Alabama House passes ‘Working for Alabama’ package

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Alabama House Speaker Nathaniel Ledbetter, R-Rainsville (left) and House Minority Leader Anthony Daniels, D-Huntsville, listen to Senate President Pro Tem Greg Reed, R-Jasper speak at an event at the Alabama State Capitol on March 21, 2024 in Montgomery, Alabama. Legislators announced a "Working for Alabama" legislative package, aimed at improving the state's low workforce participation rate. (Brian Lyman/Alabama Reflector)

The Alabama House of Representatives Thursday passed a set of bills aimed at improving the state’s low workforce participation rate.

The “Working for Alabama” package, which has the support of Gov. Kay Ivey and legislative leaders from both parties, aims to increase access to work through a combination of education programs and tax credits encouraging the expansion of housing and child care, the lack of which may hold participation down.

“I know that we’ve had groups, both in the House and the Senate, working to identify reasons that we have people in our state who are able to work and are not working — there is, of course, lots of reasons for that sometimes,” said Rep. Cynthia Almond, R-Tuscaloosa, who introduced the package.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Alabama’s workforce participation rate in January was 57.1%, according to the St. Louis Federal Reserve, compared to a national rate of 62.5%, according to the Bureau of Labor Statistics. The state’s participation rates have trailed the nation’s for at least 48 years. Experts say a lack of access to child care, transportation and training may play a role.

The House passed:

HB 346, sponsored by Almond, which would establish the Alabama Workforce Housing Tax Credit Act and provide tax credits to developers for housing projects. The bill passed 103-0 and goes to the Senate.

HB 358, sponsored by House Minority Leader Anthony Daniels, D-Huntsville, would establish an employer tax credit, child care facility tax credit and nonprofit child care provider grant program aimed at incentivizing employers to fund childcare for their employees. The bill passed 103-0 and heads to the Senate.

SB 247, sponsored by Senate Majority Leader Steve Livingston, R-Scottsboro, would rename the Secretary of Labor and Department of Labor the Secretary of Workforce and Department of Workforce and expand duties to include oversight of all current workforce development programs. The bill passed 102-0 and goes to Gov. Kay Ivey.

SB 252, sponsored by Senate President Pro Tempore Greg Reed, R-Jasper, would establish the Alabama Growth Alliance, a public corporation to provide economic development recommendations, such as increasing private investment and promoting opportunities for minority-owned businesses. The bill passed 97-0 after it was amended, and it goes back to the Senate for consideration.

SB 253, sponsored by Sen. Donnie Chasteen, R-Geneva, would create an alternative diploma pathway for students focused on career education, which faced some criticism for decreasing math requirements. The bill passed 102-0.

Child care credits

Rep. Barbara Drummond, D-Mobile, speaks with Rep. Sam Jones, D-Mobile, during a debate on a comprehensive gambling bill in the Alabama House of Representatives on Feb. 15, 2024. (Brian Lyman/Alabama Reflector)

Rep. Barbara Drummond, D-Mobile, presented Daniels’ legislation to provide child care tax credits to incentivize employers to fund child care.

“Not only will it incentivize industries, but it will give a number of women who need to get into the workforce and those that are in the workforce — it will help them greatly,” Drummond said.

The bill would provide employers up to $600,000 per year for eligible child care expenses, such as construction of a child care center or payments to a center on behalf of an employee, to be applied against applicable taxes.

It would also give child care facilities a $25,000 tax credit per year, which can significantly reduce their tax bill. The bill also creates a grant for nonprofit facilities to help with operations, construction or repairs.

The bill would cap tax credits at $15 million for all employers in 2025. The cap increases to $17.5 million in 2026 and $20 million in 2027. The tax credits would sunset on Dec. 31, 2027 unless extended by the state.

Representatives all spoke in support of the program.

Rep. Danny Garrett, R-Trussville, the chair of the House Ways and Means Education Committee, said that the sunset provision in the child care tax credits bill would allow them to evaluate the bill’s impact.

“Every workforce committee that’s looked at labor participation has identified this — child care — is a major impediment, and so we’re believing this is a good tool to help address that issue and to get people back into the workforce,” Garrett said.

House Speaker Nathaniel Ledbetter, R-Rainsville, said to reporters after the bill’s passage that he thinks the legislation is “huge.”

“If you have a single mom, and she’s having to pay $12,000 a year for two children, just to have child care, that’s not counting groceries, utilities or car or any of those expenses. It’s tough,” he said.

Child care costs estimates in Alabama range from $5,276 in Barbour County to $10,900 in Walker County a year for an infant, according to the U.S. Department of Labor Women’s Bureau. In Greene County, families spend an average of 18% of their income on child care, the highest in the state. Families in Coffee County spend the least on average as a percentage of their income, at about 7%.

Housing credit

Rep. Cynthia Almond, R-Tuscaloosa, listens to a budget presentation from the Alabama Community College System on March 7, 2023. T (Brian Lyman/Alabama Reflector)

Most Thursday’s discussion in the House centered around the housing tax credit.

Almond said the bill would provide housing developers a supplementary tax credit, which can also be used to offset financial institution excise tax, to the existing federal low-income housing tax credits already in place.

The federal tax credits are not enough to bring developers to the state because housing tends to be lower in Alabama, Almond said, leading to developers not building homes in the state because they would lose money.

