Stocks slammed again — What you need to know in markets on Wednesday

Stocks took it on the chin again on Tuesday.

After a huge rally to start the week on Monday, tech stocks led markets to the downside as the final two hours of the trading day saw a total washout on Wall Street.

In the end, the tech-heavy Nasdaq lost 2.9%, or 211 points, while the Dow lost 1.4%, or 344 points, and the S&P 500 fell 1.7%, or 46 points. Falling even more than the broad market were a number of companies that have been leaders during the post-election rally that crescendoed in early January.

Twitter (TWTR) lost 12% on Tuesday, while Nvidia (NVDA) lost 7.8%, Tesla (TSLA) dropped 8%, Netflix (NFLX) lost 6%, Facebook (FB) fell 5%, Square (SQ) dropped 4.6%, Amazon (AMZN) fell 3.8%, and Microsoft (MSFT) was off 4.6%. And as Bloomberg’s Joe Weisenthal noted on Tuesday, it turned out to be the worst day ever for the FANG stocks.

Facebook remained in the news on Tuesday with CEO Mark Zuckerberg reportedly planning to testify before lawmakers in April to answer questions related to the company’s handling of user data in the Cambridge Analytica scandal.

Tesla also dealt with negative news after the NTSB said it would send two investigators to probe a deadly Tesla crash in California, while Nvidia will reportedly suspend its self-driving car tests in the wake of Uber’s fatal accident last week. And so in addition to overall investor sentiment souring on the tech sector, the torrent of negative stories about the heaviest hitters in the space is certainly of no help.

Bitcoin (BTC-USD) prices were also lower on Wednesday, trading below $8,000 as some Wall Street analysts argued the digital currency could prove as a useful signal for investor enthusiasm with stock valuations and the price of bitcoin appearing more closely related in recent months.

Amid the drop in the stock market, bonds caught a bid with the 10-year yield falling to 2.77% while the 2-year moved back to 2.26%, a reversal from the mostly steady trading in bonds seen during last week’s market decline.

Tuesday, then, was a good old-fashioned risk-off day in markets and another sign that choppy trading from last week has not been sorted out with just two more trading days left in the first quarter.

On Wednesday, the economics calendar will bring investors the third estimate of third quarter GDP, which is expected to show the economy grew at an annualized rate of 2.7% in the final three months of 2017. Investors will also get pending home sales data for February.

On the earnings side, highlights expected Wednesday include PVH (PVH), GameStop (GME), Walgreens Boots Alliance (WBA), and Altaba (AABA).

Consumers loved stocks. Then the market fell.

At the beginning of 2018, the U.S. stock market was coming off a stellar 2017 and hitting new highs seemingly every day.

Consumers, for their part, were enthused.

In January, consumer expectations for stock returns over the next 12 months were the highest since January 2000, right before the tech bubble burst.

But after the market dropped about 10% in just a handful of trading days in February, and then continued this choppy trade into March, this enthusiasm for stocks among U.S. consumers has faded in a big way. In fact, a historic way.

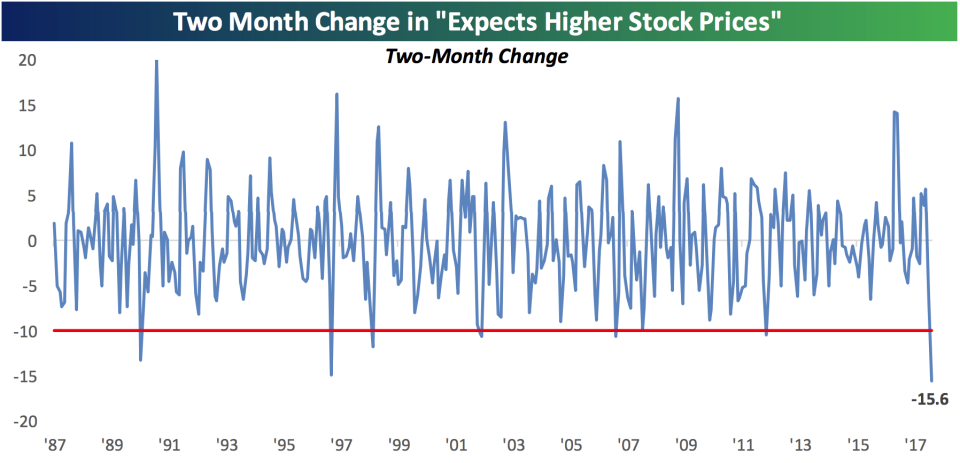

According to the latest consumer confidence report from The Conference Board, the percentage of respondents expecting higher stock prices in a year fell by 15.6% from January, the largest two-month drop in the data series which dates back to 1987.

Additionally, this report showed that the spread between those expecting higher stock prices in a year and those expecting lower stock prices in a year tightened in March to just 6%, the smallest since President Donald Trump’s election win in late 2016.

Bespoke Investment Group described this shift in consumer attitudes towards the stock market as the “shortest romance ever.”

“The examples of the big spike higher in sentiment in January and then sharp decline over the last two months show just how volatile sentiment has become recently and how little conviction there is on the part of consumers either way,” Bespoke wrote in a note to clients.

“While we wouldn’t view the recent drop in positive stock market sentiment as an outright buy signal, it is a development on the sentiment front to remember when the market starts to stabilize.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Trump’s trade moves put his favorite economic report card at risk

The Fed’s big message for markets — don’t worry about our forecasts

The Trump tax cut earned Warren Buffett’s Berkshire Hathaway $29 billion in 2017

Goldman Sachs says U.S. economic data right now is ‘as good as it gets’

One candidate for Amazon’s next headquarters looks like a clear frontrunner