3 benefits freelancers need to know about

Freelancers contribute $1.4 trillion to the economy every year. According to a study by the Freelancers Union and Upwork, 57 million Americans consider themselves freelancers. Twenty-nine percent of those are full-time freelancers, up from 17% in 2014.

More than half made the switch to being freelance in the past three years, and two-thirds said they chose to make the switch rather than out of necessity. Forty-seven percent of millennials freelance. Suffice it to say, the freelance economy — and freelancers prefer this term to the term “gig economy” — is thriving.

Making the switch from traditional work to freelance means giving up benefits, right? Well, that all depends on how you look at it.

Tax benefits

There are lots of tax benefits to being a freelancer. If you work from home, you can deduct part of your rent or mortgage payment for a home office. Travel a lot for work? You can deduct plane tickets and car rentals as long as the trip’s primary purpose is for work. You can even deduct membership dues to professional organizations.

Perhaps one of the better deductions you can take as a freelancer is your health care. According to Upwork, you can deduct your health insurance premiums that cover yourself and your family.

When it comes to retirement, you can open your own individual retirement account, like a SEP IRA.

Sick pay

Eight states, 29 cities, two counties and the District of Columbia guarantee your right to paid time off if you get sick. In late September, the governor of Rhode Island signed a sick pay law that takes effect next year.

In most places, you earn one hour of sick pay for every 30 hours of work, and you’ll be allowed to use sick time to care for a sick family member as well as yourself. Some places, like Washington, Vermont and the city of Chicago, have different formulas for how much sick time you accrue, so be sure to check your local or state laws. Most places require you to work a certain number of days before you can take advantage of your sick days though, so don’t expect to be able to get paid for a sick day in your first week on the job.

“Where a lot of progress happens is at locality,” said Sherry Lewaint, co-founder and president of A Better Balance, a group that advocates for workplace reforms. “Localities are a good place to be working to the extent that you can hopefully demonstrate that these laws don’t make the economy go into the sea or don’t hurt business that much.”

Local sick laws haven’t always been successful. In Florida, a state law banning local sick leave ordinances was passed before Orange County — which includes major employers like Disney World, SeaWorld and other big theme parks — could mandate sick pay.

Some states, like California, New Jersey and New York are even starting to pass laws to protect family leave. For example, under New York’s law, any private employee who works on a full-time or part-time basis will be eligible, as long as you have a regular schedule with a company.

Health care

A majority of freelancers have health insurance — 85% — but more than half said their premiums rose in the past year. The Affordable Care Act has helped freelancers, and 60% want Congress to keep the law on the books. Forty-two percent of those surveyed said they’d even like to see Congress keep and strengthen Obamacare.

The ability to buy your own health insurance without a company sponsoring your plan has changed the way freelancers view their health care. Seventy percent of freelancers surveyed said they would rather take home more money and get their own health insurance, up 4% from last year.

“When you look at more middle-income freelancers, they had a harder time of affording or feeling like they were getting value from their insurance, but they were still supportive of it,” said Sara Horowitz, founder executive director of the Freelancers Union. “The economic brain says one thing, but your political brain says another.”

Seventy-two percent of freelancers said they would consider crossing party lines if a candidate spoke to their issues as freelancers.

“What I think is interesting is freelancers said if a candidate would talk about their political issues as freelancers, 72% said they would cross party lines,” Horowitz said. “We’re seeing the Democratic and Republican parties starting to splinter. There’s no element of either that has come up with any real freelancer agenda that is worker-oriented. Both have come up with a corporate gig agenda, but not something that will help workers.”

Standard of living

Freelancing could even boost your standard of living. Thirty-six percent of freelancers in the U.S. report earning more than $75,000 per year. And 62% of freelancers who left a traditional job say they earn more now as freelancers than they did before.

NerdWallet ranked the best cities in the U.S. to be a freelancer. Austin, Texas, was top of the list, where the median monthly income after paying necessities like rent is $2,179; that’s $300 more than the top ten average of $1,875. Nashville and Dallas were the next best cities, given their low average rent prices.

