Alabama votes — What you need to know on Tuesday

With investors preparing for the Federal Reserve announcement on Wednesday and continuing to digest the debut of Bitcoin Futures trading, Tuesday will bring markets the week’s biggest political news.

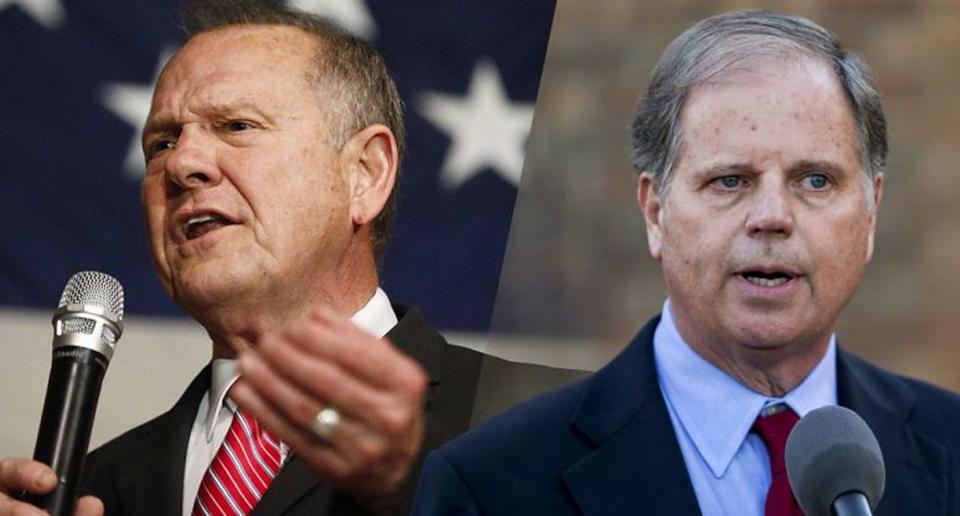

On Tuesday, Alabama will vote to fill the Senate seat vacated by Attorney General Jeff Sessions, with the race pitting Democrat Doug Jones against Republican Roy Moore.

Three polls released Monday show a very mixed picture for the race, with both Jones and Moore being shown to hold big leads in competing results and a third pointing to a race that is tied. Regardless of the outcome, Republicans will maintain a majority in the Senate, though it would be down a single vote if Jones were to prevail.

Elsewhere on the calendar, the economic schedule will bring us the November reading on small business confidence, which has been solid since President Donald Trump’s surprise election win last year. This report will be watched for any commentary from the NFIB — the small-business group that publishes the report — on the proposed tax plans in Washington, D.C.

The earnings schedule has lightened up considerably as we approach the end of the year an a lull between third- and fourth-quarter earnings reporting periods, but on Tuesday we will get results from payments company Verifone (PAY) and recent IPO MongoDB (MDB).

What’s old is new, again. Again.

It feels like the mid-2000s around here right now.

