Apple third quarter tops reduced expectations

Apple (AAPL) shares popped after reporting a better-than-expected third quarter after the market close on Tuesday.

Revenues declined 15% to $42.4 billion but beat estimates of $42.1 billion. The 13% year-over-year revenue decline last quarter marked the first quarterly revenue decline since 2003.

EPS of $1.42 also beat expectations for $1.38, marking a decline from $1.85 a year ago.

iPhones, which represent two-thirds of the company’s revenues, beat expectations this quarter, with the company selling 40.4 million iPhones versus expectations for 40.2 million units.

“We are pleased to report third quarter results that reflect stronger customer demand and business performance than we anticipated at the start of the quarter,” said CEO Tim Cook in the company’s press release. “We had a very successful launch of iPhone SE and we’re thrilled by customers’ and developers’ response to software and services we previewed at WWDC in June.”

Gross margin came in at 38%, down from 39.7% last year, but ahead of consensus estimates of 37.96%.

Average selling price (ASP) trends have remained in focus, especially following the roll-out of the lower-priced iPhone SE at the end of March.

While ASPs this quarter of $595 were below expectations for $612—largely because of the success of the $399 SE model—Apple’s CFO said that iPhone SE’s gross margins are only “slightly dilutive” to the average, which was better than feared.

China, which has been seen as the company’s most important growth market and currently accounts for 25% of sales, weighed on revenue this quarter. While much of the 33% decline was inventory related, investors remain concerned about growth out of the region. That said, the iPhone installed base in the region rose 34% year-over-year. The region will remain a key swing factor for the company, according to analysts, especially heading into and right after the September iPhone7 launch.

The company sold 9.95 million iPads, ahead of expectations for 8.7 million units. iPads have under pressure for some time, but management said last quarter it expected this quarter to be the best iPad compare in years. The company sold 4.2 million Macs, just shy of estimates for 4.6 million.

Guidance

September revenue guidance was revised to $45.5 to $47.5 billion versus, ahead of consensus calls for $45.8 billion.

And gross margin expectations for the September quarter are now 37.5% to 38%, just shy of consensus estimates for 38.3%.

As for other products, management reiterated its view of Apple TV as the foundation for a much broader business opportunity over time and also highlighted the growth in services revenue, which rose 19% year-over-year.

A fallen giant

Analysts expectations for growth had been widely reduced heading into the quarter, correlated with a slowing of iPhone sales. And the company managed to clear those lower hurdles.

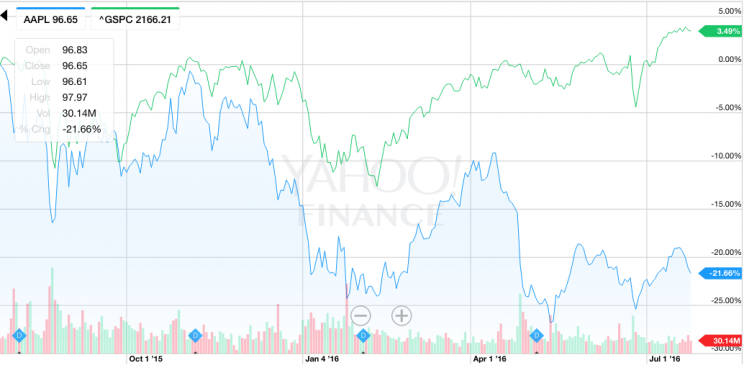

The tech company, long-considered a growth stock market darling, has underperformed the market significantly over the last year, as worries about a growth slowdown have pressured Apple shares and the overall performance of the tech sector. Additionally, macro uncertainty has given analysts pause.

iPhone 7 color look-ahead

The big focus for Apple remains its September product event.

Media reports are calling for the iPhone 7 to be unveiled during the week of September 12, meaning the device won’t be available for customers until the very end of the company’s next quarter and won’t impact guidance, but investors remain focused on evaluating how the transformative potential of this new model.