1 Oil Stock to Buy as OPEC and Russia Stand "Shoulder to Shoulder"

OPEC and Russia have done it again: They have extended production cuts until the end of 2018. This is being done to drain the market of its excess inventories following their (arguably) failed attempt to kill the U.S. shale industry. This is crucial for oil stocks like Diamondback Energy (NASDAQ: FANG) -- one of the best in the shale business that has only gotten more efficient at producing black gold.

The move goes to show just how desperately the players need higher oil prices. To that end, the Saudi Arabian energy minister didn't hold back regarding his country's newfound relationship with Russia: "We are united, shoulder to shoulder."

Image source: Getty Images.

The production cuts, first announced a year ago, have had a marked impact. Global inventories have fallen by around 50% from their peak, and oil prices have risen to multiyear highs:

Brent Crude Oil Spot Price data by YCharts.

Things are looking up for the oil industry. But for investors to dip their toes in the water and avoid getting pulled under, they can't just buy oil stocks. They need to find oil producers that can generate profits no matter what happens.

This is exactly why with OPEC and Russia standing shoulder to shoulder, investors should consider standing with Diamondback Energy. Thanks to its rock-bottom production costs, ideal positioning in the Permian Basin, and unique ability to generate profits in spite of depressed oil prices, Diamondback is a perfect stock to play OPEC solidarity.

Production costs that are the envy of the oil industry

To start, Diamondback is among the lowest-cost independent oil and gas producers. This is determined within the oil industry by average production costs per barrel of oil equivalent (BOE):

Average Costs per BOE | FY 2016 | FY 2015 | FY 2014 |

|---|---|---|---|

Lease operating expense | $5.23 | $6.84 | $7.79 |

Production and ad valorem taxes | $2.19 | $2.73 | $4.59 |

Gathering and transportation expense | $0.74 | $0.50 | $0.46 |

General and administrative -- cash component | $1.03 | $1.11 | $1.61 |

Total operating expense -- cash | $9.19 | $11.18 | $14.45 |

Data source: Diamondback Energy 10-K filing. FY = fiscal year.

According to Ernst and Young's 2017 Oil and Gas Reserve Study, the average cost per BOE for the 50 companies surveyed (which includes Diamondback) was $12.50 for the three years ended Dec. 31, 2016.

Being a low-cost producer is the only way to generate long-term profits in the oil industry, and Diamondback is leading the pack.

Location, location, location

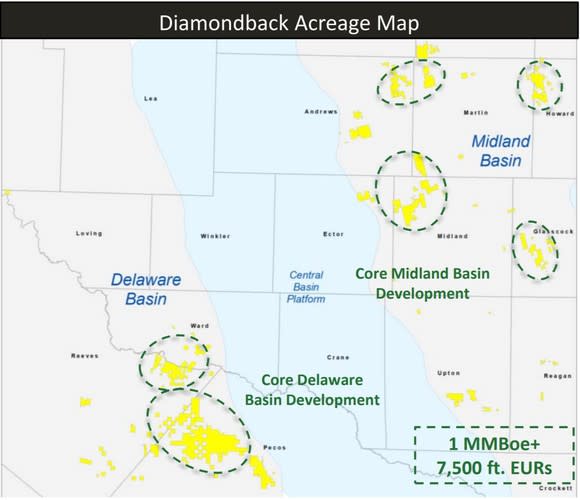

The Permian Basin, thanks to the advent of shale fracking, is now one of the lowest-cost areas to produce oil in the U.S. It also doesn't hurt that it is just a pipeline away from the massive energy hub of Houston, Texas. One of the reasons Diamondback Energy has such low production costs is its ownership of prime acreage in the Permian Basin:

Image source: Diamondback Energy investor presentation, November 2017. MMBOE = million barrels of oil equivalent.

Low-cost shale regions like the Permian are ground zero for the shale revolution -- the very reason the oil downturn started in the first place.

By cutting production to shore up crude prices, OPEC and Russia are "standing shoulder to shoulder" against the emergence of U.S. production, with companies like Diamondback leading the way.

Discipline is the surest path to success

One of the most impressive achievements exhibited by Diamondback Energy has been its ability to increase production throughout the oil downturn:

Production Metric | 2016 | 2015 | 2014 |

|---|---|---|---|

Oil (barrels per day) | 31,590 | 24,880 | 14,744 |

Natural gas (thousand cubic feet per day) | 29,313 | 21,729 | 11,907 |

Natural gas liquids (barrels per day) | 6,556 | 4,596 | 2,745 |

Total average production (BOE per day) | 43,031 | 33,098 | 19,474 |

Data source: Diamondback Energy 10-K filing.

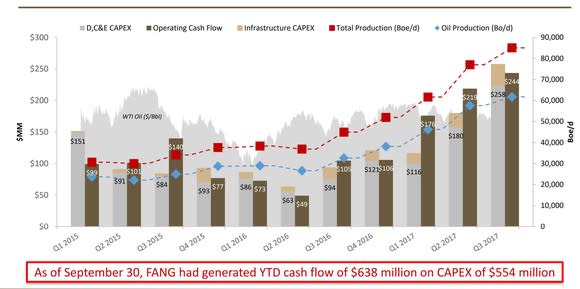

Production numbers like this look great. But any investors worth their salt will naturally wonder at what cost those production gains were achieved. It is here that Diamondback truly shines:

Image source: Diamondback Energy investor presentation, November 2017. BOE/D = barrels of oil equivalent per day; YTD = year-to-date; CAPEX = capital expenditures.

A major criticism of the shale boom has been the lack of actual returns from oil companies. True, Diamondback has outspent its cash from operations so far this year, but this is due to acquisitions. Its actual drilling operations are cash flow positive. By living within its means while still expanding production, Diamondback has proven it has what it takes to thrive, no matter what OPEC does.

What you need to know

Capital markets are no longer accepting growth at any cost from oil producers. Diamondback Energy's ability to produce profits and cash flow make it a standout exploration and production stock.

Diamondback's shares currently trade for 18 times forward estimates for earnings -- a steal with the S&P 500 at over 25 times forward earnings estimates. Not only that, but with each dollar that the spot price of crude oil rises, Diamondback's bottom line grows.

As an operator with a history of proven results, Diamondback Energy is a perfect stock to own as OPEC moves to drive oil prices upwards.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Sean O'Reilly owns shares of Diamondback Energy. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.