5 of the world’s biggest financial crimes you must know

The global financial crisis of 2008 is considered by many economists to have been the worst one since the Great Depression in the ’30s. In part, it was caused by the bursting of the US housing bubble, which was also in part due to the overvaluation of bundled subprime mortgages based on the theory that housing prices would continue to escalate.

Well, what goes up must come down eventually and when it did, a lot of speculators, investors and of course, homeowners and their families got caught.

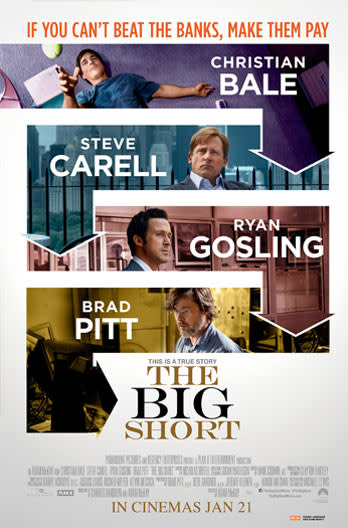

As depicted in the movie The Big Short, there were people who are happy to gain from other people’s impending doom. In the film, which is based on a 2010 book by financial journalist Michael Lewis, eccentric hedge fund manager Michael Burry (Christian Bale) discovers that the US housing market is extremely unstable and predicts that the market will collapse in 2007. He realises he can profit by creating a credit default swap market, which will allow him to bet against the housing market. He puts this plan into action and eventually earns close to 500 per cent in profit.

Others such as traders Jared Vennett (Ryan Gosling) and retired banker Ben Rickert (Brad Pitt) also become involved – essentially, profiting from ruined and lost lives.

While this bunch did not commit any crime, there are plenty others who have been convicted or are awaiting trial for white collar crimes amounting to billions of dollars. Let’s have a look at some infamous figures:

1. Nick Leeson

Nick Leeson. (Credit: nickleeson.com)

Nicholas “Nick” Leeson is known in some quarters as Singapore’s most famous criminal. The former derivatives broker made several fraudulent, unauthorised speculative trades that caused the complete collapse of the UK’s oldest merchant bank, Barings Bank. He was sentenced to 6.5 years in prison in 1996 but was released in 1999 after being diagnosed with colon cancer. He survived it though and is today a keynote and after-dinner speaker.

2. Charles Ponzi

Charles Ponzi (Credit: playingintheworldgame.wordpress.com)

This Italian businessman and con artist lent his surname to the Ponzi scheme, a money-making scheme that he used to cheat investors. He promised clients a 50 per cent profit within 45 days, or 100 per cent profit within 90 days, by buying discounted postal reply coupons – a form of postal voucher that can be exchanged for postage – in other countries and getting their face value back in the US. This is a form of arbitrage. Basically, Ponzi is saying that buyers can take advantage of the difference in prices in the markets – kind of like taking advantage of favourable exchange rates. However, in reality, Ponzi was paying early investors using the investments of later investors. It is an unsustainable, and illegal, scheme. His scheme ran for over a year before it collapsed, costing his “investors” US$20 million.

3. Bernard Madoff

Bernie Madoff. (Credit: nydailynews.com)

Bernard “Bernie” Madoff is the founder of US Wall Street investment firm Bernard L. Madoff Investment Securities LLC. He used the company, which he started in 1960 and in which he employed relatives including his brother and sons, to run a Ponzi scheme. It was not just a Ponzi scheme; it is considered to be the largest financial fraud in US history. He was arrested in December 2008. It is estimated that investors suffered actual losses of US$18 billion. Madoff is now serving 150 years in prison – he got the maximum sentence allowed.

4. Jerome Kerviel

Jerome Kerviel. (Credit: lerelais.ma)

French trader Jerome Kerviel is said to have caused losses worth 4.9 billion Euros at Societe Generale. He was convicted of breach of trust, forgery and unauthorised use of the bank’s computers. He was sentenced to five years’ jail in 2010 but was released just 110 days later to serve out the rest of his sentence wearing an electronic tag. While he did not deny making unauthorised trades, he has portrayed himself as a victim, saying he was allowed to carry on while his deals made money. But was persecuted when his losses accumulated. He also alleges in his book that his superiors knew about his trades.

5. Jordan Belfort

Jordan Belfort. (Credit: dailyentertainmentnews.com)

Perhaps the most infamous white collar criminal in recent years due to the movie The Wolf of Wall Street, Jordan Belfort was convicted in 1999 for fraud and other crimes related to stock market manipulation and the running of a penny-stock scam. He spent a relatively short 22 months in prison as he had a deal under which he testified against partners and subordinates in his schemes. The movie was adapted from Belfort’s memoir and was released in 2013 with Leonardo DiCaprio playing the lead.

In theatres.

In The Big Short, some of the men suffer emotional scarring when they realise they essentially took profit from other people’s misfortune. Catch the movie to find out what happened to their own lives after the bubble burst.

Sources: wikipedia.org, businessinsider.com

The post 5 of the world’s biggest financial crimes you must know appeared first on The Popping Post.