New $2.2B tax could double current road spending in Richland County. What projects may be included?

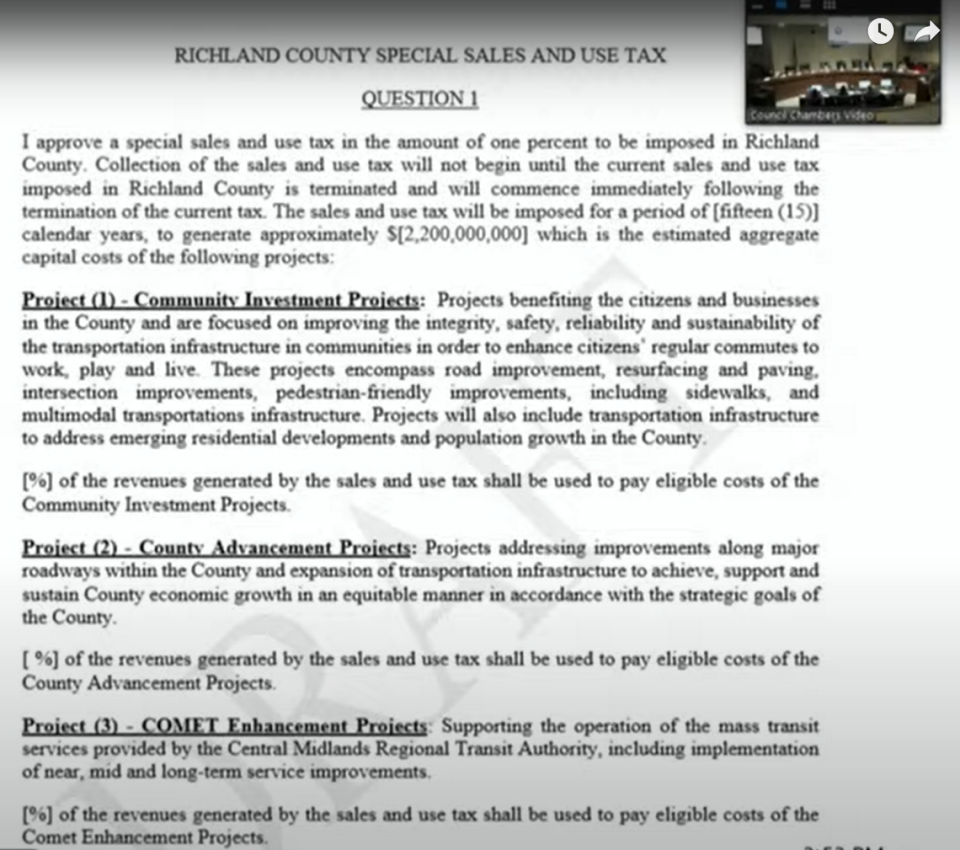

Richland County Council could ask voters to support a $2.2 billion transportation sales tax in 2024 to pay for major road projects over the next 15 years, a proposal that is at least double the amount that voters agreed to pay for road work the last time the county introduced a penny sales tax.

A draft project list reveals at least 100 road-related projects that could be considered in a new penny tax program, with some predicted to cost tens of millions of dollars, if approved. County Council heard recommendations from consultants and county staff members Tuesday on what road projects residents and municipal leaders are prioritizing in the next decade and a half.

More than $2 billion worth of possible road work was presented to council members Tuesday, but it’s unclear if all of those projects would be paid for with a new 1-percent sales tax council members are discussing asking voters for in 2024.

Of the projects that were presented to council Tuesday, the most expensive include:

Work to separate rail lines from Assembly Street, estimated at $300 million;

A $63.5 million project to widen a portion of U.S. 76 near Lake Murray, between Shadowood Drive and the Richland County line;

A $62 million project to widen Spears Creek Church Road in Pontiac between Interstate 20 and Percival Road;

And a nearly $59 million project to widen Langford Road between Blythewood’s Main Street and Hardscrabble Road.

