Tesla posts wider-than-expected Q2 loss

Tesla (TSLA) posted disappointing results on the top and bottom lines in the second quarter, even after the company reported record deliveries during the same period.

Here were the main numbers from the Palo Alto, California–based company’s report, versus consensus estimates compiled by Bloomberg.

Revenue: $6.35 billion vs. $6.44 billion expected

Adj. loss: $1.12 per share vs. 31 cents per share expected

During a call with investors Wednesday afternoon, CEO Elon Musk also reported that Tesla co-founder and Chief Technical Officer JB Straubel would be leaving the company and moving to an advisory role, adding to a spate of

Estimates for Tesla’s bottom-line results spanned a wide range, with some analysts contemplating a small profit for the quarter. On the low end, WedBush’s Dan Ives expected a loss of as much as $1.11 per share, while 86Research’s Robert Cowell anticipated Tesla would post adjusted profit of 95 cents a share.

Tesla reported a profit in each of the third and fourth quarters of 2018, before returning to a loss at the start of this year. In its latest update letter, Tesla said it continues to aim for positive GAAP net income beginning in the third quarter, “although continuous volume growth, capacity expansion and cash generation will remain the main focus.”

During a call with investors Wednesday afternoon, CEO Elon Musk elaborated that he expects Tesla will be “probably around breakeven this quarter and profitable next quarter.”

Shares of Tesla fell 10.17% to $237.95 each during extended trading.

Meanwhile, Tesla’s cash position increased substantially after a debt and equity sale during the quarter. Tesla exited the period with $5.0 billion in cash and cash equivalents, more than doubling that amount from the end of the first quarter and representing the highest level in company history.

“This level of liquidity puts us in a comfortable position as we prepare to launch Model 3 production in China and Model Y production in the U.S.,” the company said in a statement.

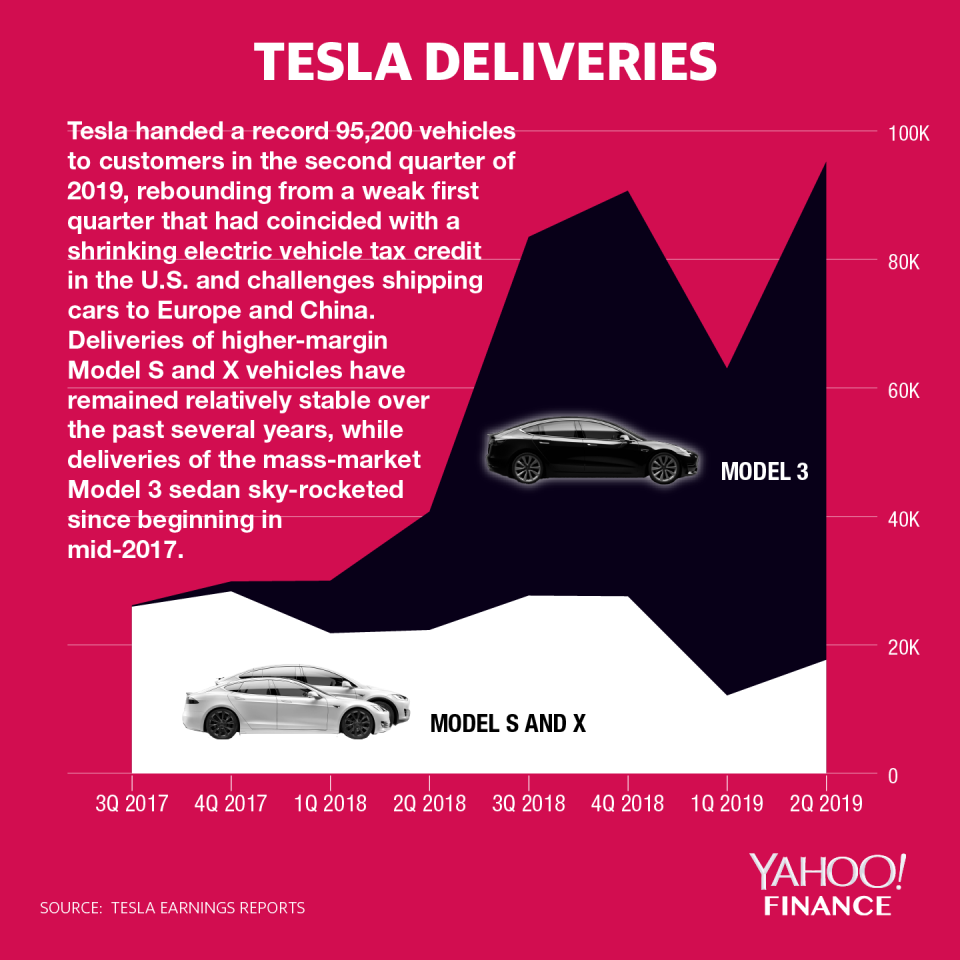

In the second quarter, Tesla’s automotive gross margins contracted by 168 basis points year-over-year to 18.9%, helping to explain the hit to the bottom-line even after the company handed over more than 95,200 vehicles to customers during the quarter, marking a company record. These delivery results had also represented a rebound from the company’s first-quarter delivery figures, which sharply missed expectations.

In its update letter Wednesday, Tesla said it is working to increase deliveries both sequentially and annually.

“This is consistent with our previous guidance of 360,000 to 400,000 deliveries this year,” the company said in a statement. Such a result would represent an increase of about 45% to 65% over last year.

Tesla also provided an update to the development of its Shanghai Gigafactory, which broke ground in January and remains key to the company’s strategy to remain cost competitive in major electric vehicle markets.

“Given Chinese customers bought well over a half a million mid-sized premium sedans last year, this market poses a strong long-term opportunity for Tesla,” the company said in a statement.

Tesla said it is looking to begin production in China by the end of the year. It continues to target production of more than 500,000 vehicles globally in the 12 months to June 30, 2020.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Netflix’s 2Q global paid subscriber additions miss expectations

Tech companies like Lyft want your money – not ‘your opinion’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Read the latest financial and business news from Yahoo Finance