Trump tweets and market volatility have a 'statistically significant' relationship, BofA finds

President Donald Trump’s tweets aren’t good for the stock market.

Bank of America-Merrill Lynch analysts said on Tuesday that the president’s prolific use of Twitter has a largely negative impact on equity returns — with his posts contributing to volatility exacerbated by the U.S.-China trade war, policy uncertainty, and a yield curve warning of a possible recession.

Despite whipsaw price action, the bank recommended stocks as a worthwhile long-term investment. Analysts at BofA found that stocks are still relatively cheap when compared to bonds, with 60% of S&P 500’s (^GSPC) components having a dividend yield above the 10-year U.S. Treasury bond.

“Trade talk, political campaigning and tweets have contributed to volatility, from China to Fed policy to tax policy,” the analysts said in a research note to clients.

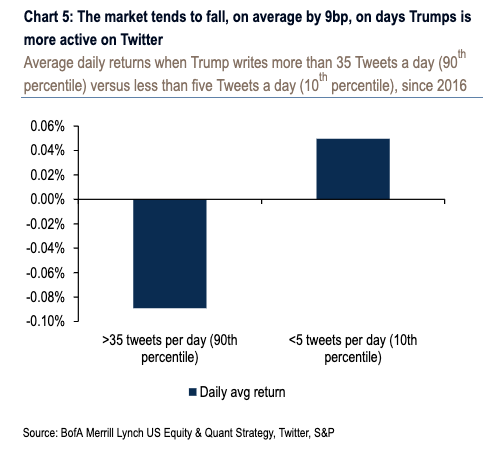

“Since 2016, days with more than 35 tweets (90th percentile) by President Trump have seen negative returns (-9bp), whereas days with less than 5 tweets (10th percentile) have seen positive returns (+5bp) - statistically significant,” the analysts added. “Tread cautiously.”

Last month alone, Trump posted more than 25 tweets about the Federal Reserve, a frequent foil given monetary policy he views as too restrictive in the face of a global slowdown, and his battle to prevail against China in the trade war.

Last month was a roller coaster for investors buffeted by soft data, plunging bond yields, diminished expectations of a trade deal — and Trump’s social media habit.

On August 23rd, the day when the president lumped Fed Chief Jerome Powell in with Beijing as an “enemy” of U.S. interests, markets tanked by over 2%. August

“What’s driving the stock market,” asked veteran market watcher Jim Paulsen on Tuesday. “Trade wars, inverted yield curves, presidential tweets, manufacturing weakness, negative yields, Fed confusion, earnings woes? Yes, all the above!”

Paulsen noted that losses in the stock market are being insulated by “considerable stimulus” — including massive government spending that’s fueling a surge in debt, and accommodative monetary policy.

-

Javier David is an editor for Yahoo Finance. Follow Javier on Twitter: @TeflonGeek

Read more:

‘They should really be ashamed:’ Wall Street blasts Fed for getting what it wanted

Investors aren't sweating US's massive corporate debt pile, but maybe they should

Nagging weaknesses underlie the better-than-expected jobs report

No tariff waiver for Mac Pro, Trump tells Apple: 'Make them in the USA!'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.