2 Names Sinking on Argentina Election Shocker

The Global X MSCI Argentina ETF (NYSEARCA:ARGT) is getting slammed today, after Argentinian President Mauricio Macri lost by a wider-than-expected margin in yesterday's primary elections, dimming expectations for a re-election victory in October. As such, the country's currency and bonds are reeling today, and Argentina-based Banco Macro SA (NYSE:BMA) stock is getting cut in half -- and an analyst downgrade hasn't helped. Against this backdrop, both ARGT and BMA shares are on the short-sale restricted (SSR) list, and are seeing unusual options activity today.

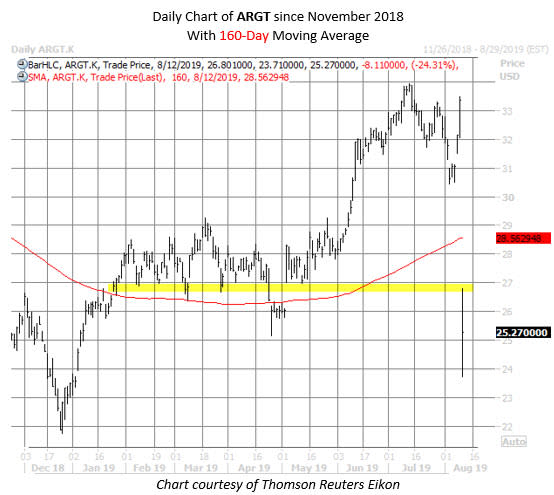

The ARGT exchange-traded fund (ETF) was last seen 24.3% lower at $25.27, on pace for its worst session ever. The shares are also set to breach their 160-day moving average -- as well as former support in the $27 area -- for the first time since early May. Prior to today, ARGT was trading north of $33, within striking distance of its mid-July annual high of $33.94.

While absolute options volume remains light, ARGT has seen 157 calls and 167 puts change hands today -- 26 times and 55 times the average intraday volume, respectively. It looks like short-term bears are buying to open the October 25 put, gambling on more downside for the ETF heading into the October elections. Meanwhile, some bears are selling to open the January 2020 30-strike call, expecting the $30 level to emerge as a round-number ceiling for the shares through the next several months.

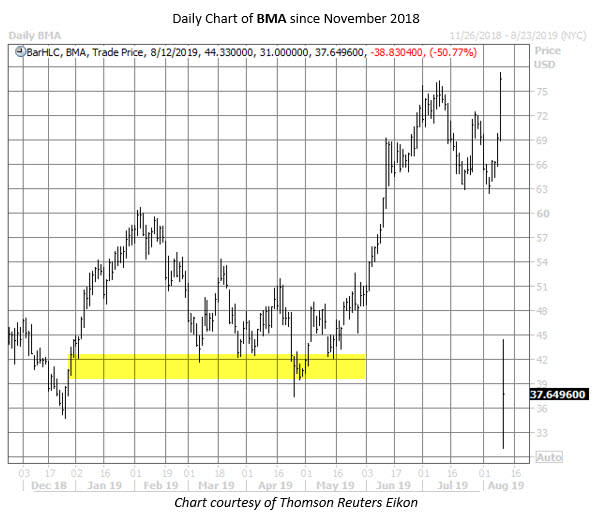

Moving on, Argentinian bank Banco Macro was downgraded to "underweight" from "overweight" at Morgan Stanley, which cited the "surprising" election results. There could be more negative analyst attention on the way, too, as three of the five brokerage firms following BMA maintain "strong buy" opinions.

BMA stock has dropped 50.7% to trade at $37.64, and earlier touched a new four-year low of $31.00. The equity is also set for its worst session on record, and is trading south of support in the $40-$42 neighborhood, which acted as a floor earlier this year.

Banco Macro has seen about 1,900 calls and 1,350 puts cross the tape today -- about 14 times the usual afternoon volume. It appears some bears may be cashing in their chips, selling to close their in-the-money August 55 puts -- the most active option today. Elsewhere, some speculators are selling to open the January 2020 60-strike calls, expecting BMA shares to remain south of the $60 level through January options expiration.