5 Madoff ex-workers convicted in case's 1st trial

NEW YORK (AP) — Five former employees of imprisoned financier Bernard Madoff were convicted Monday at the end of a six-month trial that cast them as the long arms of their boss, telling an elaborate web of lies to hide a fraud that enriched them and cheated investors out of billions of dollars.

The trial, one of the longest in the storied history of Manhattan federal court, was the first to result from the massive fraud revealed in December 2008 when Madoff ran out of money and was arrested. And it was a renunciation of Madoff's claim when he pleaded guilty to fraud charges in March 2009 before trial that he acted alone.

"The evidence was just overwhelming," juror Craig Parise told reporters as he left the courthouse.

Another juror, Sheila Amata, said she hoped "this brings some level of closure" to the victims. She added that the "facts spoke for themselves" in the case and that Madoff, who is serving a 150-year prison sentence, "seemed to have a split personality." Evidence showed him showering employees, friends and some select customers with favors and riches while he plundered the investment accounts of others.

The case focused on five people who prosecutors said helped Madoff carry out the fraud.

Each was convicted of conspiracy to defraud clients, securities fraud and falsifying the books and records of a broker dealer. Prosecutors obtained convictions on all 31 charges, though only one defendant was charged in some counts.

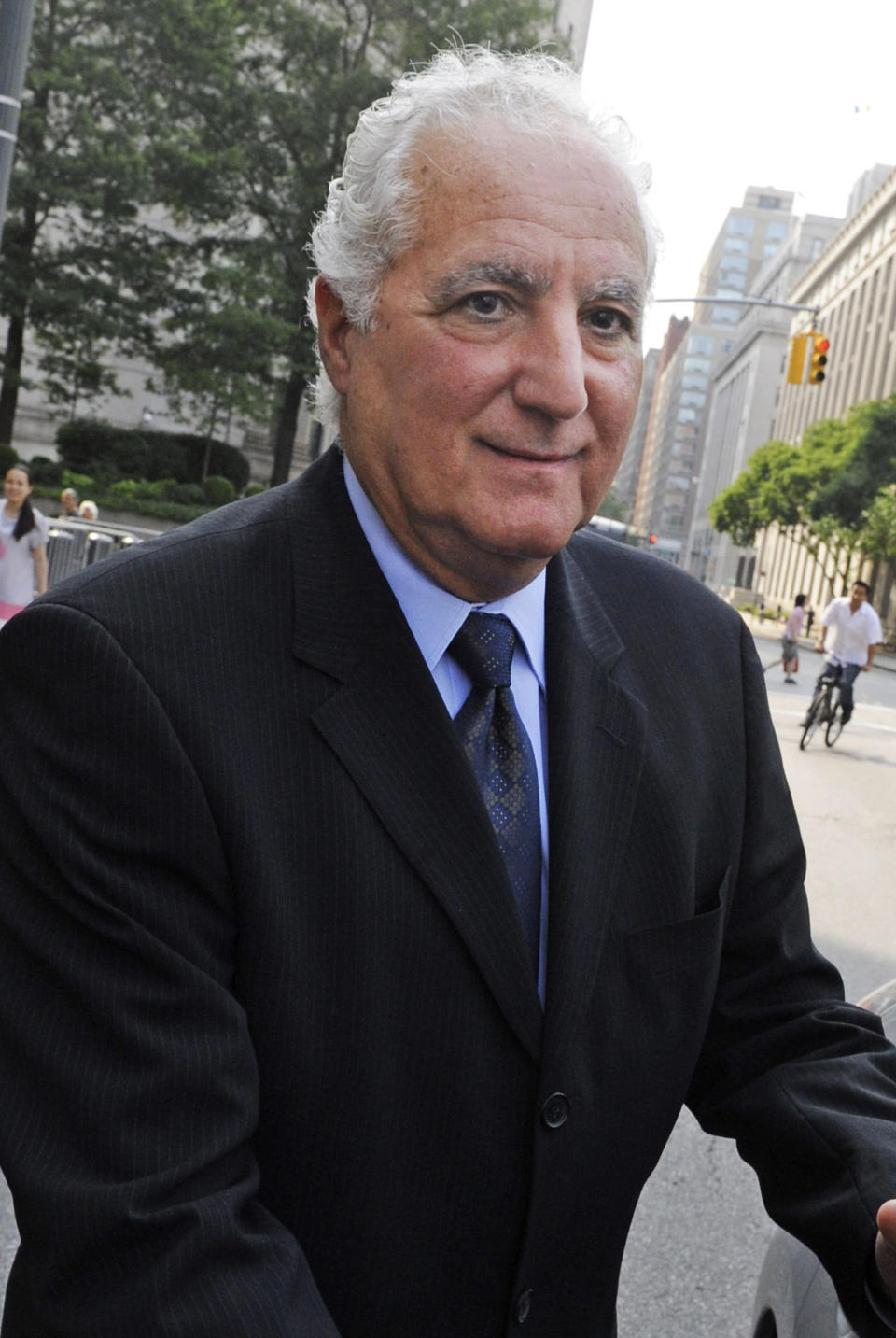

Prosecutors unveiled hundreds of exhibits and showcased dozens of witnesses to try to prove charges against Annette Bongiorno, 66, Madoff's longtime secretary; Daniel Bonventre, 67, his director of operations for investments; JoAnn Crupi, 53, an account manager; and Jerome O'Hara, 51, and George Perez, 48,computer programmers.

