5 Retail Stocks to Put on Your Shopping List

U.S. equities are drifting higher again on Wednesday thanks to another “dovish hike” from the Federal Reserve. Chairman Janet Yellen has giving Wall Street want it wants to hear — namely, that economic growth is strong and labor gains are steady, but inflation remains tepid. It’s the classic “Goldilocks” scenario that has served the bulls so well for years.

With that, the recent sector rotation dynamic that has been seen in recent weeks is continuing: traders are moving out of year-to-date winners in areas like big-tech and piling into recent areas of weakness like retailers and biotech stocks. This is being encouraged by the fact that many retailers are poised to benefit from the GOP’s tax reform plans, since they carry relatively high tax burdens.

Here are five names to put on your list:

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

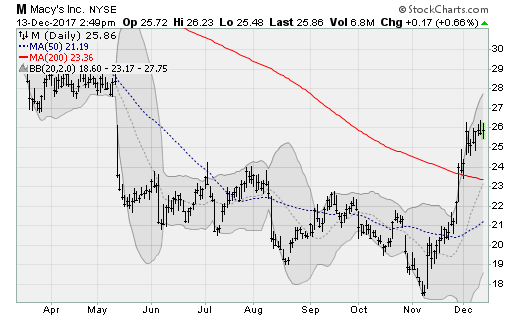

Retail Stocks to Buy: Macy’s (M)

Macy’s Inc (NYSE:M) shares have been rising powerfully off of the lows set in early November, as tepid expectations heading into the holiday shopping season have been replaced by newfound optimism returning prices to levels not seen since May. Management talked up its solid start to the holiday shopping season on Dec. 1, eclipsing bad headlines related to a blackout of its payment processing system on Black Friday.

The company will next report results on Feb. 27 before the bell. Analysts are looking for earnings of $2.48 per share on revenues of $8.5 billion. When the company last reported on Nov. 9, earnings of 23 cents per share beat estimates by 4 cents on a 6.1% decline in revenues.

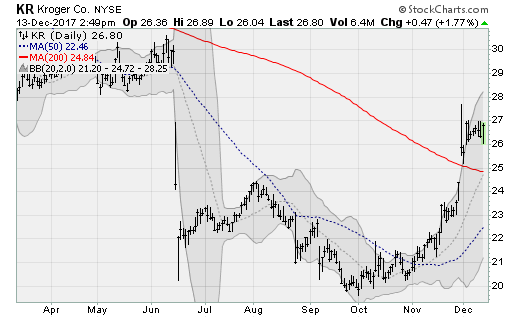

Retail Stocks to Buy: Kroger (KR)

Kroger Co (NYSE:KR) shares are up some 35% from their September/October low, cutting above their 200-day moving average, thanks to a alleviation of some of the Amazon.com, Inc. (NASDAQ:AMZN)-Whole Foods fear. Recent earnings were solid and forward guidance was positive amid process on lowering costs and boosting traffic.

The company will next report results on March 8 before the bell. Analysts are looking for earnings of 61 cents per share on revenues of $30.1 billion. The company last reported results on Nov. 30 with earnings of 44 cents beating estimates by four cents on a 4.5% rise in revenues.

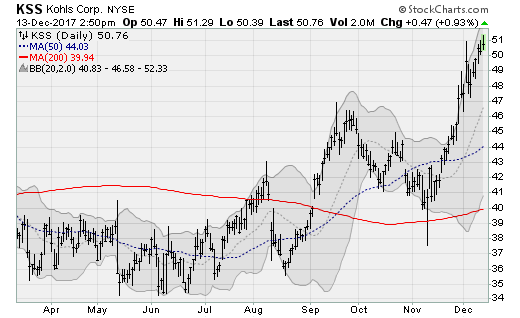

Retail Stocks to Buy: Kohl’s (KSS)

Kohl’s Corporation (NYSE:KSS) shares have gone vertical since early November, rising more than 25% after finding support at its 200-day moving average. Catalysts have included positive analyst commentary on comp-store sales trends, improving product portfolio, strong loyalty and the best Black Friday deal on the PS4 gaming console. Cost savings and inventory reduction initiatives are poised to lift free cash flow as well.

The company will next report results on March 1 before the bell. Analysts are looking for earnings of $1.46 per share on revenues of $6.4 billion. When the company last reported on Nov. 9, earnings of 70 cents per share missed estimates by two cents on a 0.1% rise in revenues.

Retail Stocks to Buy: Gap (GPS)

Gap Inc (NYSE:GPS) shares have gained more than 50% from their August low — returning to levels not seen since the summer of 2015 — thanks to ongoing success at its Old Navy brand after years of struggle at its Gap and Banana Republic labels. Analyst coverage has been positive, with KeyBanc recently noting solid holiday season performance so far.

The company will next report results on Feb. 15 after the close. Analysts are looking for earnings of 58 cents per share on revenues of $4.6 billion. When the company last reported on Nov. 16, earnings of 58 cents per share beat estimates by 1.1%.

Retail Stocks to Buy: Pier 1 Imports (PIR)

Pier 1 Imports Inc (NYSE:PIR) shares are surging higher on Wednesday, rising more than 7% to return to levels not seen since May. This represents a 50% rise off of the lows seen in September and represents a sea change after the disappointment from the last quarterly update around that time. Optimism is surrounding the appointment of new management and growing confidence in the retail environment.

The company will next report results on Dec. 13 after the close. Analysts are looking for earnings of 11 cents per share on revenues of $466.7 million. When the company last reported on Sept. 27, a loss of five cents per share beat estimates by a penny on a 0.4% rise in revenues.

Anthony Mirhaydari is founder of the Edge (ETFs) and Edge Pro (Options) investment advisory newsletters. Free two- and four-week trial offers have been extended to InvestorPlace readers.

The post 5 Retail Stocks to Put on Your Shopping List appeared first on InvestorPlace.