2012 Mogul Paydays: Why Jeffrey Got a Raise, Reed Took a Bath

Last year was good for media stocks as companies like Comcast, Walt Disney and Time Warner outperformed other major sectors and posted big profits. It only follows that many of the moguls who sit atop these mass-entertainment giants shared in the rewards.

For the fifth year in a row, TheWrap pulls back the curtain on the massive paydays for the men (yes, it's a boy's club) guiding their sprawling empires through the modern media landscape.

Not everything made sense. DreamWorks' Animation's Jeffrey Katzenberg got a massive raise, despite a big flop at the box office and major layoffs. Netflix's Reed Hastings took a big cut, though his company was headed for the stock market's stratosphere.

And though some top executives saw their compensation packages shrink even as share prices climbed ever higher, it was a long way from the dark days of 2009, when the economic downturn saw many top executives take pay cuts in a show of solidarity with the poor investor.

Also read: Reed Hastings, Sumner Redstone, Jeff Bewkes - What the Moguls Made in 2012 (Slideshow)

At least, that's true for Old Media chiefs; as in previous years, their compensation dwarfed the top executives at New Media and technology companies, despite the fact that the latter are jeopardizing their longstanding dominance of film, television and other entertainment.

Overall, in a year that saw Standard & Poor's 500 gain 13 percent, CEOs enjoyed an 8 percent pay increase across all sectors in 2012, according to a recent report in USA Today. That marks the largest increase in compensation in two years, the paper said.

Also read: How to Improve Hollywood: 9 Experts Weigh In on the Future of Film

Here's a few golden nuggets the deep dive into corporate balance sheets unearthed.

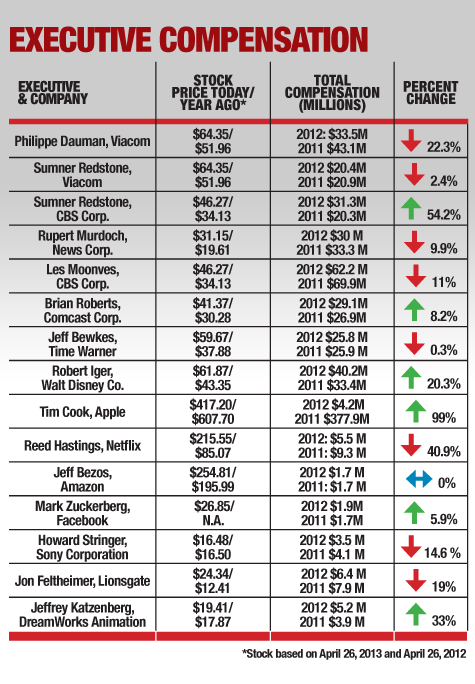

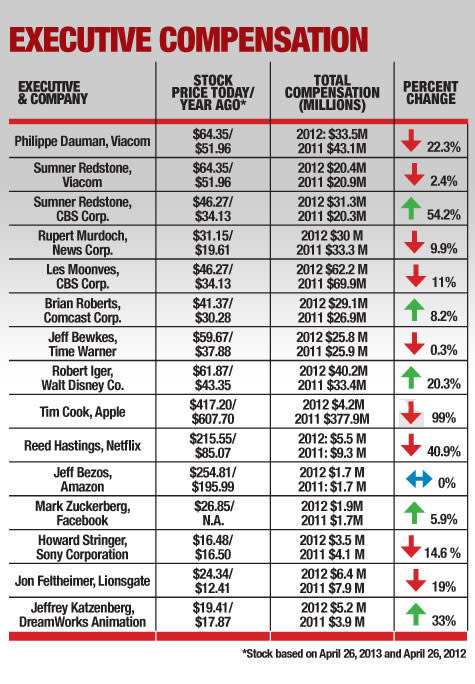

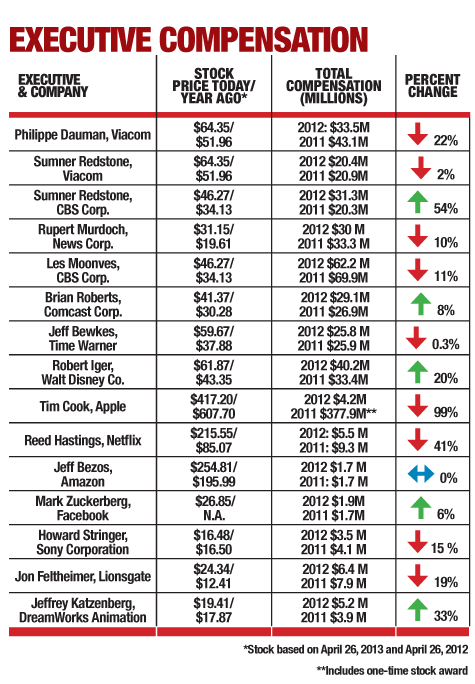

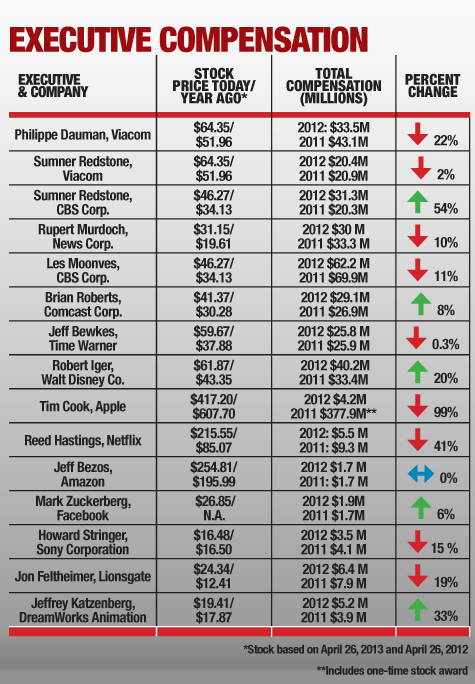

>> Walt Disney Co. Chairman Bob Iger's compensation package got a 20 percent bump to $40 million, but the hike in salary and stock options came along with record highs for the company's stock price. It also was a big year for Iger, who brought the "Star Wars" franchise into the Mouse House, thanks to a $4 billion purchase of Lucasfilm.

