Andreas Halvorsen's Top 5 Buys of the 1st Quarter

- By James Li

Andreas Halvorsen (Trades, Portfolio), manager of Viking Global Investors, disclosed this week his top five buys for the first quarter were JD.com Inc. (JD), Nvidia Corp. (NVDA), MercadoLibre Inc. (MELI), NXP Semiconductors NV (NXPI) and Activision Blizzard Inc. (ATVI).

Warning! GuruFocus has detected 1 Warning Sign with JD. Click here to check it out.

The intrinsic value of JD

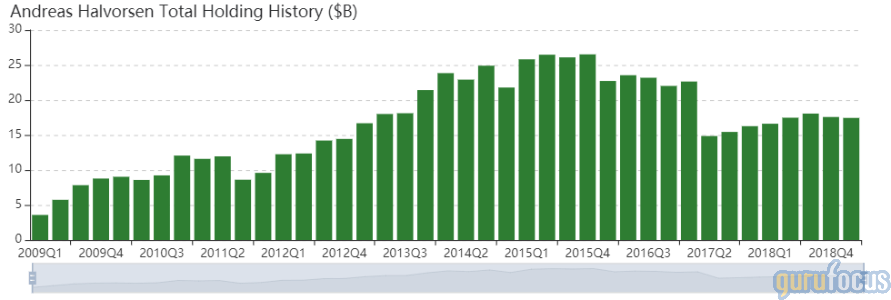

Halvorsen, a former protege of Tiger Management's Julian Robertson (Trades, Portfolio), founded Viking in 1999. According to its website, Viking manages approximately $28 billion in capital for its investors and employs a research-intensive, long-term-focused investment approach. The Greenwich, Connecticut-based hedge fund invests in public and private equity securities based on a thorough assessment of the companies' business models, fundamentals, management quality and industry trends.

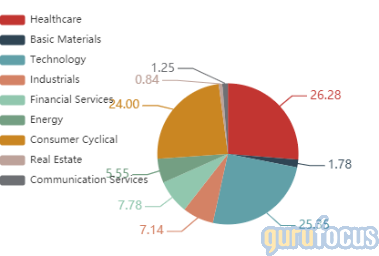

As of quarter-end, the $17.57 billion equity portfolio contains 57 stocks, of which 16 are new holdings. The top sectors in terms of portfolio weight are health care, consumer cyclical and technology; the sector weights are 36.87%, 24.40% and 21.50%.

JD.com

Halvorsen purchased 11,552,547 shares of JD.com, giving the stake 2% equity portfolio space. Shares averaged $25.30 during the first quarter.

JD.com, China's second-largest e-commerce company after Alibaba Group Holding Ltd. (BABA) in terms of transaction volume, offers a wide selection of authentic products at competitive prices. GuruFocus ranks the company's financial strength 6 out of 10: Even though the debt-to-Ebitda ratio of 2.68 underperforms 86.71% of global competitors, JD.com has a solid Piotroski F-score of 6, a strong Altman Z-score of 3.57 and a cash-debt ratio of 3.31, suggesting it can pay off debt with cash on hand.

Other gurus with large holdings in JD.com include Chase Coleman (Trades, Portfolio)'s Tiger Global Management and Ken Fisher (Trades, Portfolio).

Nvidia

Halvorsen purchased 1,885,334 shares of Nvidia, giving the position 1.94% equity portfolio space. Shares averaged $154.95 during the quarter.

The Santa Clara, California-based company designs graphics chips that enhance the experience on computing platforms. GuruFocus ranks the company's profitability 9 out of 10 on several positive signs, which include a strong Piotroski F-score of 7, a three-star business predictability rank and operating margins that are near a 10-year high and outperforming 96.82% of global competitors. Despite this, the website warns Nvidia has poor earnings quality based on its Sloan ratio.

Jerome Dodson (Trades, Portfolio)'s Parnassus Fund and Philippe Laffont (Trades, Portfolio) also purchased shares in Nvidia during the quarter.

