousins Properties Inc. (CUZ) stake. The trade had an impact of -1.39% on the portfolio.

The real estate investment trust owns and operates office properties in Texas, North Carolina and Georgia.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The ROE of 9.89% and ROA of 6.18% are underperforming 76% of companies in the Global REIT - Diversified industry. Financial strength has a rating of 4 out of 10. The cash-debt ratio of 0.02 is below the industry median 0.06.

With 0.32% of outstanding shares, Simons is the company's largest shareholder among the gurus, followed by Chris Davis (Trades, Portfolio) with 0.3% and Manning & Napier with 0.11%.

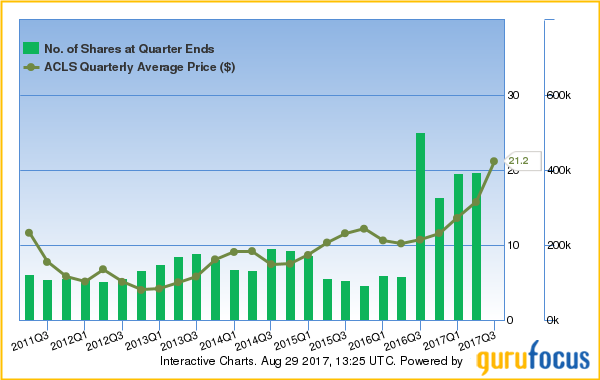

The guru exited his Axcelis Technologies Inc. (ACLS) holding with an impact of -1.24% on the portfolio.

The company produces semiconductors and a wide range of semiconductor equipment and materials.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The ROE of 14.13% and ROA of 9.41% are outperforming 64% of the companies in the Global Semiconductor Equipment & Materials industry. Financial strength has a rating of 7 out of 10. The cash-debt ratio of 2.28 is above the industry median of 1.76.

The company's largest shareholder among the gurus is PRIMECAP Management (Trades, Portfolio) with 10.8% of outstanding shares, followed by Donald Smith (Trades, Portfolio) with 8.44% and Simons with 0.2%.

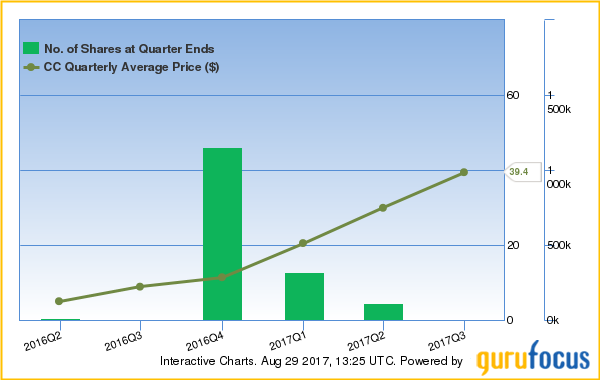

Schneider closed his position in The Chemours Co. (CC). The trade had an impact of -0.73% on the portfolio.

The company produces chemical products like refrigerants and industrial resins. It also develops a wide range of chemical solutions.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. While the ROE of 91.23% is outperforming the sector, the ROA of 4.47% is underperforming 72% of the companies in the Global Specialty Chemicals industry. Financial strength has a rating of 4 out of 10. The cash-debt ratio of 0.38 is below the industry median 0.76.

Einhorn is the company's largest guru shareholder with 1.95% of outstanding shares, followed by Simons with 1.81%, Caxton Associates with 0.05%, Lee Ainslie (Trades, Portfolio) with 0.03% and Paul Tudor Jones (Trades, Portfolio) with 0.02%.

Disclosure: I do not own any shares of any stocks mentioned in this article.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with STI. Click here to check it out.

The intrinsic value of STI