Former CBO director: Widening budget deficit is 'the biggest risk facing the U.S. over the long term'

America’s federal deficit stood at more than $1 trillion over the first 11 months of this fiscal year, according to the Treasury Department.

“If you look forward, there's just an unending forecast for red ink trillion dollars, as far as the eye can see,” former Director of the Congressional Budget Office (CBO) and current American Action Forum President Douglas Holtz-Eakin told Yahoo Finance’s On The Move (video above). “By any numerical metric, something that the United States should not be doing when we're at full employment… we're not facing a shooting war somewhere on the globe… it's I think the biggest risk facing the U.S. over the long term.”

In July, the CBO reported that if spending were to continue at current levels, U.S. federal debt could reach 92% of GDP by the end of the next decade and a staggering 144% by 2049.

Legacy programs form key expenditures

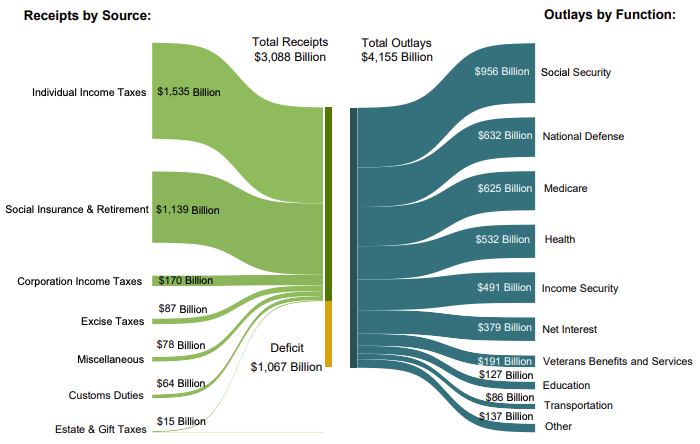

The $1.067 trillion budget deficit was a 19% increase from the previous year. The last time the U.S. reached these levels was in August 2012.

Key expenditures for the fiscal year of 2019 were Social Security ($956 billion), Medicare ($632 billion) and national defense ($625 billion), respectively. Total outlays came up to $4.155 trillion.

Key revenues came from individual income taxes ($1,535 billion), social insurance and retirement contributions ($1,139 billion), and corporate taxes ($170 billion). Total receipts came up to $3.088 trillion.

“We are spending increasingly all our money on legacy programs Medicare and Medicaid, Affordable Care Act, and not having any money available for the things our founders saw the role of government: basic infrastructure, education, national security,” said Holtz-Eakin.

‘Termites eating at the foundations’

That accruing deficit could arguably have serious implications.

“It's best thought of as just sort of the termites eating at the foundations,” said Holtz-Eakin. “This is... the government consuming funds that would otherwise be available to invest in the productivity of America's workers, invest in innovative technologies, capital goods, improve our competitiveness on the globe, and raise the growth rate of real wages… And we're missing that opportunity.”

Bipartisan Policy Center Senior Vice President G. William Hoagland previously told Yahoo Finance that the debt is “a tax on future generations and a lowering of the standard of living for our children and our grandchildren in the future. It’s a hard one for politicians who are worried about the election, two years down the road, or six years down the road, to think out that far.”

Warnings about the federal deficit, however, have largely fallen on deaf years. Hoagland lamented about the fact that “debt doesn’t matter” on Capitol Hill anymore.

“The reason no one seems to notice is that financial markets are not flashing bright red stop signs,” added Holtz-Eakin. “And that's because the rest of the world is in comparably bad shape. And so the U.S. still looks relatively good... But I think it's an illusory situation — the danger's really there. And they should be paying attention.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

'A tax on future generations': U.S. debt on path to exceed World War II levels

Fed Chair Powell: 'The U.S. federal government is on an unsustainable fiscal path'

How the ballooning $22 trillion national debt will affect Americans

'Unhinged madman': Former U.S. budget director says Trump is 'conducting 4 wars on the economy'

2019 tax refund size down nearly 17% on average, IRS reports

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.