The maximum potential sentences range from 78 years to 220 years in prison when the charges for each defendant are stacked up, but the actual sentences are likely to be far below that once the judge takes into consideration prior records and other facts unique to each defendant.

The defendants largely took the verdicts in stride except for Crupi, who looked shocked when the first guilty verdict was read and later shook her head.

After sentencings were set for the last week of July and U.S. District Judge Laura Taylor Swain rejected requests that the defendants be immediately detained, the defendants emerged from court to hug family members. They declined to comment as they passed reporters.

Bonventre attorney Andrew Frisch said as he left court they were disappointed by the verdicts and will appeal.

"The list of Bernard Madoff's victims now include these five former employees," Frisch said.

Attorney Eric Breslin, representing Crupi, said: "The name Madoff was a tall mountain to climb. I think it's just a fact."

U.S. Attorney Preet Bharara said the convictions, along with prior guilty pleas of Madoff and eight other defendants, demonstrate what prosecutors have believed since the early stages of the investigation: "This largest-ever Ponzi scheme could not have been the work of one person."

"These defendants each played an important role in carrying out the charade, propping it up and concealing it from regulators, auditors, taxing authorities, lenders and investors," Bharara said.

One case remains outstanding, that of a former senior tax partner at the accounting firm Konigsberg Wolf & Co. who was charged with aiding Madoff by directing others to falsify records to conceal his fraud.

Bongiorno and Bonventre testified for several days in their own defenses. They insisted they were victims of Madoff's fraud, losing millions of dollars they had invested with him because they believed in and trusted him.

Bongiorno told the jury she once asked how the firm was "making money when everyone else was losing money." She said Madoff told her they could make money in a down market by shorting stocks and she believed him.

Parise, the juror, said the testimony by Bongiorno and Bonventre "did not help their cause."

Clients lost nearly $20 billion. A court-appointed trustee has recovered much of the money by forcing those customers who received big payouts from Madoff to return them. When the fraud was revealed, Madoff admitted that the nearly $68 billion he claimed existed in accounts was only a few hundred million dollars.

The centerpiece of the prosecution's case was Frank DiPascali, Madoff's former finance chief, and five other insiders who pleaded guilty and agreed to cooperate.

At times, however, their testimony seemed to support the defendants' claims they were kept in the dark.

DiPascali acknowledged he lied to Perez and O'Hara "to trick them into working on the projects that he needed them to work on."

Attorney Larry Krantz, representing Perez, asked him if he was manipulating them so they could participate in the massive fraud without knowing it.

"Yes," DiPascali answered.

Defense lawyers, in their closing arguments, hammered at the notion that their clients were victims, too, losing tens of millions of dollars they had entrusted to their boss.

Attorney Gordon Mehler said his client, O'Hara, was "used, abused, manipulated, lied to, snookered and bamboozled" by two of the greatest criminal masterminds in history, Madoff and DiPascali.

Bongiorno's attorney, Roland Ripoelle, said Bongiorno "saw $50 million of what she thought was her own money but was really Bernie Madoff's monopoly money go up in smoke. ... Ms. Bongiorno relied on Mr. Madoff, and she was fooled by him."

Breslin said Crupi was a victim of "the lies that they told her to her face, year after year."

The verdict was delivered after the jury deliberated for about 20 hours over a period of two weeks. The panel was down to 11 jurors after one juror became sick during deliberations and was dismissed.

The defendants were described by prosecutors as "necessary players" in Madoff's fraud. They said Bongiorno, hired in 1968, and Crupi, hired in 1983, used old stock tables to fabricate account statements and other fake records that kept the Securities and Exchange Commission in the dark. The government said they also rewarded themselves with tens of millions of dollars in salaries and bonuses, including $2.5 million for a beach house for Crupi as the Ponzi scheme was falling apart.

Prosecutors said O'Hara and Perez developed a software program that automated the fraud, generating "information out of thin air," as one put it.

The Ponzi scheme nearly ran out of money at least twice since the early 1990s before finally collapsing during the 2008 financial crisis.

During jury selection, prospective jurors were told that they might hear references to big names including Steven Spielberg, Sandy Koufax, Kevin Bacon and Zsa Zsa Gabor, among Madoff's victims. Hundreds of exhibits and thousands of pages of materials were put before jurors.

Also mentioned were Madoff's relatives, including his brother, wife and two sons. One of the sons committed suicide two years after the fraud was revealed.

Madoff, 75, is serving his sentence at a federal lockup in North Carolina.

Over the years, Alger Hiss and Julius and Ethel Rosenberg were tried as traitors in the Manhattan courthouse, and Khalid Sheik Mohammed's nephew Ramzi Yousef was convicted there in the 1993 World Trade Center bombing and in a plot to blow up a dozen airliners.

_____

Associated Press writers Tom Hays and Jennifer Peltz also contributed to this report.