2 Rallying Pharma Stocks Roping In Option Bulls

Several healthcare stocks are higher today, led by Pfizer (PFE) buyout target Array Biopharma (ARRY). In addition, fellow biotech ArQule, Inc. (NASDAQ:ARQL) is among the best stocks on the Nasdaq today, following upbeat drug data. Likewise, Incyte Corporation (NASDAQ:INCY) shares are higher on encouraging data for the company's vitiligo treatment. Against this backdrop, both ARQL and INCY stocks are seeing unusual options action today.

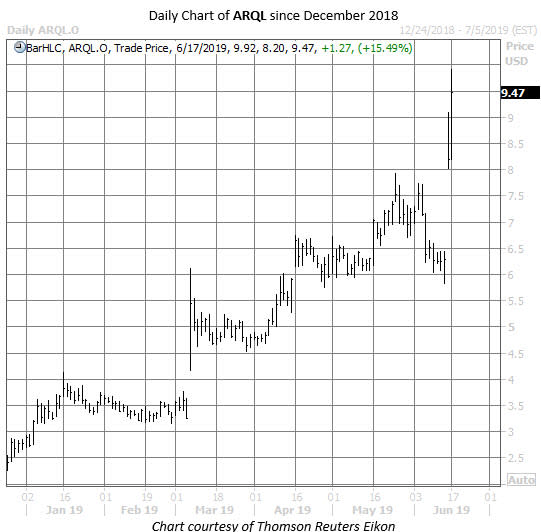

ARQL Option Bulls Eye the $10 Mark

ArQule stock was last seen 15.5% higher to trade at $9.47, and earlier notched a new 12-year high of $9.92, as traders react to the company's early-stage trial data for the treatment of a pair of rare genetic diseases. It's the second huge gain in a row for ARQL stock, which surged Friday on data presented at an annual hematology conference. As such, the equity has rallied nearly 32% so far in June, and has more than tripled in 2019.

Options traders are once again swarming ARQL, with about 5,800 calls and 2,800 puts exchanged -- three times the average intraday volume. Most active are the June and July 10 calls, buyers of which expect ArQule stock to surge into double-digit territory before the respective options expiration dates of June 21 and July 19. The security hasn't traded north of $10 since May 2007.

Meanwhile, a short squeeze could give the pharma stock an added boost. Short interest jumped 16% during the past two reporting periods, and now accounts for more than 12% of the equity's total available float. At ARQL's average pace of trading, it would take more than a week to buy back these bearish bets.

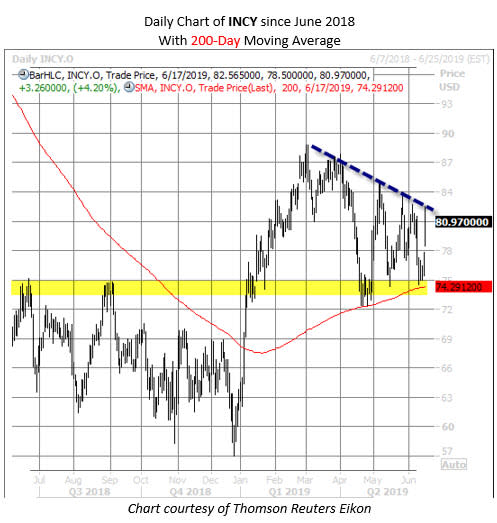

INCY Option Traders Circle the Century Mark

Incyte stock was last seen 4.5% higher at $81.04, after the company's experimental cream for vitiligo met the main goal of a mid-stage trial. Since peaking just below the $89 level in early March, INCY shares have been in a channel of lower highs, with support emerging at their 200-day moving average. This trendline is moving into the $75 area, which acted as a ceiling for INCY in the third quarter of 2018, but could now translate into a foothold.

So far today, the security has seen roughly 3,300 calls cross the tape -- six times its average intraday call volume. For comparison, fewer than 300 INCY put options have traded so far.

It appears buyers are betting on INCY to skyrocket into triple-digit territory over the next few months. More specifically, buy-to-open activity has been spotted at the September 100 call, which is the most active option so far today. By purchasing the calls to open, the speculators are hoping Incyte shares surmount $100 -- territory not charted since late 2017 -- by the time options expire on Friday, Sept. 20.

However, today's appetite for long calls merely echoes the growing trend seen on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), where traders have picked up more than 60 INCY calls for every put in the past two weeks. The resulting 10-day call/put volume ratio of 60.72 is at the top of its annual range, suggesting speculators initiating new positions haven't been this bullishly biased in the past year.

However, it's worth noting that some of the recent call buying -- particularly at out-of-the-money strikes, like we're seeing today -- could be the result of Incyte short sellers seeking options protection. Short interest shot nearly 21% higher during the past two reporting periods, and now represents more than a week's worth of pent-up buying demand, at the equity's average pace of trading.