2016 U.S. Tech Choice Study: Trust in Technology Relates to Age

Younger consumers have a noticeably higher level of confidence in technology than older consumers, according to the recently released J.D. Power 2016 U.S. Tech Choice Study.SM This is seen as especially important news for automakers, since trust in automation technology is crucial to the acceptance of autonomous vehicles.

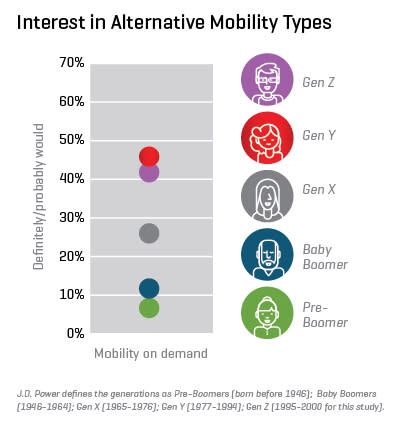

The study, now in its second year, examines consumer awareness, interest in, and price elasticity of various future and emerging technologies by vehicle make and consumer demographic. The major technology categories analyzed in the study include entertainment & connectivity, comfort & convenience, driving assistance, collision protection, navigation, and energy efficiency. Consumer interest in emerging concepts such as alternative mobility solutions, cybersecurity threats, and trust in automated technologies is also explored.

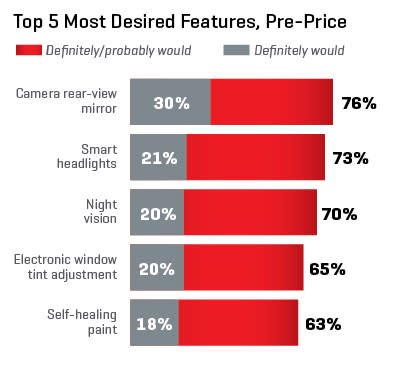

According to the study, consumers are most interested in automotive technology features that are related to the underpinnings of fully automated vehicles, such as radar, sensors, light detection and ranging (LIDAR), and cameras. Other features that are generating interest among consumers include smart headlights, night vision, lane-change assist, traffic jam assist, medical emergency stop, smart intersection, and predictive vehicle control.

But while interest in these technologies cut across all age groups, the study shows that actual trust in the technologies is directly linked to the age of the consumer. More than half of vehicle owners born between 1975 and 1994 (56%) and those born between 1995 and 2000 (55%) say they trust self-driving technology, compared with 41% of owners born between 1965 and 1974, 23% of those born 1946-1964, and 18% of those born before 1946. Of the last two categories—Boomers and Pre-Boomers—39% and 40%, respectively, say they “definitely would not” trust the technology. That percentage is progressively lower as the vehicle owner gets younger: only 27% of Gen X (those born from 1965-1976), 18% of Gen Y (1977-1994), and 11% of Gen Z (1995-2000 for this study) vehicle owners say they “definitely would not” trust the technology.

All generations show a high concern for technology security, specifically regarding privacy and the potential for systems to be hacked or hijacked or to crash.

“The level of trust is directly linked to the level of interest in a new technology among automobile buyers,” said Kristin Kolodge, executive director of driver interaction & HMI research at J.D. Power. “Acceptance can be increased with exposure over time and experience with automated technologies. But trust is fragile and can be broken if there is an excessive number of incidents with automated vehicles.”

Consumers Most Desire Navigation, Connectivity Tech

When consumers are shown the fair market value for the technologies, two of the four safety-related technologies on the top 10 list—night vision ($2,000) and lane-change assist ($1,500)—fall out of the top 10 most desirable. Less expensive features such as camera rearview mirror ($300) and camera side-view mirrors ($400) remain among the top 10. The most desired features after the price is shown are economy navigation system ($60); simple wireless device connection ($60); camera rearview mirror ($300); smart parking ($100); and predictive traffic ($150). Among the top 10 most desired technologies, self-healing paint has the highest price point at $500.

Night vision has the third-highest interest, with 70% of vehicle owners saying they “definitely would” or “probably would” want the technology in their next vehicle, prior to those owners being shown the price. When they learn the market value of that technology, it drops to 23rd overall. However, interest in night vision jumps to 36% from 16% when the price for this technology is reduced to $1,400.

Technologies that attract the lowest consumer interest (before consumers are shown the price) are trailer connect assist (25%), trailer towing visibility (29%), and full self-driving (34%). Many of these lower-interest technologies are especially appealing to a subsegment of the buying population, however. For instance, trailer connect assist interest increases to more than 60% among large SUV and large premium SUV owners. Similarly, only 35% of owners overall want new-driver monitoring, yet 58% of owners with children are interested in the technology.

Consumer Tips

Based on the study, J.D. Power offers the following consumer tips:

Stay informed of the latest automated automotive technology

Read reports of how these technologies work

Research the reliability of these technologies and base your purchase decision on documented facts

About the Study

The 2016 U.S. Tech Choice Study was fielded in February through March 2016 and is based on an online survey of more than 7,900 consumers who purchased/leased a new vehicle in the past 5 years.

Additional Research:

Abstract:

Younger consumers have a noticeably higher level of confidence in technology than older consumers, according to the recently released J.D. Power 2016 U.S. Tech Choice Study.

Year:

2 016