April Top Bear Market Stocks To Look Out For

Defensive investment strategies are those that maintain holdings in safe assets, which include stocks that meet a certain criteria that avoids losses in market value. To do this successfully, there are certain fundamentals that you should look for, which include but are not limited to: financial health, liquidity and reliable earnings capacity. Through my own research I found Nucor, BancorpSouth Bank and Industrias Bachoco. de, which can be a good place for you to start your hunt.

Nucor Corporation (NYSE:NUE)

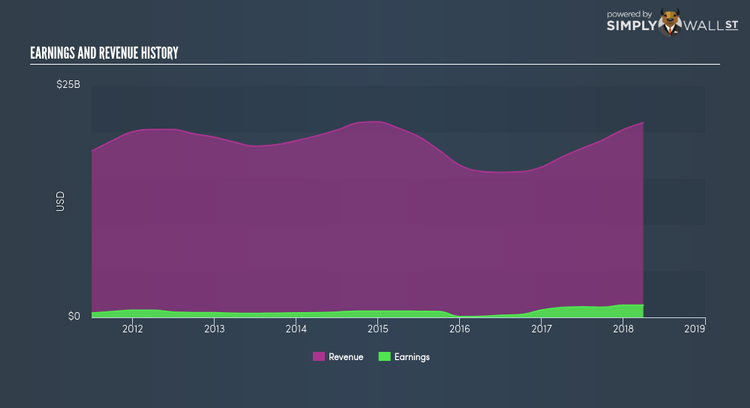

Nucor Corporation manufactures and sells steel and steel products in the United States and internationally. Formed in 1940, and currently run by John Ferriola, the company employs 25,100 people and with the company’s market capitalisation at USD $20.21B, we can put it in the large-cap stocks category.

At present the company has a strong balance sheet , due to the high ratio of current assets to long-term liabilities, which is currently at 1.79x. On top of this, cash flow from operations is 30% of total debt, a strong sign, making an investment in the company a safer bet if the cycle turns against you. Furthermore, at a US$20.21B market cap and a PE ratio of 15.5x, there are active participants in the market for the stock and there could still be room for value in the price, which minimises the potential for rapid share price falls in down cycles. With that has also been annualised earnings growth of 10.05% for the last 5 years and an even greater 23.81% last year, which demonstrates NUE has some of the necessary characteristics to maintain value during a cyclical downfall in the market. Dig deeper into Nucor here.

BancorpSouth Bank (NYSE:BXS)

BancorpSouth Bank operates as a financial holding company for BancorpSouth Bank that provides commercial banking and financial services to individuals and small-to-medium size businesses. Established in 1876, and now led by CEO James Rollins, the company provides employment to 4,305 people and has a market cap of USD $3.31B, putting it in the mid-cap group.

BXS has a robust financial position , with the majority of liabilities made up of low risk funding such as deposits which account for 91.86%. On top of this, the amount of loans that default sits at an insignificant 0.66% of total loan assets, making an investment in the company a safer bet if the cycle turns against you. With BancorpSouth Bank’s market value of US$3.31B , more buyers and sellers exist for the stock than there would be if it were smaller, which reduces risk of firm price declines and allows you to sell without a large loss due to unattractive spreads. The past 5 years show the company has grown earnings by 15.89% annually and recorded a return-on-assets over the previous twelve months that exceeded the industry average, showing BXS is a strong candidate for a bear market based on these defensive tenets. Dig deeper into BancorpSouth Bank here.

Industrias Bachoco, S.A.B. de C.V. (NYSE:IBA)

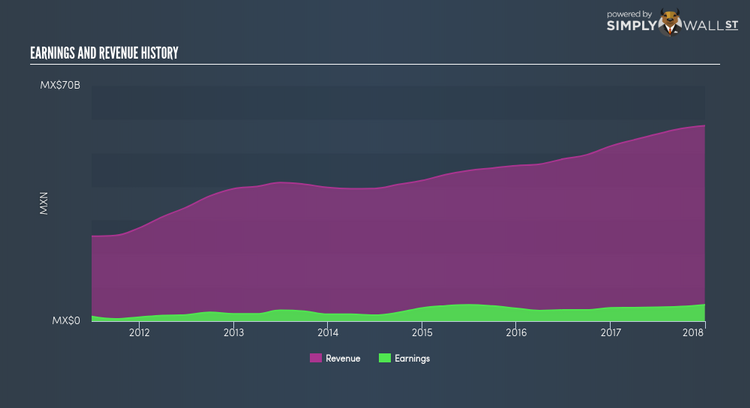

Industrias Bachoco, S.A.B. de C.V., through its subsidiaries, operates as a poultry producer in Mexico and the United States. Established in 1952, and run by CEO Rodolfo Ramos Arvizu, the company employs 25,000 people and has a market cap of USD $3.14B, putting it in the mid-cap stocks category.

IBA has a robust financial position as current assets surpass total liabilities by 5.15x. Its operating cash flow position also reached a solid 104.92% of total borrowings, making an investment in the company a safer bet if the cycle turns against you. Moreover, as its price gives it a US$3.14B value on the market and a PE ratio of 12.05x, there are active participants in the market for the stock and there could still be room for value in the price, which minimises the potential for rapid share price falls in down cycles. Seeing that last year’s earnings growth continues the previous 5 years’ positive annual growth trajectory at 22.70% and 16.99% respectively, IBA is a strong candidate for a bear market based on these defensive tenets. Dig deeper into Industrias Bachoco. de here.

For more robust companies to add to your portfolio, explore this interactive list of defensive stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.