3 Big Stock Charts for Friday: Sherwin-Williams, Regeneron and Allstate

The market managed to stop Wednesday’s strong selloff with a respectable bounceback on Thursday, but, the issue still hangs in the balance. The volume behind the gain was modest, and the indices are still within easy reach of a technical breakdown.

The bulk of Thursday’s limited number of fireworks were provided courtesy of Amazon (NASDAQ:AMZN). The e-commerce giant said it was acquiring online pharmacy PillPack, sending traditional pharmacy stocks like CVS Health (NYSE:CVS), Rite Aid (NYSE:RAD) and Walgreens Boots Alliance (NASDAQ:WBA) careening.

None of those names are well-suited for trading now though … too much volatility makes it impossible to get a read on what’s to come. Rather, the best bets from here are Sherwin-Williams (NYSE:SHW), Regeneron (NASDAQ:REGN) and Allstate (NYSE:ALL), each of which are relatively immune to the market’s normal recycling of hysteria.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Sherwin-Williams (SHW)

There’s nothing sexy about Sherwin-Williams, even when factoring in that it’s more than just paint. It’s also an industrial coating specialist, which is an industry that’s well-positioned to capitalize on broad economic growth.

Yet, SHW stock is compelling here, even if only for technical reasons.

• The bears have had ample opportunity to beat Sherwin-Williams shares down for weeks now. They just haven’t. With Thursday’s gain, the stock’s back above a recent ceiling around $403.86, extending a rally that has become pretty well developed.

• Also note that we’re still seeing more bullish volume than bearish volume, even if that trend is erratic.

• While “boring,” this stock has an impressive long-term track record. SHW shares are up more than 200% over the course of the past six years, and the momentum still seems as intact as it ever has.

Regeneron (REGN)

For a multitude of reasons, the summertime is a bullish time of year for biotech stocks even if it’s a disappointing time of year the overall market. To that end, Regeneron Pharmaceuticals is as much of sector-timing play as it is a stock-specific trade.

Even on a stock-specific basis though, this chart looks like it’s in breakout mode.

• The monthly chart’s selloff since July of last year is daunting, but the reversal that’s materialized since May is a text book reversal. May’s bar was an oddly short doji bar, indicating a pivot, and June’s bullish follow-through is confirmation of that pivot.

• The daily chart has easily pushed past its 50-day moving average line, and not looked back.

• There’s also plenty of volume behind the past several days’ worth of gains. And, that bullish volume appears to be growing.

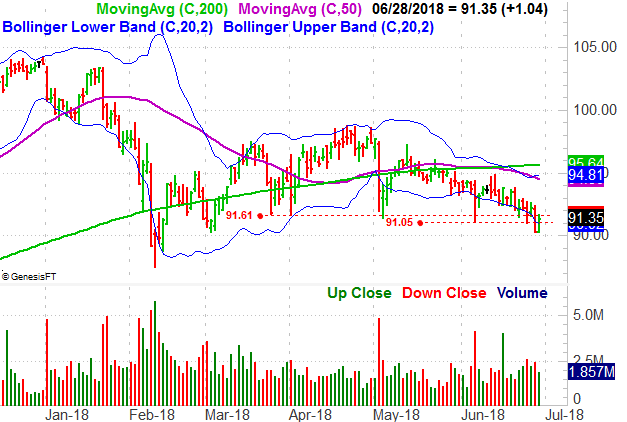

Allstate Corp (ALL)

Not every worthy trading prospect is a bullish one right now though. Like many other insurers of late, Allstate is fighting a losing battle, and just suffered tough blow in a vulnerable state. Insurers, as a group, are also falling out of favor against the back drop of rising rates and the foreseeable future of interest rates.

• As of mid-June, ALL shares dished out a “death cross.” That’s a cross of the 50-day moving average line below the 200-day moving average line, suggesting the weakness has become a significant trend.

• Thanks to Wednesday’s plunge, two key support levels — at $91.61 and $91.05 — have been broken. Thursday’s gain only partially unwound that blow. The shape of the monthly chart shows a gradual, ongoing downside acceleration. One more bad day could push Allstate over the edge.

• The daily chart also shows that the volume behind the recent “up” days has been lower than the “down” day volume.

As of this writing, James Brumley did not hold a position in any of the aforementioned securities. You can follow him on Twitter, at @jbrumley.

Legendary Investor Louis Navellier’s Trading Breakthrough

Discovered almost by accident, Louis Navellier’s incredible trading breakthrough has delivered 148 double- and triple-digit winners over the last 5 years — including a stunning 487% win in just 10 months.

Learn to use this formula and you can start turning every $10,000 invested into as much as $58,700.

Click here to review Louis’ urgent presentation.

More From InvestorPlace

The post 3 Big Stock Charts for Friday: Sherwin-Williams, Regeneron and Allstate appeared first on InvestorPlace.