Roots stock dives as slow traffic, distribution issues weigh on results

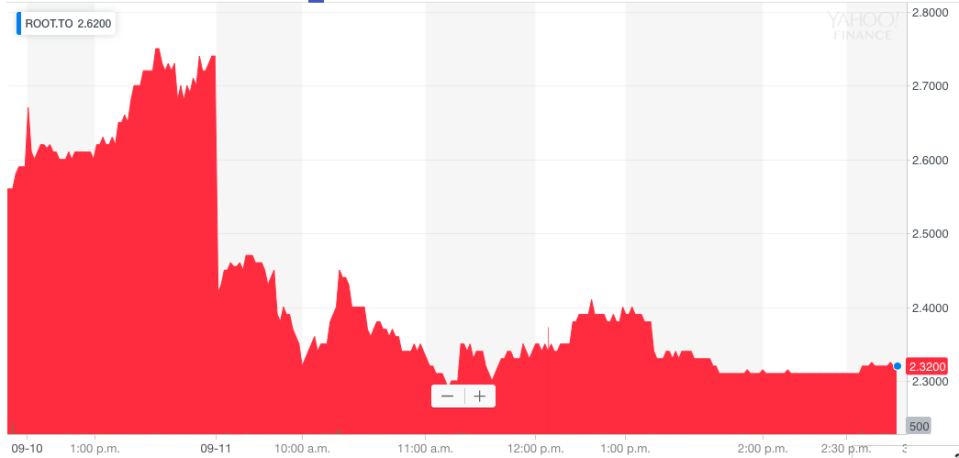

Roots Corp. (ROOT.TO) saw its stock fall as much as 17 per cent on Wednesday as the Canadian retailer lowered its end-of-year sales target following slow traffic and distribution issues that left some shelves empty.

The retailer reported a net loss of $9.7 million in the second quarter of 2019 on Wednesday, while comparable sales – a key metric in the retail industry – were down 2.9 per cent. The company’s stock fell as much as 17 per cent early Wednesday, and was trading for $2.32 at 1:45 p.m. ET, a decline of nearly 16 per cent.

“Soft store traffic continues to be a challenge,” Roots president and chief executive officer Jim Gabel said on a conference call with analysts.

“Our store traffic trends are not where we want them to be.”

Roots is also in the midst of transitioning over to a new distribution centre, which has led to incremental cost increases as well as issues with the flow of products to stores, the company said. Roots has had to make several adjustments since beginning the transition, including extending an agreement with a third-party distribution centre, adding additional shifts at the new facility, and prioritizing certain stores over others when it comes to product allocation.

Roots says costs related to the new centre will have a $5 million to $6 million negative impact on adjusted earnings before interest, tax, depreciation and amortization (EBITDA).

“Given the immense scale and scope of the project, we have been experiencing some challenges that affected our ability to flow product into our stores in a timely manner,” Gabel said.

“In terms of how we are progressing, as I look at June and July, there were periods that some of our stores had empty shelves – not completely empty, but in some of our key categories.”

Gabel noted that in August the retailer prioritized the company’s top stores in major cities to make sure there was an improvement in the flow of product to those locations. He said the distribution centre is operating at about 60 per cent of the capacity Roots wants. The plan is to be operating between 80 per cent and 85 per cent capacity by the start of the fourth quarter, and close to 100 per cent by the end of it.

Roots also lowered its end-of-year sales targets on Wednesday to the low-end or below its previously disclosed target of between $358 million and $375 million, due in part to macroeconomic and geopolitical challenges in Asia.

“While we and our parters continue to believe in the long-term growth prospects for Roots in Asia, all three of our markets that we are operating in are currently facing macroeconomic and geopolitical challenges,” Gabel said.

“We are seeing an impact on the business and anticipate that that will continue through the remainder of fiscal 2019.”

Roots has 115 partner-operated stores in Taiwan, 39 in China and one in Hong Kong.

RBC Capital Markets analyst Sabahat Khan wrote in a note to clients Wednesday that there are potential headwinds for the company, particularly across international stores.

“Although Roots has built strong momentum over the recent years, we believe it could become increasingly difficult for the company to deliver against its (full year) 2019 targets as the apparel retail operating backdrop becomes more challenging,” Khan wrote.

Download the Yahoo Finance app, available for Apple and Android.