From the Rolex Daytona’s 60th Birthday to the Rise of Dress Watches, 12 Watch Industry Predictions for 2023

“What’s your boldest prediction for the watch industry in 2023?”

We put that question to 12 movers and shakers in the watch industry and got a raft of insightful, provocative and surprising responses in return.

More from Robb Report

The Most Expensive Watches Sold at Auction in 2022, From a Unique Patek to Rare Rolexes

Audemars Piguet Freshens Up the Royal Oak With a Dimpled Dial

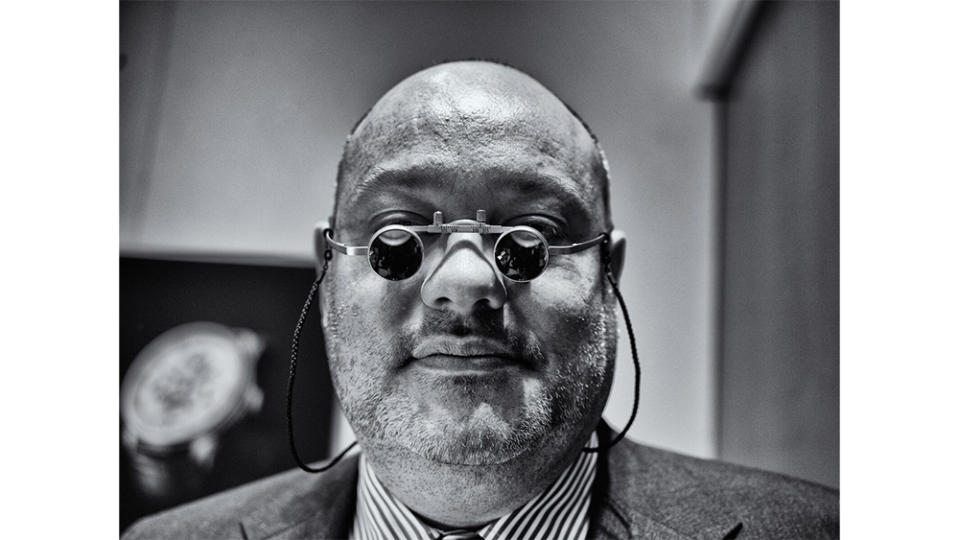

Meet Daryn Schnipper, the Sotheby's Watch Expert Who Sold the World's Most Expensive Patek--Twice

The general consensus is that after three super-charged years, the market appears to be cooling down. That the opportunity for pre-owned watches, especially in light of Rolex’s recent certified pre-owned announcement, is bigger than ever. That sustainability will continue to dominate the corporate watchmaking agenda. And those highly coveted timepieces, particularly ones from small-batch independent watchmakers, are poised for evermore growth.

To find out what else is brewing for the new year, read the prognostications in full below.

Kathleen McGivney, CEO of RedBar Group

“We will continue to see more brands move forward without assigning gender categories to watches. We’ve already seen some movement in this direction as a result of the larger conversations around gender within the watch community, and I think the industry has started to listen.”

Asher Rapkin, Co-Founder of Collective Horology

“We’re in a serious correction, which I don’t think is a bad thing. Seeing us go from $200,000 Nautiluses back down to rational prices is very good for everybody. Going through this correction, we’ll see three things come out of it:

If we think about the pre-Covid watch community, we saw it grew significantly through Covid. I think we’ll see a pullback from people in the space, but the total number of people in it will be greater than pre-Covid.

We’re starting to see signs of dress watches, smaller watches, metiers d’art watches, things we didn’t see in the era of the steel sport watch-obsessed community. We’re even seeing microbrands lean into dress watch territory. I think we’ll see more exploration into the traditional side of watchmaking outside the sport watch trend.

The third thing we’ll see is an evolution of the secondary market. For the last two years, the fact that watches had ballooned in value and were discussed as an asset class created a very different secondary market than collectors who’d spent 20 years in the category were used to. The secondary market was always a driver for opportunities and exploration; a way to move into watches at more rational prices. When we see the secondhand market move back to that state, we’ll see a lot more liquidity in the market because more people will be able to trade, and more people will buy watches.”

Paul Altieri, Founder and CEO of Bob’s Watches

“It all depends on what the Fed does. They raised interest rates pretty aggressively so far and if they continue to raise them to slow the economy down, you’ll see art, watches and real estate come down gradually.

Rolex still can’t produce watches fast enough; they have five, 10, 20 buyers for every model they make. Most people still can’t buy a brand new one because they’re out of stock. I don’t see that right-sided anytime soon. There will continue to be a premium on Rolex for the next year because you can’t just get them new. Prices may drift down a little until you start seeing more inventory in the stores.”

