The smart money is heading overseas to cash in on the eSports boom

As video gaming becomes more popular and more lucrative, fund managers are betting that eSports and video game stocks will break out. And while most investors have focused their attention on the big names in the United States, the upside for the international names is arguably much higher.

Bank of America Merrill Lynch analyst Justin Post said in a recent note to clients that he predicts eSports could generate direct revenue of over $900 million this year and $1 billion in 2019.

“Over time, and using a traditional sports analogy, we believe eSports advertising (streaming, sponsorship), ticket sales, promotions, and merchandise sales could reach $15 billion,” Post said.

Video game research provider NewZoo’s latest eSports market report sees the professional video gaming economy growing 38% this year, largely thanks to major investments from brands such as Toyota (TM), HP (HPQ), Intel (INTC) and Disney (DIS). Morgan Stanley analyst Brian Nowak previously predicted “Call of Duty” eSports alone could make up $105 million of revenue in 2020.

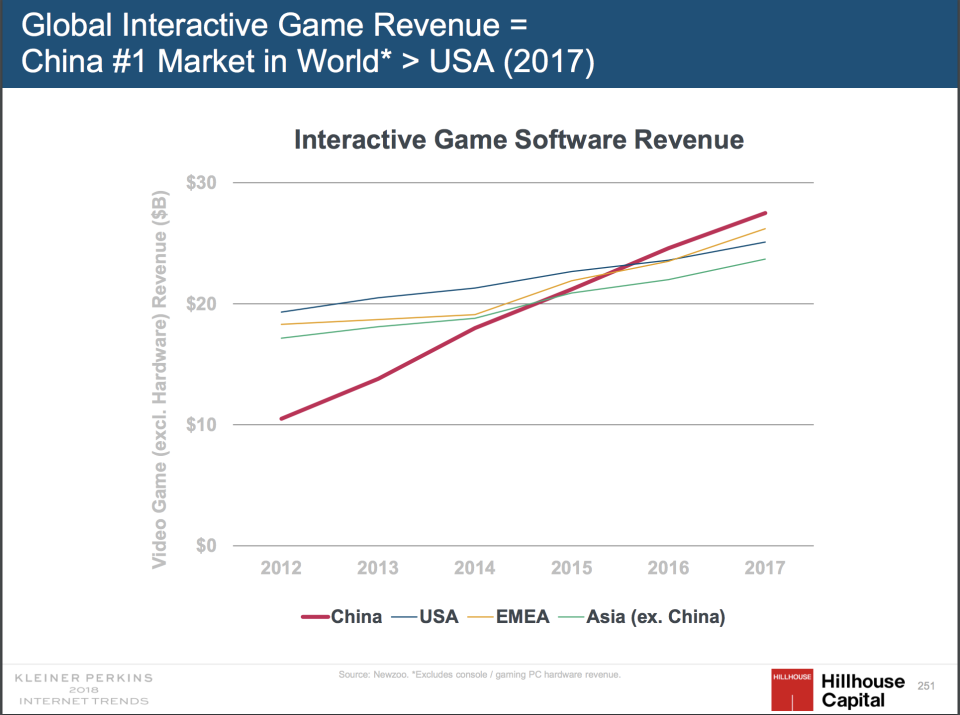

The big opportunities are in Asia

China, Japan and Korea have caught the attention of some U.S.-based asset managers.

Peter Gillespie, managing director and emerging markets portfolio manager at Lazard Asset Management, is expecting eSports and gaming to drive strong returns for years to come and he’s put bets down on a number of companies in Asia.

“As consumer trends grow in Asia, in particular, we can see the continued growth of the gaming industry,” Gillespie told Yahoo Finance. “We think local companies understand local markets better and would be able to take advantage of local preferences and become major game developers in their own right.”

Asset management firm T. Rowe Price has diversified its video game holdings. The company owns more than 18 million shares of EA (EA), but also holds 4 million shares of China’s Tencent (TCEHY) and has investments in Korean gaming companies NetMarble, makers of “Iron Throne,” and NCSoft, which produces the popular “Lineage” titles.

Investors can also get exposure to the gaming market through companies like Hong Kong-listed game developer NetEase (NTES) and e-commerce giant Alibaba (BABA), which has major investments in eSports.

Video games recently have become something of a crowded trade for the U.S. market, as asset managers jump on the eSports bandwagon. Already, BlackRock, the world’s largest asset manager, as well as passive investing giants like State Street and Vanguard, have major holdings in U.S.-based companies such as Activision (ATVI), Electronic Arts and Take-Two Interactive (TTWO).

But not everyone is bullish: Short sellers also are moving in, betting on the stocks to fall. Data from S3 Partners shows that EA and Activision are the two most shorted companies in the home entertainment software sector, with $933 million and $593 million of short interest betting against them respectively. Short interest in the sector has increased by $309 million over the last month.

Making money on free games

Gillespie is betting on Asia to generate big profits because of the way companies there are making money from gamers.

In markets like Korea and China, rather than paying upfront, players will get the games for free and then pay for upgrades like armor or weapons that make them superior competitors. Some gamers have been known to spend thousands of dollars to improve their abilities.

Such a model has been endeavored in the United States, but led to disastrous results. Electronic Arts’s “Star Wars: Battlefront II” faced so much criticism for giving advantages to players who paid to improve powers that EA pulled all of the so-called microtransactions from the game. In its highly anticipated “Battlefield 5,” everyone who buys the game will get all the post-release content without paying extra.

“It is a slightly different model, and the Asian companies are better positioned to take advantage of that model — and we think that will be one of the drivers for their earnings growth over many years,” Gillespie said.

The global video game market was forecast to have crossed $100 billion last year, with China responsible for more than a quarter of the haul — $27.5 billion — according to Newzoo. Tencent recently announced it would invest 100 million Chinese yuan ($15.75 million) in Fortnite eSports, and Epic Games, which it owns nearly 50% of, will award $100 million in prize money for eSports.

“The phase that the games market is now entering is redefining how we talk about our industry, audience and future,” Newzoo chief executive Peter Warman said in a statement last year. Chinese gamers “remain very interested in the top Western personal computer franchises, even though the majority of the most popular games is home grown.”

Still, pure-play gaming companies like NCSoft and Netmarble have posted negative returns so far this year. Analysts recently cut NCSoft’s price target after the company pushed back the release of its latest game, and big companies like Netmarble could be in for stricter regulation. Additionally, the companies are hard to access by investors outside of Korea.

The risk/reward of investing in gaming is akin to investing in movie studios years ago, Gillespie said. He also noted that gaming is quickly moving into mobile, increasing its reach and appeal.

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

See also:

Why PC companies are making big bets on gamers

What it takes to play video games for a living: Insane hours and tons of stress

‘Detroit: Become Human’ review: Strong characters make your choices matter