Labour weighs up huge tax hikes on shareholders and homeowners

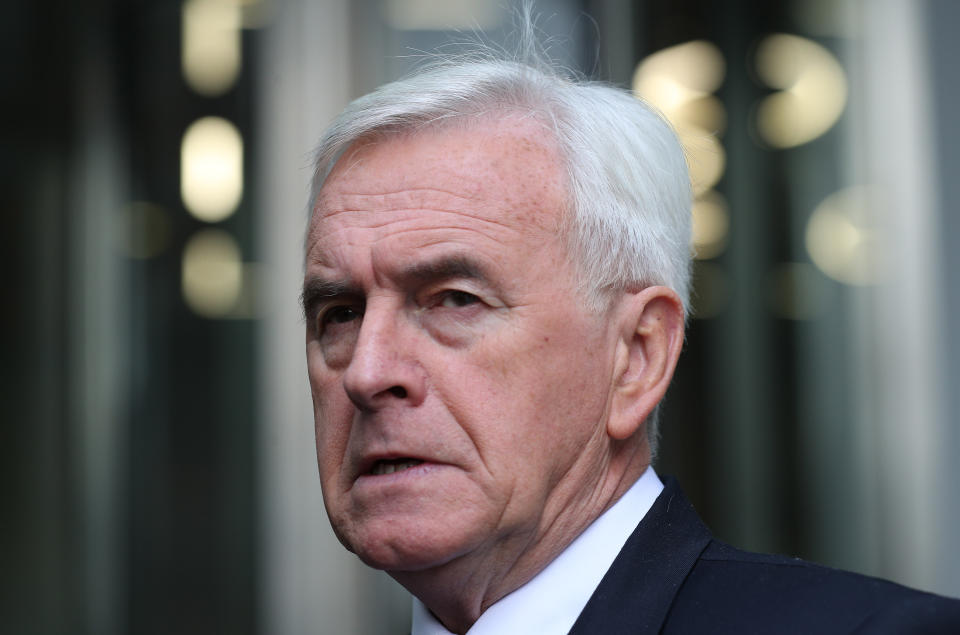

Labour will “look carefully” at plans for steep tax hikes on high-earning shareholders and owners of multiple properties, according to shadow chancellor John McDonnell.

The UK opposition is weighing up an overhaul of Britain’s tax system after a left-leaning think tank said dividends and increased property values should be taxed at the same rate as income.

Proposals also include slashing the tax-free allowance on capital gains and scrapping tax reliefs for entrepreneurs, holders of government and some corporate bonds and those who inherit wealth.

The moves could double tax bills for self-employed traders and partners who avoid income tax by paying themselves through dividends or capital gains.

READ MORE: UK government urged to pass law against class discrimination

Tom Kibasi, director of the Institute of Public Policy Research (IPPR), said it was “fundamentally wrong” that shareholders and property investors paid far less tax than other workers with similar earnings.

The think tank says wealthier people are more likely to receive income from shares or property, and more able to deliberately avoid tax by switching their earnings from wages to dividends and capital gains.

Such reforms could see the highest earners taxed at 45% of their income from shares and property, up from 20% and 28% respectively.

McDonnell said: “We will look carefully at any proposals which seek to address the unfairness of those who work for their money paying higher taxes than those whose money does their work for them.”

He added that Labour had already pledged at the last election to reverse the Conservatives’ cuts to capital gains tax rates, but the proposed reforms would go much further if adopted by the party.

How the tax changes would affect property owners

Property owners are charged capital gains tax (CGT) when they sell up, if the property has increased in value since they bought it.

Individuals’ main homes are currently exempt from the tax, and the IPPR and Labour are not proposing scrapping the exemption.

But owners of more than one property are charged a slice of any gains made from increases in value on all properties that are not their ‘primary residence.’

READ MORE: Single biggest issue facing property market ‘is not Brexit’

The rate is set at 18% for individuals who earn up to £50,000 a year, but the IPPR’s plan to tax capital gains at the same rate as income tax would see this rise to 20%.

Higher earners currently pay 28% of capital gains in tax, but this would rise to 40% for those earning up to £150,000.

For individuals taking home more than £150,000, the hike would be even steeper, rising to 45%.

How the reforms would affect shareholders and bondholders

The IPPR says capital gains on most assets other than property, such as dividends or business assets, currently face a 10% tax for those taking home up to £50,000 a year.

The rate is 20% for earners on higher incomes, though various forms of relief mean many individuals currently pay no tax on these earnings.

The 10% rate would double to 20%, and the existing 20% rate would rise to 40% for earners on up to £150,000 a year and 45% for those on even higher incomes.

The effective tax rise would be even higher, as the IPPR proposes slashing the current £12,000 tax-free allowance on capital gains, currently enjoyed on top of the tax-free personal allowance on income, to £1,000.

The IPPR says the current framework means individuals earning from both work and capital gains unfairly “pay a lower average tax rate” as they have two tax-free allowances while wage earners have just one.

READ MORE: Sajid Javid quietly releases bad news for commuters, graduates and smokers

It claims the status quo “creates opportunities for tax avoidance,” with self-employed workers and partners sometimes shifting earnings from wages to more lightly taxed dividends or capital gains.

The think tank also proposes scrapping entrepreneur’s relief, another tax exemption for individuals selling certain assets linked to firms they own, work for or have lent to.

The tax relief is intended to promote entrepreneurship, but the IPPR claims it has been shown to be “ineffective” and “deepens inequality.”

Another proposal is to scrap the current exemption for government bonds and certain corporate bonds, which the IPPR says “encourages firms to pursue debt over equity financing.”