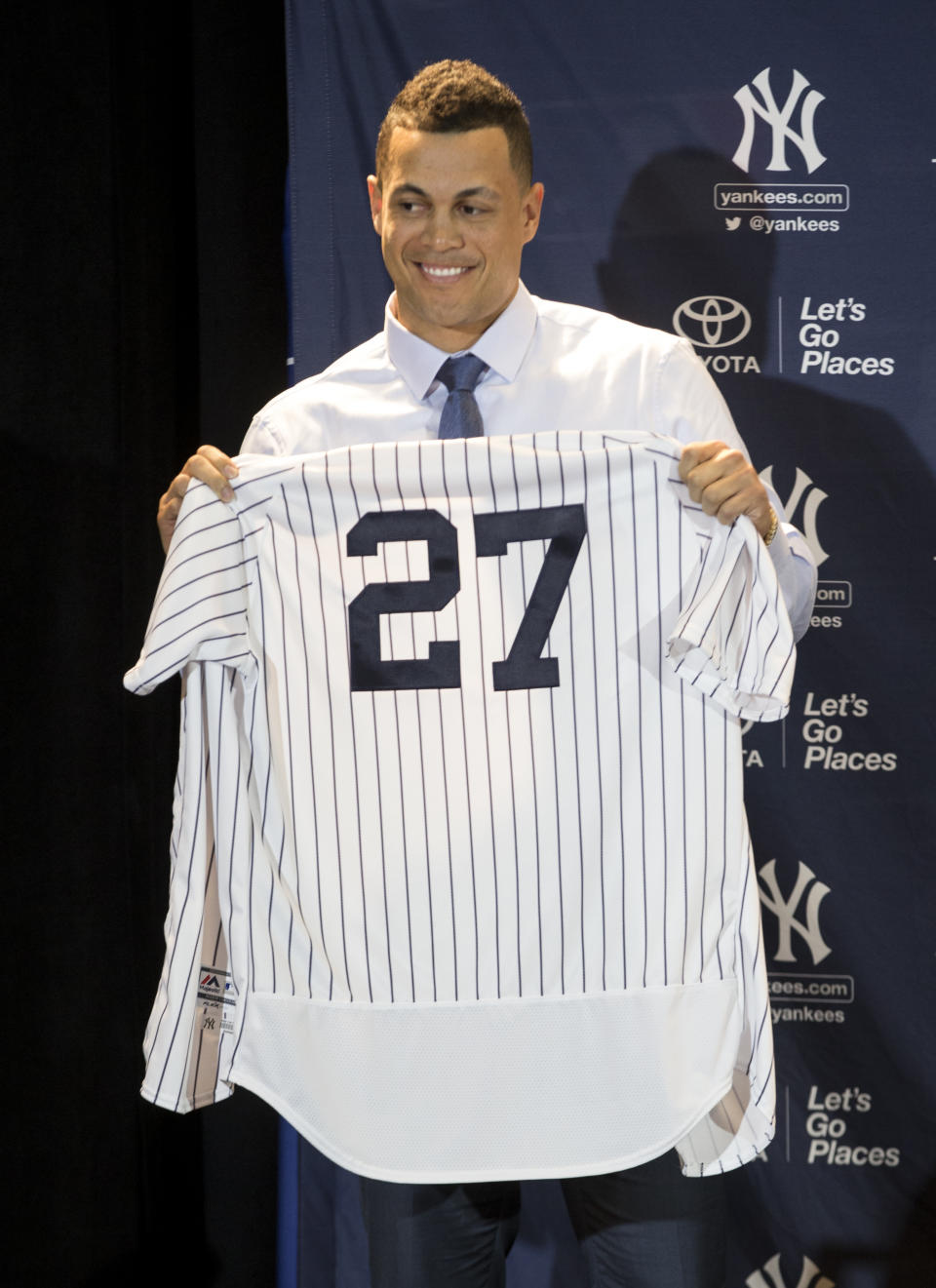

There’s a Republican administration in Washington, D.C. set to cut taxes. The Federal Reserve is raising interest rates. The U.S. Treasury yield curve looks set to invert. Stocks are riding high. Bitcoin has replaced flipping houses as America’s latest get-rich-quick scheme. And the New York Yankees just traded for the best player in baseball.

Now, the next decade for markets was turbulent, to say the least.

And a few economic and cultural touchstones making the present look like the past really says nothing about the future for markets or anything else. But if the post-crisis stock market run and meager economic recovery convinced investors of one idea, it might be that traditional economic and business cycles were dead.

It’s been almost ten years since a recession, the stock market hasn’t moved up or down 2% in a week in exactly a year, and the Fed pegged interest rates at record lows for eight years.

And while many economists don’t see a recession in the offing for 2018, it seems likely that we’re closer to the next economic pause than the last one, all while the Fed raises rates and the bitcoin mania captures pent-up investor enthusiasm for financial assets.

For investors, things right now and in the recent past have been good, pretty much no matter what you slice it up. But today’s optimism sows the seeds for tomorrow’s disappointment.

“We doubt that equities in the US will plummet next year as the Fed tightens policy further, because the economic backdrop there and elsewhere should remain healthy,” writes the team at Capital Economics in a note out Monday. “We do think, however, that there is a good chance of a major correction in equity prices in 2019.

“This is not because we think that the valuations of equities are unsustainably high and must inevitably come crashing back down. Rather it reflects our belief that cracks will be starting to show in the economy in the US in 2019…If history is a useful guide, a bear market in the US would be contagious, with equities in other developed markets also falling sharply.”

We could quibble over the usefulness of using the past to predict the future. But in the end it’s all we have.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: