Apple Options Run Hot After New "Sell" Rating

Maxim downgraded Apple Inc. (NASDAQ:AAPL) stock to "sell" from "hold," and established a $190 price target on the tech shares -- a 28% discount to last night's close. The brokerage firm also forecast a 5% year-over-year drop in iPhone revenue and a 2% annual decline in total operating profits, and labeled expectations the tech giant could transform the healthcare industry as "unrealistic."

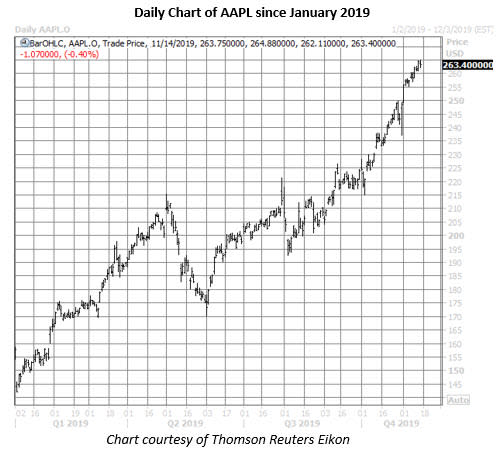

While AAPL stock tagged a new record high of $263.40 out of the gate, it was last seen trading down 0.4% at $263.15. The equity has been on a tear in the second half, up nearly 55% from its June 3 low near $170. As such, Apple's 14-day Relative Strength Index (RSI) settled last night at 81 -- well into overbought territory -- suggesting the security may have been due for a short-term retreat.

Looking to Apple's options pits, total volume is running at 1.2 times what's typically seen at this point, with roughly 221,000 puts and 192,000 calls on the tape so far. Options bears have targeted the November 262.50 and weekly 11/22 265-strike puts, with new positions being purchased to bet on a bigger retreat for the Dow stock over the next six sessions.

The November 265 call, meanwhile, is AAPL's most active option today, and it looks like speculators may be buying to open the contracts for a volume-weighted average price of $0.90. If this is the case, breakeven for the call buyers at the close tomorrow, Nov. 15, is $265.90 (strike plus premium paid).

Apple has certainly been an attractive target for premium buyers over the past year. The equity's Schaeffer's Volatility Scorecard (SVS) reading arrives at 100 (out of a possible 100), meaning the FAANG stock has tended to make bigger moves in the last 12 months, relative to what the options market had priced in.