Slack beats on top and bottom line, stock slumps

Slack (WORK) issued its first earnings report as a public company after the bell on Wednesday, beating on the top and bottom line.

Here are the mosts important numbers from the company’s first report.

Revenue: $145 million versus $141.5 million (expected)

Adjusted losses per share: $0.14 versus $0.19 (expected)

In spite of numbers that looked relatively encouraging, the stock plunged as much as 13% in after hours trading, as the company’s third quarter outlook showed a loss that is slightly more than current estimates. The stock closed up 8% on the day at $31.07.

Slack’s Q3 2020 guidance called for a loss of between $0.08 per share and $0.09 per share. Analysts, however, were looking for expected losses $0.07 per share.

Basically, Slack’s business model involves offering its office collaboration services to smaller businesses for free, while charging large organizations and those looking for increased functionality.

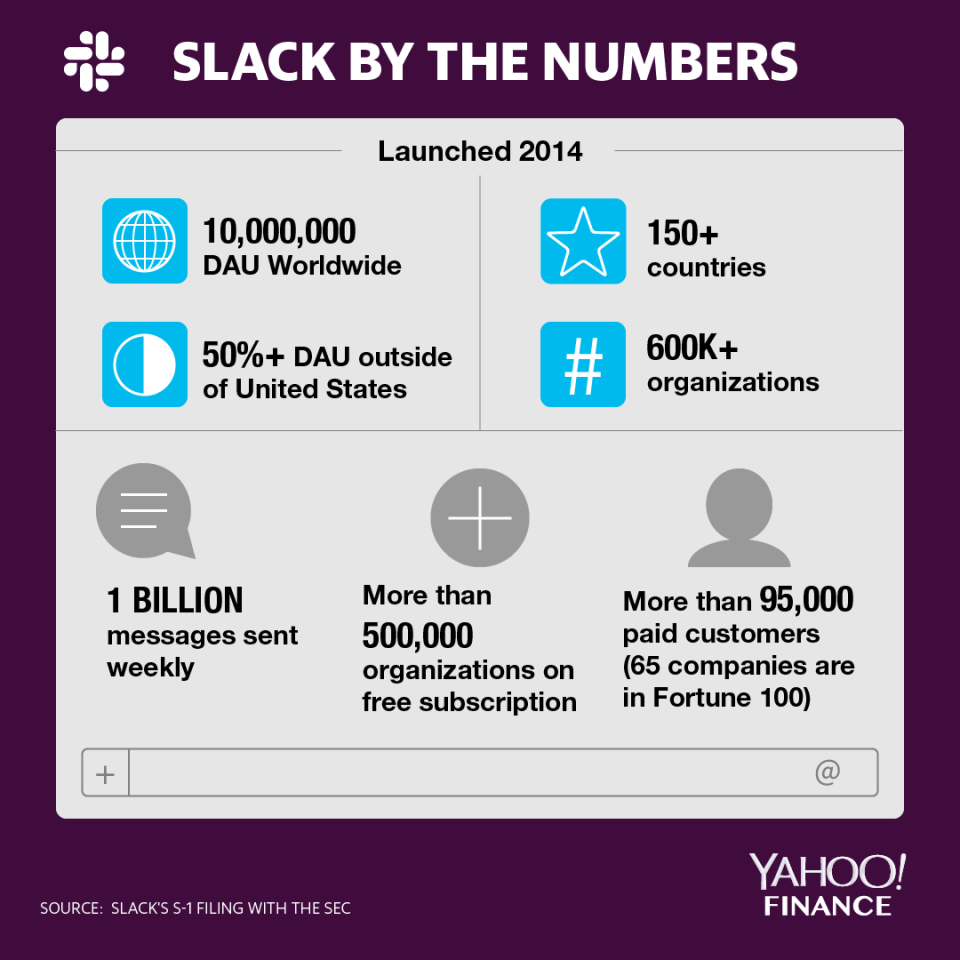

In its S1 filing, the company revealed that as of January 2019, more than 500,000 organizations used the free version of the messaging service.

As of April, Slack had as many as 95,000 paid customer organizations. In the three months ending in April 2019, 43% of Slack’s revenue came from 645 paid organizations that spent more than $100,000 annually.

According to Bloomberg, that’s about 1% of Slack’s total customer base. The company is expected to add 75 customers that paid more than $100,000 annually in Q2 2020, versus 61 in the comparable year-ago quarter.

Bloomberg project’s Slack’s sales will slow in the near term as it continues to expand in the enterprise space, with the company seeing a 52% increase in fiscal 2020 compared to an 82% in 2019. Sales are expected to continue to slow in 37% in 2021.

Slack has a good deal of competition in the enterprise messaging space. One of its biggest competitors is Microsoft (MSFT), which has a solid chance at cutting off Slack’s business via its Teams enterprise messaging service.

Both Slack and Teams offer third-party app integration, and can be used either free or via a subscription with enhanced functionality.

Like Lyft and Uber, both of which also filed IPOs this year, Slack has admitted it doesn’t currently make any money — and there’s the risk that it never will. It all depends on how many enterprise customers the company can convince to spend on its service.

More from Dan:

Google’s new Android Focus Mode could break your app addictions

The biggest differences between Apple's new credit card and most other cards

Fitbit debuts premium fitness and health tracking service as part of turnaround

Email Daniel Howley at dhowley@yahoofinance.com; follow him on Twitter at @DanielHowley.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.