More tariffs — What you need to know in markets on Wednesday

Stocks gained ground for a second day on Tuesday, though the overall market action was less than encouraging.

The small cap Russell 2000 and the tech-heavy Nasdaq underperformed on Tuesday for the second day, with financials and consumer discretionary stocks lagging badly, and indication that the mini three-day rally investors enjoyed through Monday’s close has run out of gas.

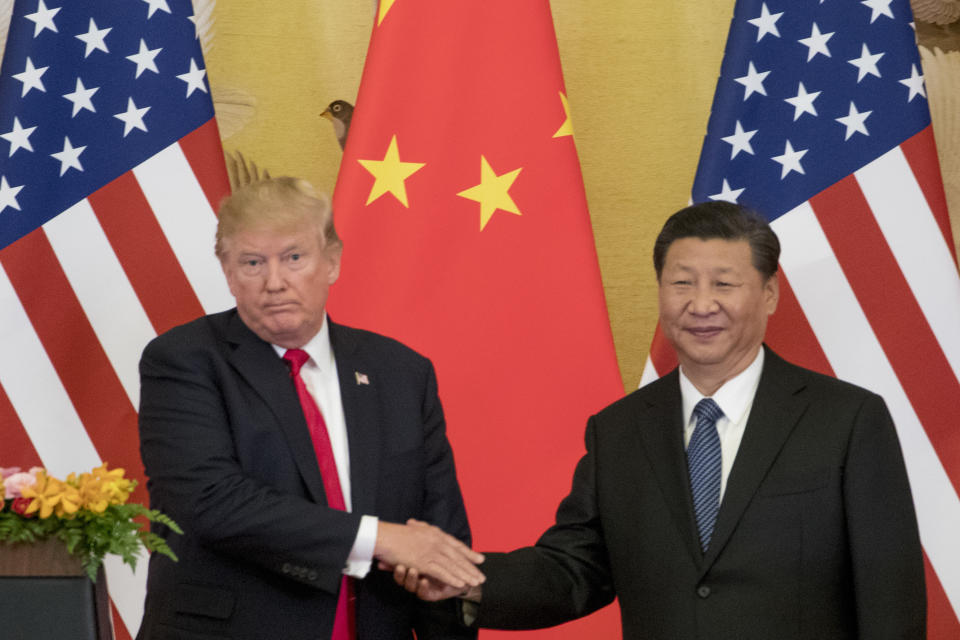

This market action, however, came against a backdrop of no new developments on the trade side. But late Tuesday President Trump released a new list of $200 billion in additional Chinese imports that would be hit with tariffs.

Expect investors to track any reaction in overseas markets overnight, with this potentially setting the tone for Wednesday’s trade.

The economics and corporate schedules on Wednesday will be light with producer prices for the month of June the only economic report of note. And on the earnings schedule, Fastenal (FAST) is the only S&P 500 member set to report results.

A 17-year high for quits

In May, the rate at which Americans quit private sector jobs hit a 17-year high.

According to the latest job openings and labor turnover survey, or JOLTS report, released by the Bureau of Labor Statistics on Tuesday, the private sector quits rate hit 2.7% in May. This is the highest quits rate since April 2001.

This was also a marked increase from the 2.5% quits rate seen in April and an acceleration in a rate that had been parked right around 2.4% for the last few years.

Additionally, the number of unemployed workers per job hit another all-time low for the JOLTS data at 0.91, indicating that there is now more than one job open for each unemployed worker. After the financial crisis, there were more than 6 unemployed workers per job opening.

These data clearly point to a tightening labor market in which workers are more confident about their prospects and employers are facing a dwindling pool of candidates.

But they are a slight contrast to the labor market outlined in last Friday’s June jobs report, when 213,000 jobs were created in the economy while wages rose 2.7%, less than forecast. (In May, the month that corresponds with Tuesday’s JOLTS data, there were 244,000 jobs created while wages rose 2.8% over the prior year.)

This contrast, however, is not an outright contradiction. There can be more slack in the labor market than certain numbers like a 4% unemployment rate and a record number of open jobs might indicate while the overall labor market is still fairly characterized as tight.

Because while wages are not rising at the pace economists might’ve expected given these dynamics, a 2.7% uptick in wage gains over last year is still a notable improvement over the 2% gain in wages workers were experiencing a few years ago. So wages are certainly rising, just not at an accelerating rate.

Which is another reminder that as the labor market continues to improve, it has not done so in a straight line. Something that is unlikely to change.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Harley-Davidson shows the unintended consequences of Trump’s tariffs

Oil prices won’t hurt the economy until they hit $120 a barrel