Amazon's patent on one-click payments to expire

(BI Intelligence)

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Amazon’s US patent on its one-click payments technology will expire this year, enabling other online retailers to deploy similar technology on their sites, PYMNTS.com reports.

The patented tech is a signature part of Amazon’s checkout process that allows customers to complete a purchase with a single click by using payments credentials and shipping information previously stored with Amazon.

This takes out the frustrating step of manually entering payment card and shipping address information whenever one makes a purchase. The technology also allows Amazon Echo owners to complete a purchase with a single voice command.

Removing this friction in the checkout process is often highlighted by experts as one of Amazon’s biggest advantages in the online retail space. Until now, the only way for other companies to deploy such technology was to license it from Amazon — Apple pays an undisclosed annual sum to use a version of the technology in its iOS app store for app purchases. When the patent runs out, and online retailers become free to launch one-click technology without going through the e-commerce giant, the company will lose the competitive edge it has enjoyed with the patent. Some estimate that Amazon's exclusive hold on the technology has earned it billions by making it easy for customers to make repeat purchases with the site.

One-click payments is considered such an important part of the online shopping experience that the World Wide Web Consortium (W3C) gathered a number of major tech firms last year to start working on standards for adding payments credentials to web browsers. That could allow online shoppers to make one-click payments through any site via the credentials saved in their web browser. Google is already working on a one-click payments system for its Chrome browser, and other browser companies are expected to do the same.

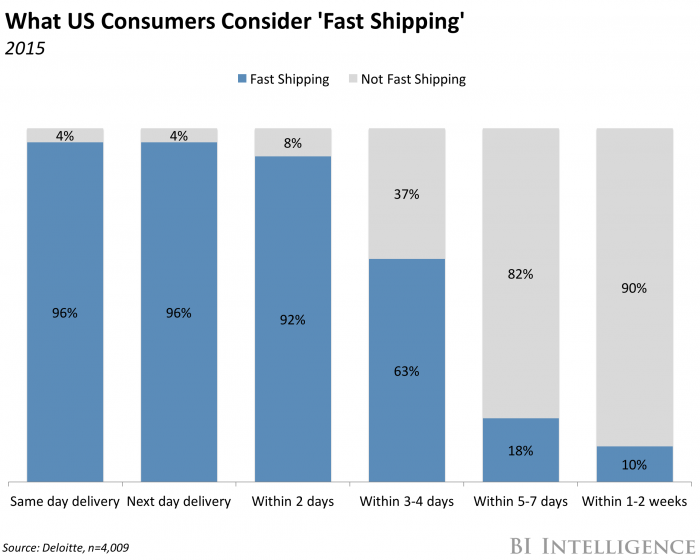

However, Amazon may be prepared to lose its one-click payments advantage, as it looks to build an edge in other corners of the e-commerce market. For example, it has spent billions to strengthen its logistics and fulfillment operations to position itself as a leader in faster delivery. And as consumers increasingly demand speedier shipping, Amazon should benefit from its early investment in this area. Moves like this one indicate that the company is focused on carving out new advantages as the e-commerce space evolves.

The parcel delivery industry — a segment of the shipping sector that deals with the transportation of packages to consumers — is booming thanks to e-commerce growth, and players outside the industry want a piece of the pie.

BI Intelligence, Business Insider's premium research service, has compiled a detailed report on the future of shipping that looks at efforts by Amazon, Alibaba, and Walmart to handle more of their own shipping and concludes that big retailers are well positioned to disrupt the parcel industry.

Here are some of the key points from the report:

Transportation and logistics could be the next billion dollar opportunity for e-commerce companies. The global shipping market, including ocean, air, and truck freight, is a $2.1 trillion market, according to World Bank, Boeing, and Golden Valley Co.

There is much at stake for legacy shipping companies, which have seen a boom in parcel delivery as e-commerce spending has risen. Twenty different partners currently share the duties of shipping Amazon's 600 million packages a year, with FedEx, USPS, and UPS moving the most.

Amazon, Alibaba, and Walmart have so far focused on building out their last-mile delivery and logistics services but are increasingly going after the middle- and first-mile of the shipping chain.

Amazon has already made major moves across each stage of the shipping journey. It launched same-day delivery service, which it handles through its own fleet of carriers, cutting out any third-party shippers. The company also recently began establishing shipping routes between China and North America.

Walmart's interest in expanding its transportation and logistics operations is almost purely related to cost-savings. It's begun leasing shipping containers to transport manufactured goods from China and is making greater use of lockers and in-store pickup options to cut down on delivery costs.

Alibaba has begun leasing containers on ships, similar to Amazon's Dragon Boat initiative. This means that Alibaba Logistics can now facilitate first-mile shipping for third-party merchants on its marketplace.

In full, the report:

Sizes the market for the shipping industry.

Explains how the industry operates in broad terms.

Suggests why major e-commerce retailers should disrupt the space.

Outlines the shipping initiatives of Amazon, Walmart, and Alibaba.

Concludes how these moves might impact traditional carriers.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store. » BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of the future of shipping.

More From Business Insider