Analyst Bets on More Upside for Charles Schwab Stock

Positive analyst attention today from KBW has the shares of investment firm Charles Schwab Corporation (NYSE:SCHW) slightly higher, set to extend a three-day win streak. Specifically, the broker lifted its price target to $39.50 from $38, just ahead of the company's third-quarter earnings report, due out before the open tomorrow, Oct. 15.

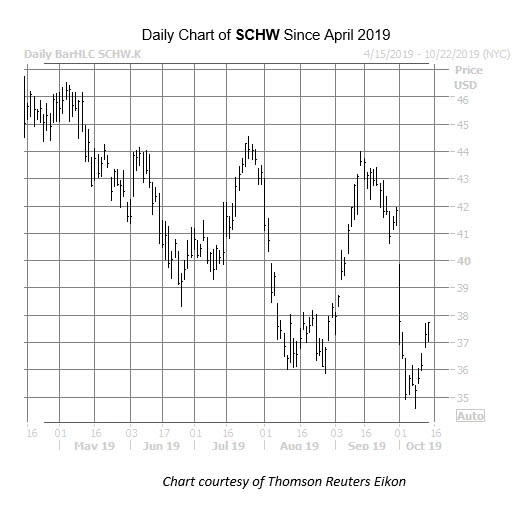

Looking back, SCHW stock just suffered a massive bear gap following an announcement on Oct. 1 that it would be removing commissions for stock, ETFs and options trades. The security bottomed out at a three-year low of $34.58 just a week later. While the stock has added 7.5% since bottoming out, its appears to be running out of steam right at the $37.50 area.

Circling back to analyst sentiment, the brokerage bunch has been split on the investment banker, with six calling it a "buy" or better, and seven saying "hold" or worse. On the other hand, the consensus 12-month target price holds just a slim 9% premium to current levels.

KWB's price target hike could be reached sooner rather than later, if history is any indicator. During its last eight earnings reports, SCHW was lower one day later only two times, averaging a post-earnings swing of 1.8% in either direction. This time around the options pits are pricing in a much bigger 5.7% next-day move.

Options players have been quite bullish of late, with the stock's 10-day call/put ratio of 3.18 ranking in the 96th percentile of its annual range on the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).

Tomorrow's turn in the earnings confessional has call options running slightly hotter today, too, with 2,539 calls across the tape, compared to only 579 puts. The weekly 11/8 41.50-strike call is receiving heavy attention, with positions likely being bought to open here. This suggests that these traders are betting on a lot more upside for SCHW ahead of tomorrow's report.