“Our rent is too low to make the math work for the developer to build this type of housing without the housing tax credit. So the credit incentivizes the developer to do something that he or she otherwise would not do,” Almond said.

Rep. Laura Hall, D-Huntsville, expressed concern that the Housing Choice Voucher, formerly known as Section 8, exists to address housing issues, but landlords may not accept the vouchers.

“There are people that are working, who has this, but their homes have been taken or where they were living has been taken from them. So you have this place here, where these people are falling into, and they cannot get— what I have been told by the individuals that have reached out to me, those individuals are finding themselves homeless,” Hall said.

Almond said the bill could be part of the solution and “that is exactly the type of housing we’re talking about here, and that’s what we need.”

Rep. A.J. McCampbell, D-Linden, said that access to affordable housing is impeding people from achieving “the American dream.”

“Our American dream is now becoming a nightmare to a whole lot of people,” McCampbell said.

It’s a privilege to be able to work and provide for a family, he said, but that privilege is not equal, and it doesn’t make sense for some people to work if they can’t provide for their families.

“Some of the jobs that we have are not paying a living income that will allow people to be able to have fair housing,” McCampbell said.

Rep. Curtis Travis, D- Tuscaloosa, said that the only concern he had with the bill is that it didn’t provide enough funding for the incentives and that it sunsets too quickly.

“My only concern is that because $5 million goes rather quickly. In these areas, we’re talking about Huntsville, from what I know, is a very hot market,” Travis said.

Rep. Arnold Mooney, R-Indian Springs, said it’s important to get people back into the workforce but he would hope the state considers developing a process to give people entering the workforce some sort of ownership, to allow them to build equity in the process “in a manner other than being sort of a paycheck-to-paycheck type of thing.”

Growth Alliance

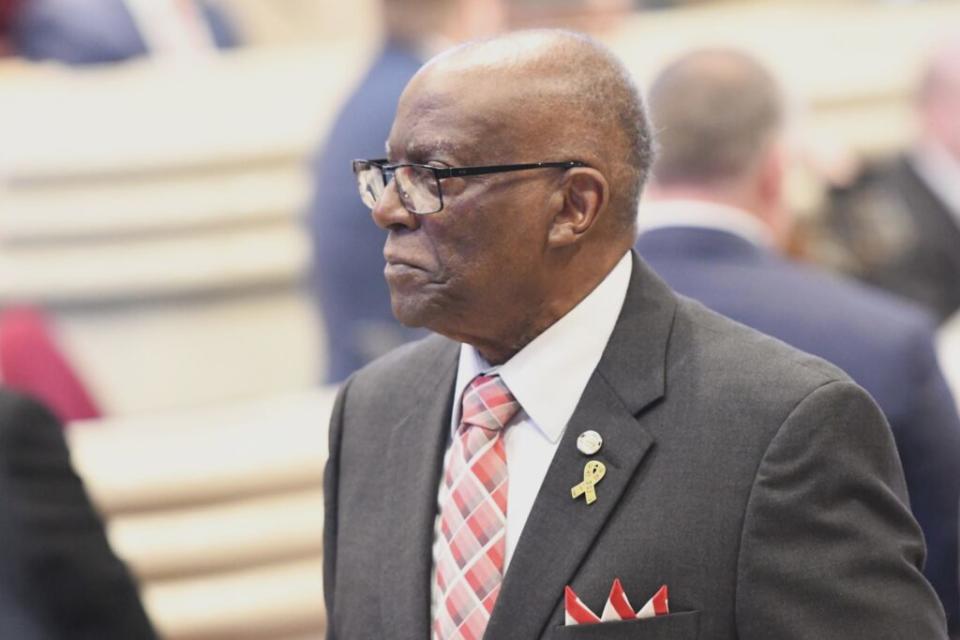

Rep. Thomas Jackson, D-Thomasville, stands on the floor of the Alabama House of Representatives during a session on Feb. 6, 2024 in Montgomery, Alabama. (Brian Lyman/Alabama Reflector)

There was debate over legislation to create the Alabama Growth Alliance, a public corporation to provide input and support on economic development. Democrats expressed concerns that the state would be creating an entity that is exempt from ethics laws.

Rep. Thomas Jackson, D-Thomasville, said they are creating “shade in gray area” by involving the private sector and individuals to advise the state on economic development.

“Who brought up this ‘fiscal responsibility’ phrase?” he said to Republicans. “I think it was your group. Your party. So, we’re going to be fiscally responsible in our due diligence,” Jackson said. “Now why do you want to take that away?”

Rep. Randall Shedd, R-Fairview, who presented the bill in the House, maintained the body would be an advisory board made up of people with first-hand experience in economic development.

Rep. Juandalynn Givan, D-Birmingham, said the general public needs to know more about those on the board, even if they are volunteers. She said “this House is doing something shady, and this is wrong.”

“We should not be creating bodies of individuals that we give authority to act on any matter of fiscal responsibility for the state of Alabama, and they are not held to a standard,” she said.

Shedd maintained they won’t have the authority to spend money and said, “we’re asking the private sector to give us their greatest ideas.”

Givan said they are giving a group of powerful individuals, or because they have some sort of status, the power to steal from the state.

“No, ma’am. Girl, bye,” she said. “They are more prone to steal. They are more prone to commit some type of act. They are more prone to misrepresent.”

The post Alabama House passes ‘Working for Alabama’ package appeared first on Alabama Reflector.