Will Activision Blizzard Return to Audience Growth on Thursday?

The shift toward online content delivery is making video games more valuable and pushing profitability to new highs for the industry's biggest players. That tailwind was clear from Electronic Arts' (NASDAQ: EA) latest earnings results, which beat management's targets despite challenges in a few major gaming brands.

Activision Blizzard (NASDAQ: ATVI) is up next, with its third-quarter report due out on Thursday, Nov. 8. The industry leader will likely issue an updated outlook for its core Call of Duty franchise, which has a tough battle ahead to defend its title as 2017's top-selling video-game brand. There will be plenty more for investors to watch in this report, too.

Image source: Getty Images.

The gamer base

Thanks to a flood of new intellectual property launched over the last few years, including brands such as Overwatch, Hearthstone, and Destiny, Activision's business is far less reliant on its older Call of Duty and World of Warcraft franchises. Still, investors will be looking for signs that these brands continue to attract millions of gamers. Both franchises faced important tests recently, with a major expansion pack launching for World of Warcraft, and Call of Duty: Black Ops 4 being released in mid-October.

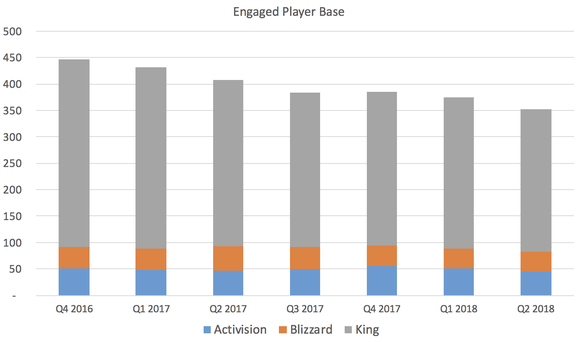

Player base in millions. Data source: Activision Blizzard.

More broadly, CEO Bobby Kotick and his team will update investors on Activision's total gamer base, which has slipped over the last few quarters down to 352 million at last count. That number should rebound now that the company has put out a few of its biggest new content releases of 2018.

Engagement and in-game revenue

Activision is aiming to transition into more of an entertainment company over time. Video games will stay central to its growth strategy, but executives hope to take advantage of the popularity of gaming as a spectator event by maximizing advertising and licensing revenue. Investors will get fresh data on that progression on Thursday, including whether daily gamer engagement levels budged any higher from the previous mark of 50 minutes.

Meanwhile, look for in-game spending to reach at least $1 billion for the third consecutive quarter as the company benefits from increased full-game downloads and those smaller tack-on purchases of additional content. Full-game purchases were a bright spot in EA's report last week, which implies the shift toward digital spending has plenty of room to run.

The outlook

Activision's 2018 results have always been reliant on the seasonally strong period around the holiday shopping season, but that tilt is even more pronounced this year. That excess seasonality was a key reason executives left their full-year outlook unchanged last quarter despite having just exceeded management's forecast.

With solid sales data now available for the latest chapters in the World of Warcraft and Call of Duty franchises, Kotick and his team will have a much better idea about how this year should shape up. To that end, look for a potentially significant update to their 2018 outlook that currently predicts sales of around $7.3 billion and earnings of $1.84 per share.

The latest forecast from rival EA implied flat sales, mainly because the company had to delay major parts of its key Battlefield V release into the next fiscal year. Shareholders will find out on Thursday whether that shift helped Activision's Call of Duty launch and contributed to an overall brightening of the industry leader's outlook.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Activision Blizzard. The Motley Fool owns shares of and recommends Activision Blizzard. The Motley Fool recommends Electronic Arts. The Motley Fool has a disclosure policy.