>> News Corp. Chairman Rupert Murdoch's pay shrunk along with his company. Battered by the phone hacking scandal at its U.K. tabloids, the media conglomerate announced it would spin off its publishing and education divisions. But even shaving his compensation by 10 percent, Murdoch still managed to net $30 million in salary, bonuses and equity awards.

>> DreamWorks Animation CEO Jeffrey Katzenberg got a 33 percent raise to $5.2 million, despite suffering an $87 million write-down from "Rise of the Guardians." That animated flop led the studio to lay off 350 of its 2,200 employees.

>> Netflix CEO Reed Hastings gave up stock options and saw his compensation fall by 41 percent in order to make amends for the subscriber backlash that greeted the company's ill-conceived plan to spin off its DVD-by-mail business.

>> Viacom CEO Philippe Dauman's compensation took a 22 percent hit to go alongside Nickelodeon's ratings slide. Still, his salary, bonuses and other niceties topped out at $33.5 million for the year.

Also read: Brad Pitt Talks Big Hollywood Salaries: 'Yeah, That Thing Died'

"Whether these kinds of salaries are fair is more of a philosophical question," Michael Yoshikami, chairman and CEO of Destination Wealth Management, told TheWrap. "Where it is justified is when compensation rewards performance for the company over the longterm. Where it's not warranted is when companies reward consistent under-performance. When you look at a person like Robert Iger, you have to ask yourself how much a company like Disney has gone up in market capitalization under his leadership?"

In the case of Disney, the market capitalization under Iger stands at $114 billion, a tremendous leap from the $80 billion where it rested roughly a year ago.

On the lower end of the scale -- though not exactly on Poverty Row, New Media executives such as Mark Zuckerberg and Jeff Bezos drew measly compensation packages of $1.9 million and $1.7 million respectively -- a fraction of the fees commanded by the likes of Murdoch, Iger and Time Warner's Jeff Bewkes.

"Many of these companies are less mature, less seasoned and they need the cash to expand their operations, to grow or make acquisitions," Hal Vogel, a media analyst and president of Vogel Capital Management, said. "The older legacy media companies have more leeway to spend cash on executive compensation. And for a founding member or visionary, if you will, they may prefer to forgo salary in favor of equity."

Indeed, weep not for Zuckerberg. The Facebook founder exercised $2.3 billion of stock options shortly before the social network went public last May. Roughly $1.1 billion of that was used to pay off a massive tax bill.

No mogul experienced a bigger comedown on the compensation front than Tim Cook. The Apple chieftain saw compensation drop to $4.2 million is deceptive. His 2011 compensation package of $379.9 package included a one-time stock grant that was worth $376.2 million at the time but will be doled out over a period of years.

A paycut may be the least of Cook's trouble. Lacking a technological innovation on the level of the iPad or iPhone, Apple's stock has endured tremendous volatility of late, falling from a $702.10 peak in September to slightly more than $400 in recent trading.

Despite the seven- to eight-figure compensation packages, a case could be made that some moguls offered a relative bargain to shareholders. Lionsgate CEO Jon Feltheimer, for example, put the indie studio in the big leagues with the successful launch of "The Hunger Games" franchise and pulled off a leveraged buyout of "Twilight" producer Summit Entertainment.

Wall Street loved the moves, and today Lionsgate's shares have doubled in value from where they were trading a year ago. Yet Feltheimer's reward was a 19 percent cut in compensation.

And what a difference a year makes in the case of Reed Hastings. Last year, Netflix was still suffering from an ill-conceived and abandoned plan to spin off its DVD business and a controversial price hike to its most popular subscription plan. Users fled the service and the stock nose-dived from north of $300 in the summer of 2011 to roughly $85 in the spring of that following year.

Cue the launch of two web-based shows in "House of Cards" and "Arrested Development" and all of a sudden Netflix looks like a visionary again. Its stock has climbed back above $200, during a time that saw Hastings' compensation package receive a 41 percent haircut.

The eye-popping salaries commanded by many of these tycoons could stir the inner populist among Hollywood's rank-and-file, but analysts point out that they pale in comparison to the paydays commanded by top hedge fund managers like David Tepper who made an estimated $2.2 billion in 2012, according to Forbes.

"Compared to some hedge fund managers, these guys are paupers," Vogel said.

Here is TheWrap's comprehensive round-ups of what the big guys made:

Tony Maglio contributed to this report.

Related Articles:

Reed Hastings, Sumner Redstone, Jeff Bewkes - What the Moguls Made in 2012 (Photos)

Executive Pay: Why Are Hollywood Moguls Making the Big Bucks? (Video)

How to Improve Hollywood: 9 Experts Weigh In on the Future of Film