2 Stocks to Help You Make Money in Retirement

Your financial needs change drastically when you finally hand in your punch card and set off for retirement. You're no longer bringing home a paycheck, and Social Security alone probably won't be enough to live on. That's why you'll want to find stocks that can help you make money in retirement, like dividend-paying utility Duke Energy (NYSE: DUK) and high yield midstream partnership Magellan Midstream Partners, L.P. (NYSE: MMP). Here's a quick primer on each of these money machines.

Changing for the better

Duke Energy is one of the largest utilities in the United States, providing millions of customers with electricity and natural gas. Its top- and bottom-lines are largely driven by its regulated electric and natural gas utility businesses where Duke is granted a monopoly in its service areas but, in exchange, must get rate increases approved by regulators. The rest of its business is built around long-term contracts and fees (renewable energy production and midstream energy assets). It's a fairly stable business overall.

Image source: Getty Images.

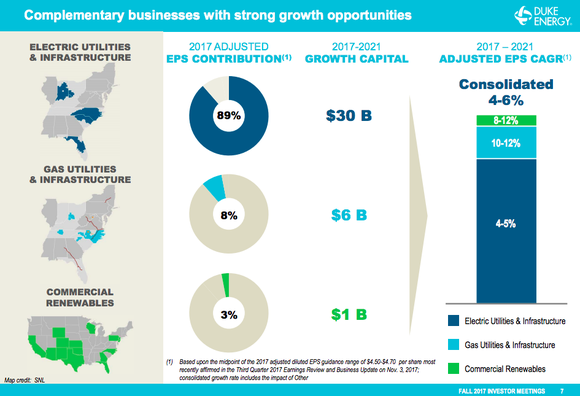

In fact, Duke has paid a dividend for over 90 consecutive years, with annual increases in each of the last 13 years. That said, the current makeup of the company is very different than what it was not too long ago. For example, the utility only recently bought the natural gas business, and it sold its carbon-fueled merchant energy fleet and foreign operations not too long ago. But this has put the company on a solid path to serve today's energy market. It expects earnings and dividends to grow at a solid 5% (or so) a year driven by big capital spending plans.

Duke Energy's spending plans. Image source: Duke Energy.

The real value of Duke in a portfolio, though, is that, well...it's kind of a boring company. The stock's beta, a measure of relative volatility, is a tiny 0.26. So when the market is gyrating, Duke probably won't be. And you can keep collecting the roughly 4% dividend yield, backed by inflation beating dividend growth, without having to stress out. More important, having a solid cornerstone investment like Duke will allow you be a little more aggressive elsewhere in your portfolio.

A distribution growth machine

This is where Magellan Midstream Partners comes into play. Magellan is a large midstream oil and natural gas partnership that owns largely fee-based assets in the transportation and storage areas. The current distribution yield is around 5.5%, and its beta is higher, at 0.78 (which is still relatively modest).

The truth is, Magellan is hardly a risky investment. In fact, it's one of the most conservatively managed midstream companies around. For example, debt to EBITDA is only around 3.5 times, while some midstream peers operate with debt to EBITDA ratios that are double that level (or more). Still, Magellan is a more aggressive investment than utility Duke Energy because its growth is tied to new capital projects (and acquisitions), whereas Duke can grow its giant utility businesses just by investing in its existing assets. (Duke's renewable power and pipeline businesses require new assets to grow, but these are relatively tiny compared to its regulated utility operations.)

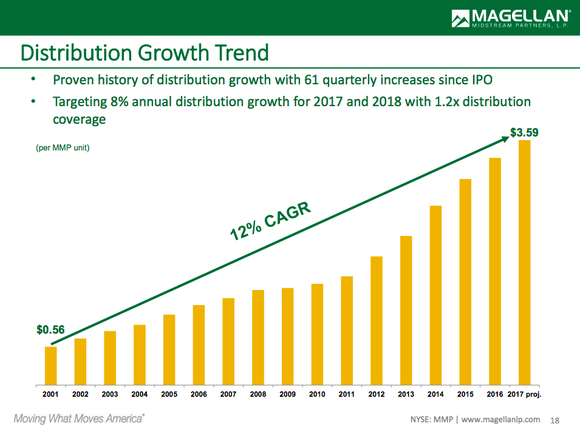

The really interesting thing here, though, is Magellan's distribution growth history. Over the past decade, the partnership has a compound annual distribution growth rate of 11% -- nearly four times the historical rate of inflation growth. It's targeting 8% over the next few years, which is nearly three times inflation.

Magellan Midstream's impressive distribution history. Image source: Magellan Midstream Partners, L.P.

Adding to this income story, the partnership has a 17-year history of annual increases. In fact, it's increased its distribution every single quarter since coming public. The distribution has now increased 590% since the first payment in May 2001. That impressive record is driven by the midstream player's conservative finances, which allow more cash to flow through to unitholders, and constant spending on growth. Over the next few years, Magellan has $1.6 billion worth of growth spending on tap.

The risk is that Magellan's spending doesn't pan out as planned, which could lead to slower than anticipated distribution growth. That could happen at Duke, too, but its massive utility assets (where nearly 90% of its spending will take place) suggest that won't be the case. That's why the two could be such a nice pairing.

Supplementing Social Security

With relatively high yields, long histories of returning value to investors via quarterly disbursements, and notable distribution growth plans, Duke and Magellan are both worthwhile considerations if you're looking to make money in retirement. Duke is a cornerstone investment that will let you sleep well at night. Magellan is a little more aggressive, but its distribution growth history suggests it's worth the extra risk (though it is far from a risky investment). Paired together, though, they'll keep you flush with cash, low on the risk scale, and beat inflation by a solid margin over time.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Magellan Midstream Partners. The Motley Fool has a disclosure policy.