The Trump tax cuts still aren't helping regular folks

Seven months after they went into effect, the Trump tax cuts are sharply boosting corporate earnings.

Ordinary Americans are still waiting.

A quarterly wage index administered by Payscale, the compensation-analytics firm, found that income actually fell by 0.9% from the first quarter to the second quarter of this year. The Trump tax cuts went into effect on Jan. 1 of this year, and on their own should have increased take-home pay for about 65% of households, according to the Tax Policy Center.

But that’s not what workers are reporting in the Payscale survey, which solicits information from 300,000 workers each month. “I’d like to say it’s an anomaly, but I’m concerned it’s not,” Payscale chief economist Katie Bardaro tells Yahoo Finance. “So far, there hasn’t been any bolstering of paychecks for the typical worker.”

Other measures of income tell a slightly different story. On a year-over-year basis, incomes in the Payscale survey rose 1.1%. The Labor Department’s latest numbers show average hourly earnings rising 2.7% during the last 12 months. Another measure, the employment-cost index, also shows a 2.7% annual increase. None of those numbers account for inflation.

Bardaro isn’t sure why the Payscale numbers are lower than other income measures, but part of it may involve methodology. The Paycale index only covers full-time workers in the private sector, so it leaves out government workers, part-timers and others. It’s not clear why pay would be falling in the private-sector, though, if it’s going up elsewhere.

[Check out our Next-Recession Survival Guide]

The Payscale survey measures all cash compensation, including bonuses. So it captures bonuses some companies issued earlier this year, to share the tax-cut bounty with their employees. It’s also possible, however, that more private-sector companies are giving one-time bonuses instead of permanent raises, which could erode pay over time, since bonuses eliminate the benefit of rising base pay, which pushes earnings higher and higher.

Rising health care costs could also be part of the explanation. An employer spending more to cover health care benefits for workers will have less available for pay and raises. Health insurance costs have moderated in recent years, but with employers hiring more, their overall health care costs are rising considerably, which might contribute to lower pay.

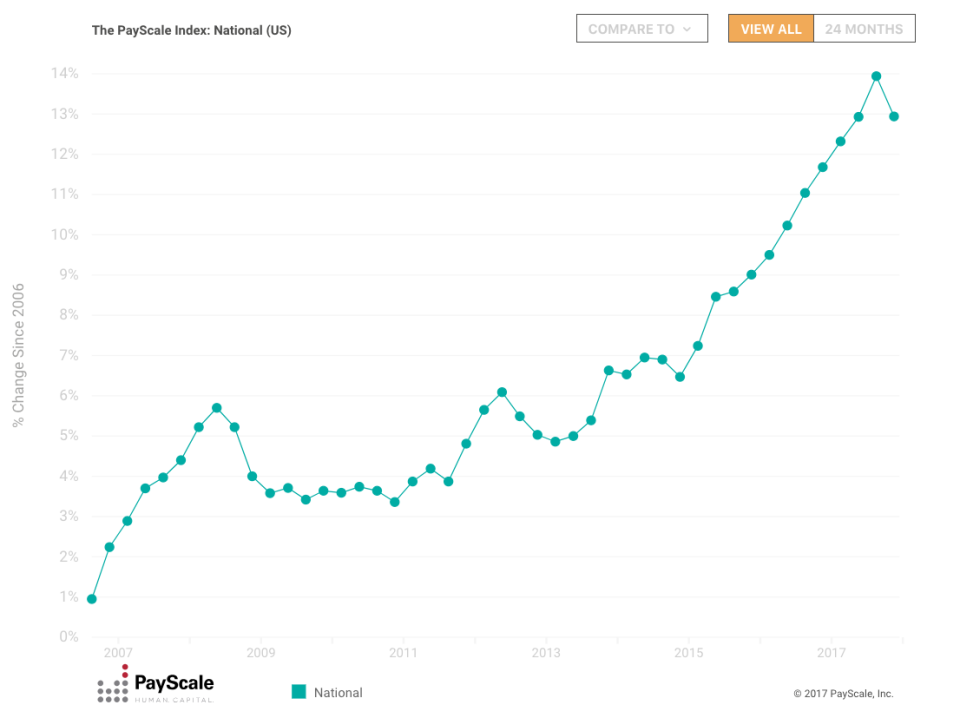

The decline in the Payscale income data was the first since 2015. Here’s the trend since 2006, when Payscale started the survey:

Manufacturing workers saw the sharpest decline in pay from the first to second quarter, with wages falling 5%. Pay fell 4.7% for construction workers, 3.4% for restaurant workers and 0.7% for retail workers. Pay rose modestly for others, including those whose jobs involve technology, finance, sales and science.

White House economists have argued it could take several years for the benefits of the Trump tax cuts to trickle down to ordinary workers through stronger employment, higher pay and a more vibrant economy. But many other economists say that’s never likely to happen, because too much of the bounty goes to shareholders who might just pocket the gain. Economists at the Federal Reserve Bank of San Francisco wrote recently that the tax cuts, a powerful form of fiscal stimulus, came at the wrong time to do much to boost economic growth. Fiscal stimulus provides the most bang for the buck during a downturn, when the economy needs help, not when the economy is growing, as it is now.

The tax cuts remain unpopular, which means they’re a political problem for Trump and his fellow Republicans. About 36% of Americans approve of the tax cuts, while 42% disapprove, according to the Real Clear Politics average of polls. Republicans seemed to think voters would love the tax cuts and reward them during the midterm elections, but many people feel the tax cuts strongly favor the wealthy, while doing little or nothing to help regular workers. Future Payscale data could show wages rising again, but for now, the numbers show skeptical voters are right: the tax cuts haven’t reached them yet.

Confidential tip line: rickjnewman@yahoo.com. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn