Week Ahead: Retail Earnings, Berkshire Hathaway, and Time to Buy Nvidia Stock?

The week of February 21 is set up like it may be another active one even with the shortened schedule. With earnings from retail leaders such as Walmart WMT, and Target TGT, as well as chip giant Nvidia NVDA, we will be getting significant insight into the underlying economy.

Quick Technical Overview

Last week was a bit slow, as the market traded primarily in a range. But by the end of the week offers started piling in and the tape was getting heavy, with stock indexes finishing at the weekly lows. From a technical perspective, it looks like SPX is breaking down from a minor consolidation, indicating potential for further selling.

Image Source: TradingView

Tuesday

Home Depot HD and Walmart were front and center on Tuesday morning. HD beat EPS estimates but missed revenue for the first time since 2019. Management also warned of slowing demand and rising wages. This wasn’t taken well by Wall Street and Home Depot stock was down -5% through morning trading.

Walmart beat expectations for both earnings and revenue, but subdued guidance was enough to unsettle investors. After selling off nearly 10 points in the premarket, but the stock reversed the move and as of mid-day is slightly positive.

Although earnings from these two retail giants were good enough, mostly beating estimates, the guidance is clearly concerning. It seems there is potential for a bleak economic picture of rising wages and slowing economic growth based on these results.

Notable earnings: HSBC, MDT, SFTBY, PANW, O, COIN, CHK

Wednesday

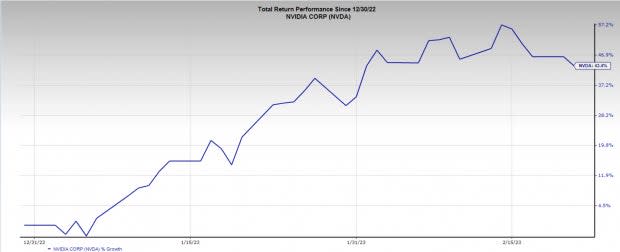

Nvidia, the US based chip company, reports earnings on Wednesday after the close. NVDA has been one of the market leaders so far in 2023, with NVDA stock up over 100% from its October 2022 lows.

Image Source: Zacks Investment Research

NVDA is a giant, and something of a hedge fund hotel, so results from its earnings call can be quite influential on the broad market. The current quarter estimates have already been revised lower, meaning analysts are expecting a poor report. Current quarter projected sales are $6 billion, a YoY decrease of -21%. Earnings are no better, expected to shrink -39% to $0.81 per share, based on Zacks estimates.

If these pessimistic expectations can’t be reached it will likely weigh heavily on the stock market. Alternatively, if estimates can beat that may signal a reversal in chip and tech expectations.

Sentiment became extremely bearish on semiconductors and technology stocks late last year, and though they have rallied considerably since then, valuations are at a reasonable levels. NVDA however, is far from reasonably valued, currently trading at 69x forward one-year earnings, while the broader tech industry is trading at an average of 22x next year’s earnings.

Image Source: Zacks Investment Research

February 1st FOMC minutes will come out on Wednesday at 2pm. While most of this information has already been disseminated, the report can sometimes move the market. Watch closely for comments on future rate hikes, and the potential for a 50 bps raise.

Notable earnings: TJX, BIDU, EBAY, U, ETSY, LCID, NTAP, TPL

Thursday

Data on initial jobless claims will be significant for gauging the strength of employment.

The Q4 GDP revision released Thursday morning will also be an important tell on economic growth.

Strong growth and strong jobs are typically positive developments. But these aren’t typical times as the Fed is trying to trample inflation. If employment becomes too tight, it may induce another rally in inflation, which nobody wants to experience.

It will also be interesting to get earnings results from Chinese e-commerce giant Alibaba BABA. China has finally reopened its economy, dramatically improving economic output for the country, so we will see if the country’s retailers are getting the boost.

Notable Earnings: INTU, BKNG, AMT, MRNA, NTES, MELI, MNST, SQ, CNSWF, NEM

Friday

Friday looks like it will be another very active day. There is a long list of economic data releases including consumer spending, PCE and Core PCE, new home sales, and consumer sentiment, as well as a litany of speeches from Federal Reserve Board members.

Possibly the most significant event of the week is an earnings report from Berkshire Hathaway BRK.B. Warren Buffett’s conglomerate was one of the few stocks that outperformed the market last year. Berkshire currently holds a Zacks Rank #3 (Hold), indicating minimal earnings revision trend. Expectations for the company have remained still for the last three months.

Berkshire has an extremely diversified portfolio of businesses, along with its massive investment portfolio, so its earnings can provide a cue on the broader economy. Comments from Buffett, and any guidance that is offered will likely have a huge effect on market price action.

Notable earnings:

Conclusion

This is going to be an active week, no doubt about it. Earnings season is nearing its end and looks like we are going out with a bang. Nvidia will be a very important lead for the growth and techj stocks, and any comments from Warren Buffett can have significant impact on the market.

A final segment of the market worth keeping an eye on is interest rates. The rate on the 10-year US treasury note has quickly rallied from 3.5% to nearly 4% in just the last two weeks. If rates can take out last year’s highs it can have a significant impact on the market broadly.

Higher rates have two primary implications for the market. With rates on risk-free treasuries getting so high, it makes owning them potentially more appealing than owning equities. One-year notes are offering 5%, which is a nice yield. Additionally, higher rates mean higher cost of capital, and slower growth. Slower growth means shrinking earnings, which is also a headwind for stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report