Here is what usually happens after a market correction

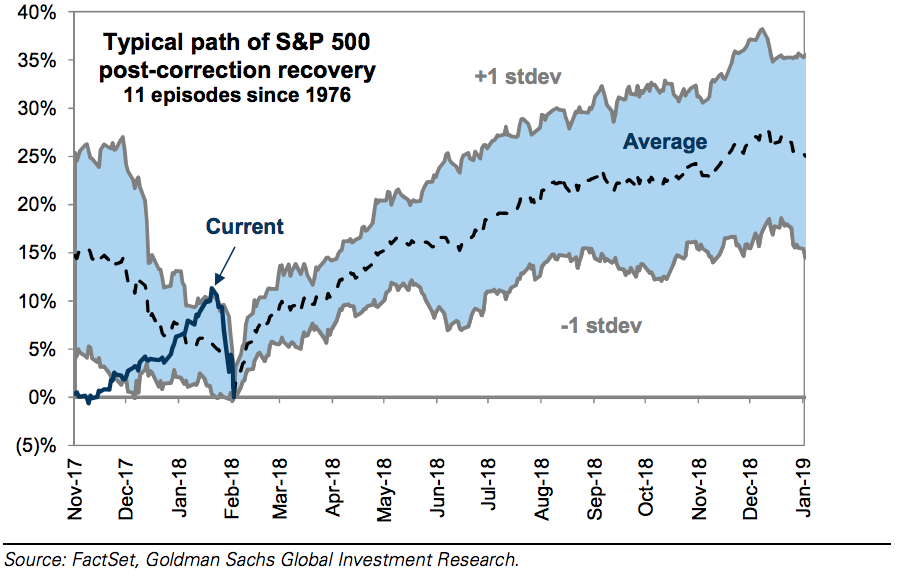

The stock market just had the worst week in two years, now it’s entering into the correction territory after a more than 10% decline. As it rebounds, what will happen next?

No one has a crystal ball, but analysis of historical corrections suggest while it’s reasonable to prepare for a larger slide, the result is not likely to be catastrophic.

Bear market? Not so often

Put the market correction into historical context. It’s more comparable to 11 corrections that took place during non-recession times since 1976. Among those, 1987 was the only time the stock market ended up crashing more than 20% and then turned into a bear market.

That’s not likely to be the scenario this time, according to Goldman Sachs. A bear market would mean the S&P 500 (GSPC) falls from its low of 2,535 on Friday to below 2,300, which is unlikely to occur as little signs in the economy signal recession. With a GDP growth target of 2.5% and the unemployment rate at 4.1%, investors have reasons to believe in the recovery.

“Most equity market corrections recover without developing into bear markets or presaging recessions,” Goldman Sachs’ Portfolio Strategy Research team wrote in a recent note. “Our economists believe the probability of a recession remains well below average, given strong global GDP growth and loose financial conditions. Earnings fundamentals also remain strong.”

More of a dip? Possibly

Throughout history, market corrections usually happen a little more than once per year. The median decline for the S&P 500 in 16 total prior corrections (non-recession and recession) was 18%, and the S&P 500 typically plummeted 15% during the non-recession corrections over the course of 70 days, according to Goldman.

That leaves room for further correction in the market this time. A fall of this magnitude would carry the index to 2,450, about 6% below Friday’s level. Some analysts believe the high valuation of U.S. equities may also push further slides.

“Valuations are a bit lower after the slump in the index, but they are still high by historical standards,” analysts at Capital Economics wrote in a note on Monday. “At face value, this suggests that there is plenty of scope for them to continue to fall.”

For investors, they may not need to wait for a bottom to profit from the correction. Goldman says an investor who bought the S&P 500 10% below its peak would have scored median 12-month returns of 18%.

Krystal Hu is a reporter for Yahoo Finance. Follow her on Twitter.

Read more:

The real reason why traders are shorting Alibaba