The 3 Best Health Care and Pharma Stocks for 2017—Whatever Happens to Obamacare

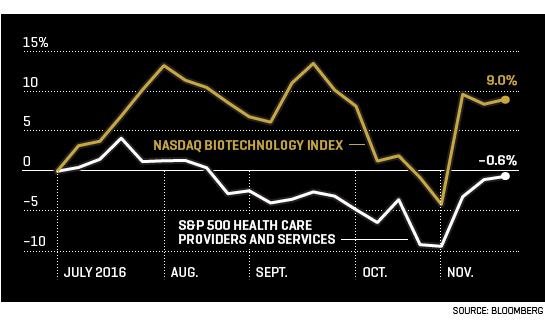

To understand the uncertainty over what Donald Trump's presidency will mean for health care, look no further than the stock market: The day after the election the Nasdaq Biotechnology Index surged almost 9%, diverging from hospital operators like -Tenet Healthcare , whose shares plunged 25%. The market, evidently, had taken Trump's campaign promises--or lack thereof--at close to face value. His No. 1 health care policy objective, to "repeal and replace" the Affordable Care Act reforms better known as Obamacare, will hurt hospitals if it comes to pass. And while Hillary Clinton had promised to rein in drug price hikes, pharma investors interpreted Trump's relative silence on the issue as an all clear. "The Trump win is a tremendous boost to the sector on a couple of parameters: less regulation and more free-market principles," says Michael Gregory, head of health care credit and equity for Highland Capital Management.

At the same time, some investors caution that the short-term pharma-stock resurgence won't last in an era when members of Congress on both sides of the aisle have taken executives to task over exorbitant price increases. "I just don't think that President-elect Trump is going to look at that much differently. I don't think he's a big fan of price gougers either," says John Roth, portfolio manager of the Fidelity New Millennium Fund. Still, the health care sector, which has historically traded at a premium to the S&P 500, remains 14% cheaper than that index. ClearBridge managing director Margaret Vitrano sees value as well as reassurance in , which has been deriving its growth mostly from increases in patients' taking its blockbuster drugs, such as Revlimid, a multiple myeloma treatment, rather than price increases on those drugs. Celgene has a pipeline of 24 disease treatments in advanced clinical trials, and Vitrano forecasts it can grow its earnings at nearly 20% annually for the next five years, without price hikes that could draw regulatory backlash. Celgene could also benefit if the Trump administration offers a tax break for bringing home its overseas cash, which accounts for more than 70% of its total hoard.

With the future of Obamacare a wild card, investors have largely dumped companies that could lose customers if Americans are no longer required to have health insurance. The Affordable Care Act allowed an estimated 20 million newly covered patients to visit hospitals; without them, many hospital beds may now go empty more often, says Mary Pierson, who comanages $4.9 billion in mid-cap assets for Fairpointe Capital. But the selloff also hit companies that sell equipment to hospitals, unfairly punishing companies such as Varian Medical Systems , which has an attractive estimated P/E of 18 for fiscal 2017. A maker of advanced radiotherapy devices for cancer treatment, Varian gets more than 50% of its revenues--and much of its growth--outside the U.S., where it would be "unaffected by changes to Obamacare," Pierson notes.

For health insurers, the ACA was more a drag than a benefit: "It's not a bad thing for the insurance companies if these health exchanges go away," Gregory notes. Many portfolio managers favor , which not only had largely pulled out of the state insurance marketplaces but also is the only major carrier not tied up in a pending merger and accompanying antitrust litigation--yet another potential source of uncertainty under a new U.S. administration.

PICKS:

Celgene

Varian Medical Systems

UnitedHealth Group

This is part of Fortune's 2017 Investor's Guide feature, "The 21 Best Stocks to Buy Before Donald Trump Becomes President.” For the rest of the picks (including two funds) in other sectors, click on the links below:

A version of this article appears in the December 15, 2016 issue of Fortune with the headline “Stocks to Keep a Nest Egg Growing.”