3 Top Small-Cap Stocks to Buy in October

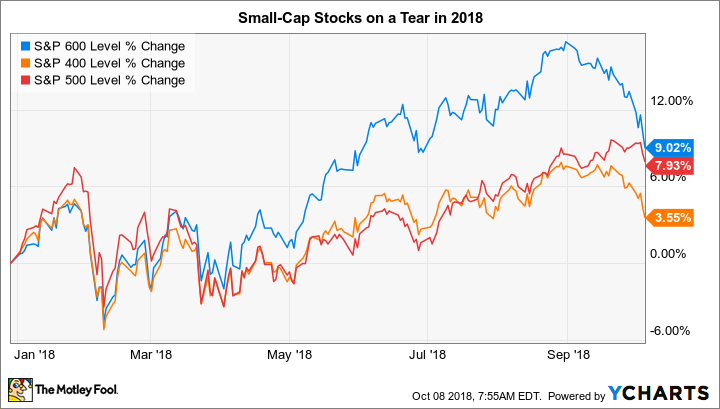

Small-cap stocks had a big run-up this year, with the S&P Small Cap 600 index more than doubling the performance of the S&P 500 through Sept. 1. Since then, however, although their year-to-date performance is still beating the broad market index (and the mid-cap index, too), small-cap stocks have fallen hard, down over 7% compared to the S&P 500 essentially being flat.

We asked three Motley Fool contributors to identify a small-cap stock that they believe could outperform the market and is a good buy this month. Check out why Greenbrier (NYSE: GBX), Novavax (NASDAQ: NVAX), and Winnebago (NYSE: WGO) made the cut.

This train is steaming ahead

Neha Chamaria (Greenbrier): At the time of this writing, Greenbrier is a few million short of moving out of the small-cap and into the mid-cap stock category. That's one reason why I am recommending the still-small-cap Greenbrier today -- the stock's been on a tear lately and is visibly on its way to becoming bigger, backed by solid underlying fundamentals.

Wait, this Greenbrier isn't the luxury resort that goes by the same name. The Greenbrier I'm talking about manufactures railcars and transportation equipment and parts. Now that's a pretty boring business, but well positioned for growth especially in the currently strong business environment. Railroads are scrambling to keep up with strong demand from key end markets like coal, metals, oil and gas, and chemicals.

That's exactly what a rail equipment manufacturer like Greenbrier wants. Why, in just the months of June and July, Greenbrier bagged orders for 5,000 railcars worth more than $425 million. That's a good boost to the company's backlog value of $2.3 billion as of May.

There's another reason why Greenbrier caught my attention right now: Oil prices are surging, which bodes well for the manufacturer of tanker cars. With the company set to release its fourth-quarter numbers in the coming weeks, you might want to hop on to this train to not miss a likely profitable ride.

Image source: Getty Images.

A small-cap biotech on the rise

George Budwell (Novavax): Novavax, a small-cap vaccine maker, could be a great stock to add to your portfolio this month. The company's shares have already started to heat up in recent weeks, thanks to the news that its experimental respiratory syncytial virus vaccine, ResVax, is set to produce a key interim data readout early next year.

Digging into the details, the vaccine is presently in a late-stage study where it's being assessed in pregnant women. The basic idea is to understand whether ResVax can help boost immunity against this common and often dangerous respiratory infection in unborn children. RSV is a leading cause of hospitalizations among children under the age of 5 in the United States.

Why is this interim data reveal such a big deal for the company? In short, Novavax recently announced that the Food and Drug Administration has agreed to allow this preliminary analysis to be used as the basis for a potential regulatory filing. So, if things go according to plan, the company could have a high-value product on the market as soon as 2020.

The fly in the ointment, though, is that ResVax has already failed in one late-stage study in elderly adults and it wasn't exactly a showstopper in its previous mid-stage trial in pregnant women. Long story short, this experimental RSV vaccine is far from a sure thing -- meaning that investors arguably shouldn't buy more than they can afford to lose.

In sum, Novavax could turn out to be incredibly undervalued at current levels if ResVax hits the mark in this ongoing pivotal trial.

Driving a hard bargain

Rich Duprey (Winnebago): RV maker Winnebago has lost 42% of its value so far this year, hit by a combination of factors playing against the industry, including rising steel and aluminum prices due to tariff actions, a glut of inventory, and elevated gas prices hovering around $3 per gallon that might make buyers leery of purchasing gas guzzlers.

The RV Industry Association says shipments fell nearly 13% in August, though year to date they're up almost 6%. But there remains good reason to believe things will turn around, not least because there are 9 million people who own an RV today, the most ever and up 64% since 1980. Baby boomers are now coming into the period of their life when buying an RV is highest and millennials are showing increased interest in the lifestyle. The RVIA forecasts almost 506,000 units will be shipped to dealers this year, the ninth straight year of growth.

Winnebago's third-quarter earnings saw revenue jump 18% over the year-ago period, as towable sales surged 33%, while gross margins widened 30 basis points to 15.2%.

Although tariffs and rising costs remain an industry concern, and should be watched as the RV industry is a surprising bellwether for how the economy will go, Winnebago's depressed stock gives investors a chance to buy into this stock. It trades at just 10 times trailing earnings and eight times this year's estimates while also going for a fraction of its sales. With a dividend that yields a modest 1.2%, Winnebago could be one to drive off with toward greater gains.

More From The Motley Fool

George Budwell has no position in any of the stocks mentioned. Neha Chamaria has no position in any of the stocks mentioned. Rich Duprey has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.