Amazon actually helps money-losing USPS, but probably not for long

This past spring, President Donald Trump routinely targeted Amazon (AMZN) for a role he suspected the online retailer was playing in causing massive losses at the United States Postal Service.

After calling out the “Post Office scam” in numerous tweets, Trump greenlit a task force in April to investigate the mounting losses at USPS. However, the task force, which released their findings Tuesday, didn’t implicate Amazon specifically for the twelfth consecutive year of net losses at the USPS. Instead, it revealed that Amazon may have played a role in helping the money-losing agency and making things less worse than they otherwise could have been.

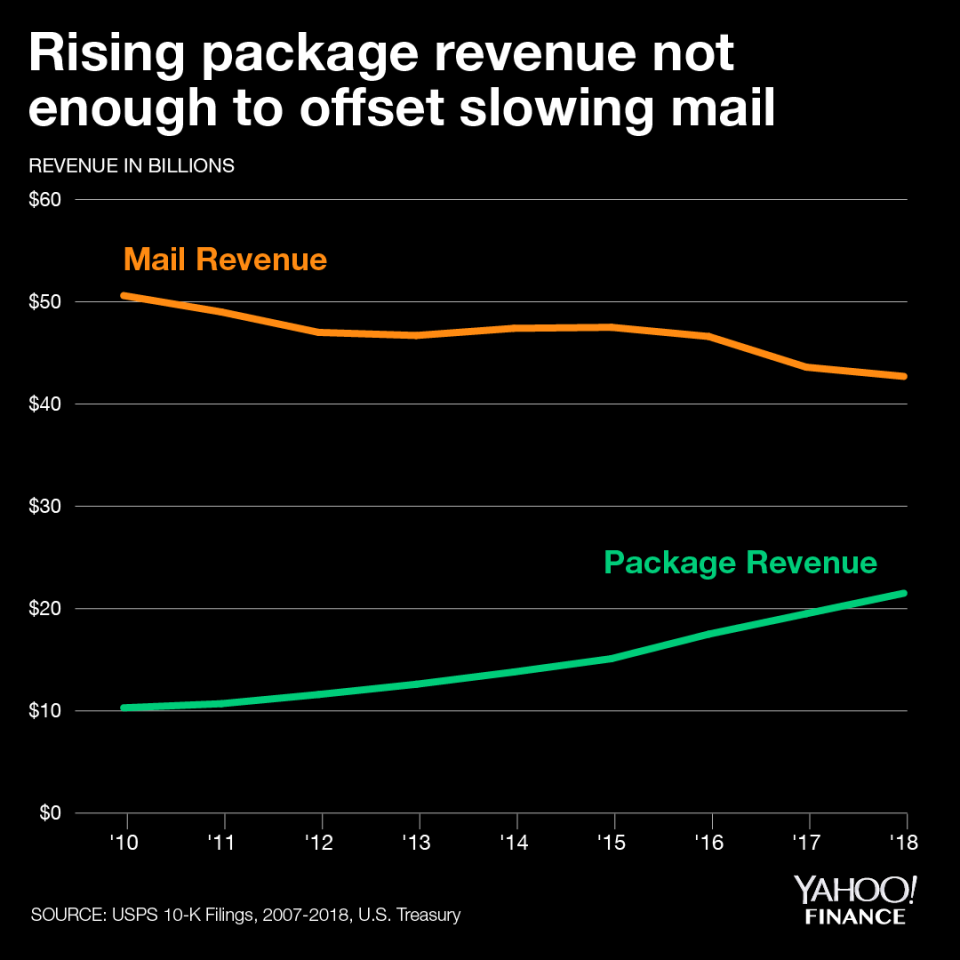

The reason being is that the USPS has long suffered shrinking revenue as a result of dropping mail deliveries. The rise of e-commerce companies, like Amazon, may have actually helped in the form of package deliveries but “package revenues alone cannot offset the decline in mail revenues,” the report found.

That said, the task force report did echo Trump’s belief that charging more for package delivery was both an option on the table and likely necessary to stop the Postal Service’s decline.

“Although the USPS does have pricing flexibility within its package delivery segment, packages have not been priced with profitability in mind,” the report’s recommendations read. Without instituting price increases above the consumer price index cap the USPS has normally been tied to, the task force painted a dire future.

“Under the current model, the USPS cannot survive on an operating basis, let alone pay for its long-term liabilities including its debt and unfunded retiree benefits,” the report concluded. In total, the USPS balance sheet reflects $89 billion in liabilities against $27 billion in assets, representing a net deficiency of $62 billion as of the fiscal year ended in September. A failure to offset declining revenue with cost-cutting resulted in $69 billion in losses over the past 12 years.

Among other potential maneuvers floated to help turn losses were delivering mail five days of the week instead of six, raising costs on commercial mail, cutting USPS wages, and franchising out to other shippers the monopoly the USPS has enjoyed on delivering directly to mailboxes around the country.

Amazon has its own plan, is less reliant on shippers

The task force’s findings come just weeks after the USPS proposed a 9% to 12% hike in prices for delivery services used by e-commerce companies like Amazon in October. That change was estimated to amount to a $1 billion hit to Amazon in 2019, according to Credit Suisse analyst Stephen Ju.

However, the pain felt by potential USPS price hikes is likely to be dulled by Amazon’s increased push into its own air freight service Prime Air. The retailer’s fleet of nearly 30 planes is estimated to shave off $1 billion-$2 billion in 2019 shipping costs, according to Morgan Stanley analyst Ravi Shanker, who sees the savings “largely offsetting shipping cost increases in the U.S. (USPS), Europe and Japan.”

The firm also estimates that about 45% of Amazon’s package volumes, including ground, are handled by USPS, compared to the 30%-35% handled by UPS and 10-15% by FedEx. As Amazon continues to build out its air fleet, Shanker sees a 10% net loss of shipping revenue impacting both FedEx and UPS by 2025. He did not have figures for USPS.

But even more threatening for the USPS, Amazon is also focusing on building out its ability to handle delivery in the so-called last mile. The package deliveries that have grown to offset dropping USPS letter revenue, could suffer a hit as Amazon looks to handle its own local logistics in-house and with other delivery partners. Amazon Flex, for example, hires contractors to deliver packages locally for around $18 to $25 an hour.

As the task force’s own findings conclude, the USPS has long benefited from servicing “more densely populated areas that have lower costs for service.” Deliveries in those regions help to offset costs in servicing more sparsely populated rural areas.

However, Amazon has also looked to focus its last mile efforts in major cities. Last year, Amazon introduced its Amazon Key lock system, which allows Prime members to remotely unlock doors to allow Amazon’s delivery workers to drop off packages inside homes in 37 cities. With all due respect to the USPS, a service like that could outshine whatever value there may still be in owning a “monopoly on the mailbox.”

As the task force’s report sadly summarizes, “Although the USPS remains central to the nation’s social structure and continues to process important transactional mail, particularly for the government and for small- and medium-sized businesses, its role in promoting national cohesion has diminished relative to its historical role, and it is no longer the primary institution that binds the nation.”

Ouch.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Why Altria possibly taking a stake in Juul is a smart move

Juul surpasses Facebook as fastest startup to reach decacorn status

How Juul became the FDA’s latest target

Joe Camel illustrator: E-cig maker Juul’s marketing ‘seems more egregious’