5 Top Stock Trades for Friday Morning

It’s been one day since the FOMC press conference and announcement that the Federal Reserve will raise interest rates. Despite U.S. stock indexes barely budging, there was a lot of movement below the surface. Let’s look at some of that movement with our top stock trades.

Note: Friday is quadruple witching, the third Friday of March, June, September and December when index futures, index options, stock options and stock future options all expire. It can create some funky price action as a result.

Top Stock Trades for Tomorrow #1: Huya (HUYA)

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Does a day go by where Huya Inc – (ADR) (NYSE:HUYA) and iQiyi, Inc (NASDAQ:IQ) aren’t in the news? It doesn’t seem like it.

With a 20% rally in HUYA and a more than 13% rally in IQ stock on Thursday though, you can understand why investors are constantly talking about them.

I like them all — Huya, IQ and Sogou Inc (NYSE:SOGO). But the rally has been too far and too fast. With an RSI over 90 for both IQ and Huya, we need these stocks to cool off a bit.

Who knows. Maybe they’ll be like those IPOs that go from $30 to $90 in a few months, crater and then stay stagnant for years. No matter how you play, just be careful. We caught some of the move and are grateful for that. But remember, these moves are fast and furious.

Top Stock Trades for Tomorrow #2: Fitbit (FIT)

Fitbit Inc (NYSE:FIT) has been on a mission this month, rising more than 40% in June at its highs. So what do we need to see now?

Exactly what Fitbit stock is doing: consolidating. We need this name to chill out a bit and work off that overbought condition, which we can see via the RSI (blue circle). As long as FIT holds up for $7, we could get another leg higher in the name.

Below that and $6.50 is in the cards.

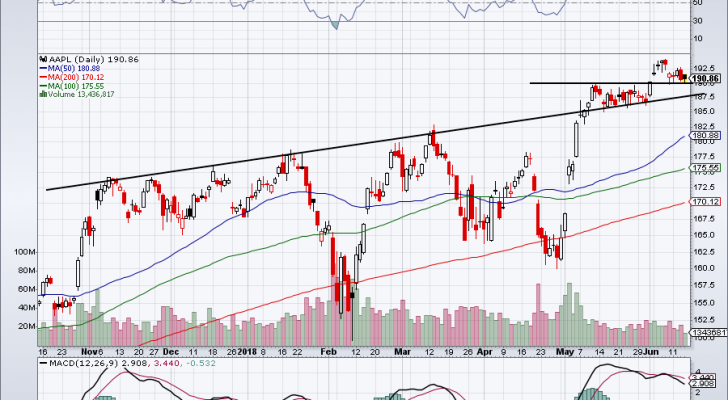

Top Stock Trades for Tomorrow #3: Apple (AAPL)

After posting a mini-breakout over $190, Apple Inc. (NASDAQ:AAPL) has been retreating somewhat. However, it’s finding support at that previous breakout level. Additionally, there’s a trend-line of support that could come into play just below $190 as well.

Should stocks follow through on this not-bearish FOMC reaction (if that’s a good way to put it?) then tech could benefit. If $190 holds, look for Apple to retest its highs sooner rather than later and make a run toward to $200.

Top Stock Trades for Tomorrow #4: JD.com (JD)

Like Huya, IQ and other Chinese stocks, JD.Com Inc(ADR) (NASDAQ:JD) has been enjoying the ride. Support near $36 held earlier this month, although JD did give investors a scare that perhaps it wouldn’t.

Thursday’s 6% rally was impressive as well. It thrust JD over the 100-day and 200-day moving average. If JD can find support above these levels and start to migrate higher, old resistance near $49 shouldn’t be out of the question. It’s just a matter of how long it will take and whether a shift in Chinese-stock momentum will veer that plan off course.

Top Stock Trades for Tomorrow #5: Salesforce (CRM)

There is one simple trade in Salesforce.com inc. (NASDAQ:CRM): buy on pullbacks to the 75-day moving average. That’s highlighted in blue ovals on the chart.

More aggressive bulls can buy retests of the 50-day while more conservative bulls can buy on retests of the 100-day.

In any regard, shares are starting to get overbought near current levels. That could lead to a buying opportunity. Notice the green rectangles at the top of the chart, which signals when CRM sports an RSI over 70.

An RSI is not the sole deciding factor for a trade. For instance, I would not sell CRM on this factor alone. However, in this case it would keep me from buying Salesforce stock at the moment. Notice that it’s barely overbought, with an RSI of “just” 72.6. So it can go so much higher, as shown in the past.

However, should we get a correction down to the $122 to $128 area, bulls would be wise to buy it. CRM is a buy-the-dips stock.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell was long CRM and AAPL.

More From InvestorPlace

The post 5 Top Stock Trades for Friday Morning appeared first on InvestorPlace.