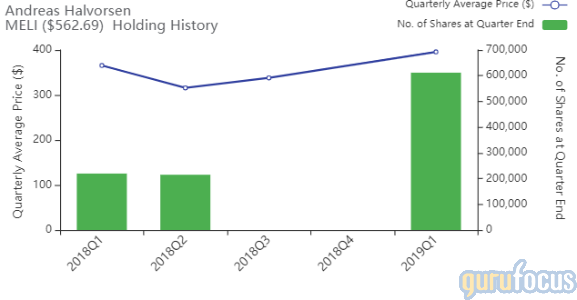

MercadoLibre

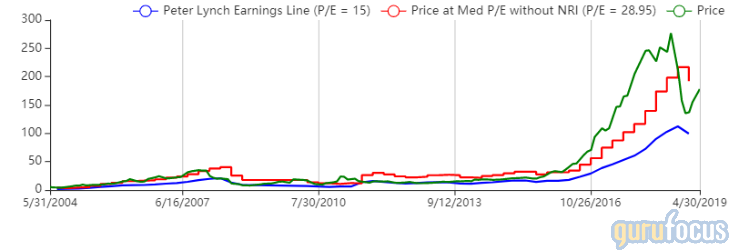

Halvorsen purchased 611,869 shares of MercadoLibre, giving the holding 1.78% weight in the equity portfolio. Shares averaged $395.73 during the quarter.

The Argentine specialty retail company operates online commerce marketplaces in several Latin American countries, offering services like payment processing, advertising and online store management. GuruFocus ranks the company's financial strength 7 out of 10: Even though debt ratios are underperforming over 90% of global competitors, MercadoLibre's Piotroski F-score ranks a moderately strong 5 out of 9 while its Altman Z-score of 8.89 suggests little financial distress.

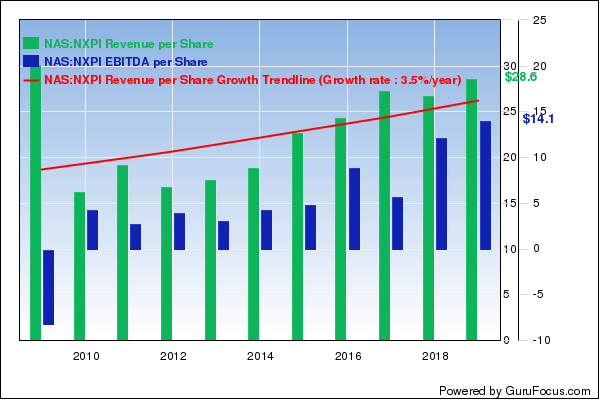

NXP Semiconductors

Halvorsen purchased 2,725,389 shares of NXP Semiconductors, giving the stake 1.38% weight in the equity portfolio. Shares averaged $87.6 during the first quarter.

The Netherlands-based semiconductor company provides high-performance mixed signal and standard product solutions that leverage its combined portfolio of intellectual property, deep application knowledge and process technology. GuruFocus ranks NXP Semiconductors' profitability 7 out of 10: Although the company's three-year Ebitda growth rate of 27.60% outperforms 81.27% of global competitors, its operating margin and three-year revenue growth rate are outperforming just over 50% of global semiconductor companies.

Activision Blizzard

Halvorson purchased 4,909,367 shares of Activision Blizzard, giving the position 1.28% equity portfolio weight. Shares averaged $45.26 during the first quarter.

The Santa Monica, California-based company's portfolio of video games include "World of Warcraft" and "Call of Duty." GuruFocus rated Activision Blizzard's profitability 9 out of 10 on several positive indicators, which include a strong Piotroski F-score of 7 and operating margins that are outperforming 91.42% of global competitors despite contracting 5.5% per year over the past five years.

Disclosure: No positions.

Read more here:

Chris Davis' Top 6 Buys in 1st Quarter

Scott Black's Top 5 Buys in 1st Quarter

Brandes Investments' Top 5 Position Boosts in 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with JD. Click here to check it out.

The intrinsic value of JD