Other major projects proposed include more than $46 million to widen Broad River Road between Interstate 26 and Chapin Road, near Lake Murray; and two roughly $38 million projects to widen a stretch of Two Notch Road in Elgin and to widen Lost Creek Road outside of Irmo.

More than three dozen possible bikeways are on the proposal, including one on Two Notch Road between Beltline and Decker boulevards, and on Gervais Street from Park Street to Millwood Avenue.

Other potential projects could include a $6 million effort to bury utility lines on Forest Drive, a $7 million intersection improvement at Langford and Blythewood roads, and $13 million for the next phase of streetscaping on Assembly Street in Columbia.

The report also includes $100 million each for general resurfacing and dirt road paving projects, and $50 million for sidewalks.

The list provided to County Council Tuesday was a draft and might not include all of the projects that would be paid for with a new transportation tax, and not all of the projects presented may ultimately be funded.

The $2.2 billion estimate did not include any money for the COMET bus system, but several council members said they do still support using the transportation tax to help pay for that system.

Currently, one-third of the county’s transportation sales tax revenues go toward the bus system, but County Council members could alter that amount if they ask for a new tax.

The county’s consultants created the list of possible projects by asking area municipalities and the Central Midlands Council of Governments which projects are vital to each, as well as by conducting public input sessions across the county in recent months.

Councilman Don Weaver, who represents the Forest Acres area, said he would like to see the more than $2 billion the new tax would generate divided more fairly across council districts. He plans to suggest that each district be allotted a minimum amount of the tax revenue, with the understanding that some districts would still receive more than the minimum amount.

Residents in his district have asked for more than $30 million in projects they would like to see just in the Forest Acres area, and many of those projects were not included in the draft list Tuesday, Weaver said.

Weaver added that he supports using the new tax to continue paying for the COMET, but he would like to see that system get 20-25% of the money, instead of the 33% it currently receives.

Would voters get behind a new tax?

In October, Richland County Council began work to create a new transportation tax referendum, which would be on the ballot for the Nov. 5, 2024, general election. But it’s unclear how voters will respond if they are asked to approve another transportation sales tax in 2024.

“People are sick of it, they’ve destroyed the public trust,” Tracy Robins previously told The State while attending a November 2023 presentation on the transportation penny program. Robins is also a Republican candidate for S.C. House District 75 in the 2024 election.

The county has a current transportation tax that charges a 1-percent sales and use tax to pay for road projects and the bus system.

That tax, approved by voters in 2012, was meant to last for 22 years or until $1.07 billion was collected for the fund. But the county estimates it will meet that collection limit by 2026 — just 13 years into collection.

That tax was also mired in controversy. Voters rejected the tax in 2010 before approving it in 2012. But by 2015, the South Carolina Department of Revenue began questioning how the county was using the sales tax money. A half-decade of legal strife followed, with the Department of Revenue and Richland County suing each other over the tax.

The Department of Revenue alleged that the county was unlawfully spending millions of dollars on non-transportation work, including on “routine office expenses” from computers to coffee to company cars. An initial audit report by the department identified $41 million in misspent dollars, then the amount was reduced to roughly $32 million.

In 2021, Richland County reached a settlement agreement with the Department of Revenue and agreed to pay $15.5 million back into the program. Under the settlement, the county did not have to pay anything to the DOR.

Beyond the legal challenges, some residents have criticized the program for benefiting the University of South Carolina more than it benefited rural residents.

Nearly $1 out of every $6 the county planned to spend on referendum roadway projects directly benefited the university and its sports facilities, according to a 2020 analysis of penny tax projects by The State Newspaper.

Weaver agreed that he thinks residents will need to see how the tax will benefit their local communities before they support the new tax. He also noted that if the transportation tax doesn’t pass, residents may have to pay for the bus system in their property taxes, which Weaver said he hopes does not happen.

Council members still have work to do before they finalize plans for the new tax. The council has not made a final decision on if it will ask for another tax, how much it will ask for or which projects the tax may pay for.

The council must decide by Aug. 15 to meet the deadline to get the referendum on the November ballot.