This week in Trumponomics: Trump chokes off good news, again

There’s good news about jobs. But, never mind. Instead, let’s talk about tariffs and other things financial markets hate.

President Trump has now broached the full monte, threatening to impose tariffs on essentially every product imported from China. This is the full-blown trade war investors have been fearing, and it’s depressing financial markets, as expected.

Here’s the scorecard on Trump’s trade war with China. So far, he has imposed 25% tariffs on $50 billion worth of Chinese imports, while China has retaliated by doing the same on a like amount of U.S. exports to China. Trump has set the stage for tariffs on another $200 billion in Chinese imports, which could happen any day. And on Sept. 7, he said he’s ready to hit another $267 billion worth of Chinese imports with tariffs, with his underlings preparing the necessary paperwork.

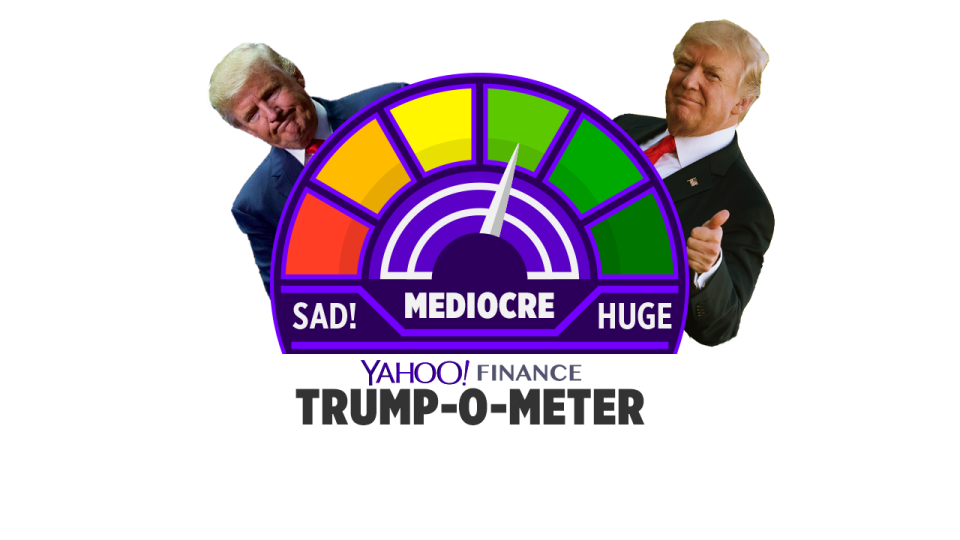

Add it all up, and basically every smartphone, TV, baseball bat, pair of shoes and every other product imported from China that would bear an additional 25% tax. Tariffs of this magnitude would damage corporate profits, push up prices, hurt consumers and slow GDP growth. Ordinarily, this would earn one of the lowest readings on our weekly Trump-o-meter.

But there’s mitigating news in the labor market, with employers adding 201,000 jobs in August—a strong pace of job growth that shows the underlying economy on solid footing. Since all of the news isn’t lousy this week, our Trump-o-Meter reads MEDIOCRE, the equivalent of a C+:

One has to wonder why Trump routinely steps on good news about the economy by pressing trade wars, which most CEOs are firmly against. Stocks slipped on Trump’s latest threat, and they drifted lower on the week, with investors bracing for the next salvo in Trump’s protectionist crusade.

That could come as early as next week. The Trump administration has held hearings on the next possible tranche of tariffs, and has now run the traps necessary to impose new tariffs on an additional $200 billion in Chinese imports. Trump seems eager to reach the point where the United States can outgun China on tariffs, because we import so much more than they do. In theory, that means China would have a hard time retaliating, which might leave no option but to concede defeat and take steps to reduce exports, as Trump wants.

But there are other retaliatory tools China can tap, and few trade experts think China will capitulate any time soon. China could begin punishing the hundreds of American businesses that operate in China, for instance. It could also devalue its currency, to make exports cheaper in the United States. As a kind of nuclear option, it could sell off billions’ worth of U.S. Treasuries it holds, although that could hurt China as much as the United States.

Trump remains confident he can win his trade war with China—one reason he’s willing to press it during a midterm election year, even though criticism of his tactics is mounting in key states and districts. China, for its part, may be willing to endure short-term pain and see how the U.S. midterms turn out. If Trump’s Republicans lose control of one or both houses of Congress, it will weaken Trump’s leverage and strengthen China’s, and represent of repudiation of Trump’s trade policies by his own voters.

The booming labor market and the strong economy, ironically, may be enabling dangerous trade policy, by propping up stocks that would be sending more alarming signals if the economy were weaker. Trump pays attention to the stock market, and it hasn’t yet screamed loud enough to force a moderation of his protectionism. But that day may be coming. Strong hiring can only mask so much damage.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman