5 Guru Stocks Expected to Boost Earnings

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, a Premium feature, as of Sept. 30 the following guru-held companies have positive future earnings estimates from Morningstar analysts.

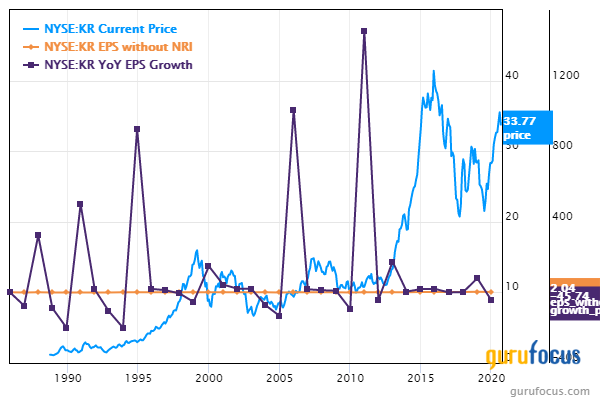

The Kroger Co.

Shares of The Kroger Co. (KR) were trading around $33.77 on Wednesday.

The American grocer has a GuruFocus profitability rating of 8 out of 10. Its earnings per share have declined 0.20% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 6.35%. The return on equity of 27.83% and return on assets of 5.63% are outperforming 77% of companies in the retail, defensive industry.

With 3.37% of outstanding shares, Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder, followed by Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 2.82% and Pioneer Investments (Trades, Portfolio) with 0.21%.

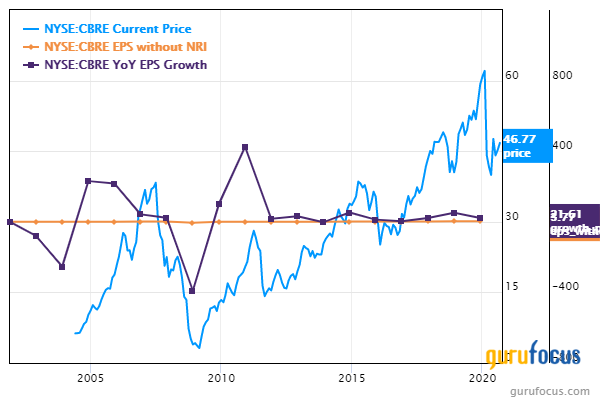

CBRE

On Wednesday, CBRE Group Inc. (CBRE) was trading around $46.77 per share.

With a market cap of $15.68 billion, the real estate services provider has a GuruFocus profitability rating of 8 out of 10. Its earnings per share have climbed 30.70% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 5.88%. The return on equity of 19.49% and return on assets of 7.42% are outperforming 90% of companies in the real estate industry.

ValueAct Holdings LP (Trades, Portfolio) is the company's largest guru shareholder with 3.05% of outstanding shares, followed by Al Gore (Trades, Portfolio) with 2.51% and John Rogers (Trades, Portfolio) with 0.59%.

Essex

Shares of Essex Property Trust Inc. (ESS) were trading around $199.60 per share on Wednesday.

With a market cap of 13.02 billion, the company has a GuruFocus profitability rating of 7 out of 10. Its earnings per share have risen 2% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 1.83%. The return on equity of 10.12% and return on assets of 4.83% are outperforming 77% of companies in the REITs industry.

With 0.65% of outstanding shares, Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons' Renaissance Technologies with 0.50% and Third Avenue Management (Trades, Portfolio) with 0.15%.

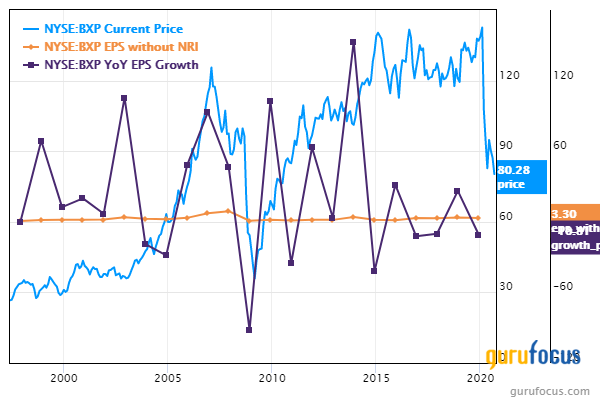

Boston Properties

Boston Properties Inc. (BXP) was trading around $80.28 per share on Wednesday.

The real estate investment trust has a market cap of $12.49 billion and a GuruFocus profitability rating of 8 out of 10. Its earnings per share have risen 0.40% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 1.04%. The return on equity of 17.26% and return on assets of 4.71% are outperforming 76% of companies in the REITs industry.

With 0.35% of outstanding shares, First Eagle Investment (Trades, Portfolio) is the company's largest guru shareholder, followed Pioneer Investments (Trades, Portfolio) with 0.13%, Chris Davis (Trades, Portfolio) with 0.07% and Paul Tudor Jones (Trades, Portfolio) with 0.05%.

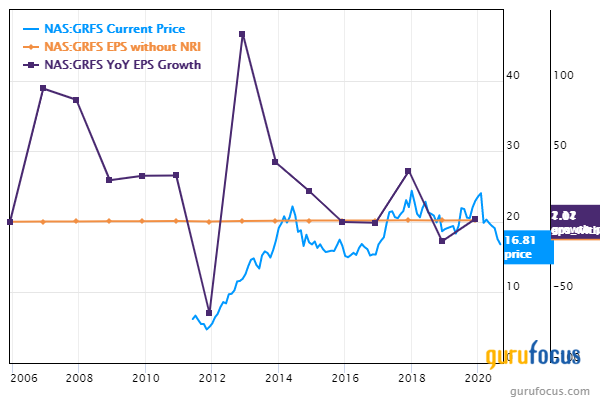

Grifols

On Wednesday, Grifols SA (GRFS) was trading around $16.81 per share.

With a market cap of $11.51 billion, the plasma derivative producer has a GuruFocus profitability rating of 8 out of 10. Its earnings per share have climbed 4.40% over the last three years.

Analysts project a three-year to five-year earnings growth rate of 8.97%. The return on equity of 11.18% and return on assets of 3.74% are outperforming 61% of companies in the drug manufacturers industry.

With 0.39% of outstanding shares, George Soros (Trades, Portfolio) is the company's largest guru shareholder, followed by Simons' firm with 0.01% and Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Insurance Companies Trading With Low Price-Earnings Ratios

5 Guru Stocks With Predictable Businesses

4 Defensive Stocks Trading With Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.