Catherine Renier, CEO of Jaeger-LeCoultre

“Predictions are based on the near past and the last three years have been very surprising. There is nothing that happened in the last three years that we could have planned. However, the business has been really very resilient to the turmoil that we experienced, between the sanitary crisis, now the energy crisis, and inflation.

My short answer: The world is difficult to predict as we’ve seen over the last period. But we are in a very resilient industry. Jaeger-LeCoultre has been overperforming and growing despite these challenges. The U.S. has been a priority for us, to elevate our visibility in this very important market. We are really very confident.”

David Hurley, Deputy CEO of Watches of Switzerland Group, North America

“2023 will see a massive focus on sustainability within the watch industry. Younger consumers are demanding it and the sales are there to support it. Following in the footsteps of Breitling and Panerai, expect to see more watches made from sustainable materials and less over-the-top packaging.”

Oliver R. Müller, Founder of LuxeConsult

“We will see the market cooling down substantially in 2023. Nevertheless, I expect we will have growth. I expect 2023 to be in the region of +2% to +4%. And if I’m proven wrong, I’m very happy for the watch industry.

I expect growth at the main players to go on. But things are cooling down. The crazy things we have seen over the last two years are not a part of the business anymore. Like when you opened the doors on January 1, 2022 and you knew your whole yearly production was sold out. That’s basically what Audemars Piguet, Rolex and Patek Philippe managed. It’s a very polarized market. A lot of other brands are a little bit average.”

William Massena, Founder of Massena LAB

“I think everybody will tell you that 2023 is going to be all about the used market—certified pre-owned (CPO)—and I agree. Rolex is telling us what 2023 will be about in terms of retailers. In 2022, I said that groups would be disintegrating and I think that’s going to continue; we’ll see more. But CPO will be the big word for everybody, especially at the big brands: Cartier, Omega, Patek, the big ones.

People look at watches as an investment; you know exactly what Rolex will be worth in three years because you have the pricing. But at Cartier, you’re clueless. Which watch are you going to buy? It’s all about information, it’s all about transparency—that’s the beauty of the whole thing.”

Steven Rostovsky, Founder of Rostovsky Watches

“The watch market will continue its downward price correction specifically for status brands, but much less so for independent brands. For the smaller indie brands like Greubel Forsey, De Bethune, Romain Gauthier, Grönefeld, Ludovic Ballouard, etc. the demand will exceed supply, therefore prices will remain strong. Speculators will fall out of the market. Buyers will buy for enjoyment without an expectation of profit/resale value, and collectors will be reenergized, their passion fired up, and they will have fun again!”

Mojdeh Cutter, Head of Partnerships & Events, Swiss Institute & Managing Director, TimeForArt

I foresee and hope for a new era of creative collaboration between the fields of contemporary art and horology, where emerging and experimental artists come together with watchmakers to move the creative conversation forward and to bridge the gap between the two worlds, which are undoubtedly intertwined at the core.

Paul Boutros, Head of Watches, Americas for Phillips

“A couple of things come to mind for 2023. You’ve got the 30th anniversary of the Audemars Piguet Royal Oak Offshore and the 60th anniversary of the Rolex Daytona.

There was a lot of excitement in 2021-22 with hype watches. I think there’s going to be a “less is more” approach from the brands in 2023. I think they don’t want to continue the exuberance that we saw. There may be fewer product launches, but more impactful models released.

I think the brands are probably going to read the environment and say, “Let’s not do big fireworks in ’23. Let’s be a bit subdued. Let’s bring out killer pieces without too many additional models released at the same time.”

Ruediger Albers, President of Wempe US

“Interest in wristwatches will continue to remain strong as so many young people have discovered watch collecting. The newly announced Rolex Certified Pre-Owned program will finally take the ambiguity out of shopping for a pre-owned Rolex, offering a 2-year warranty and reliable authentication.”

Yoni Ben-Yehuda, Head of Watches at Material Good

“The past year was a most exciting and unprecedented time for the watch world. As we saw countless new collectors enter our growing community and demand for rare timepieces reached a fever pitch, toward the latter part of the year we also saw a shift back to some levels of normalcy with regard to pricing. It was a joyous blur of a rollercoaster.

I believe that 2023 will be the year of refinement and record-breaking results for the most coveted examples of timepieces. My boldest prediction is that independent brands will continue to break world records in terms of sales, and the very finest of timepieces from storied maisons will reach new heights in terms of value and collectability. As the saying goes, a rising tide lifts all ships; well, a steady tide also allows a closer glimpse at the most special.”

Best of Robb Report

Sign up for Robb Report's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.