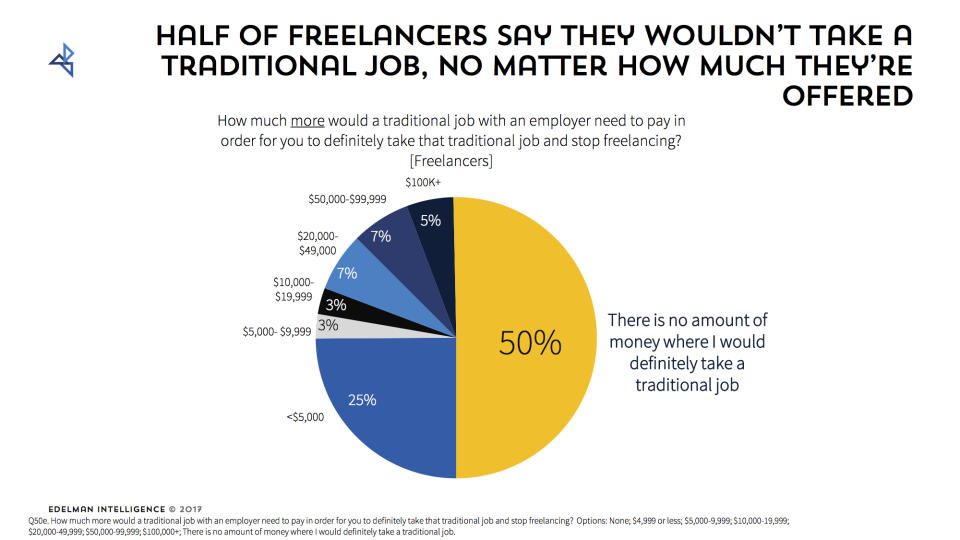

More than 17 million people have quit traditional jobs to freelance full time, and half of freelancers in one survey said no amount of money would convince them to take a traditional job.

It’s not all roses

Freelancing isn’t for everyone. Income can be unpredictable, and 71% of full-time freelancers said it hindered their ability to save money for the future.

Moonlighters said their main reasons for not turning to freelance full-time was the concern they wouldn’t be able to find enough work to support themselves, the desire to keep company benefits like paid vacation and health insurance and difficulty finding freelance work.

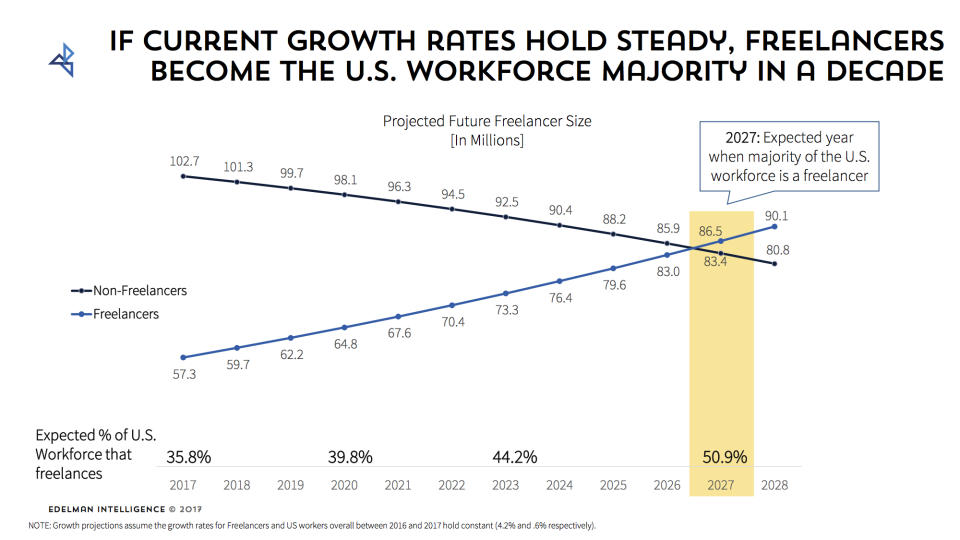

But if the rise in freelance work stays on the same trend it is currently, freelancers could outnumber traditional job holders in just 10 years.