How Peloton dramatically changed my life

Something happened to me when I crossed the line from mid-30s into, well, that “backside” of the millennial age bracket that many people for years told me is when things would start to suck a bit (I ignored them all). Mostly, that sucking — per the wisdoms of the older folks in my life — would pertain to the slow degradation of mind and body.

Depressing, but facts of life I suppose. Luckily for me though, I discovered the fountain of youth.

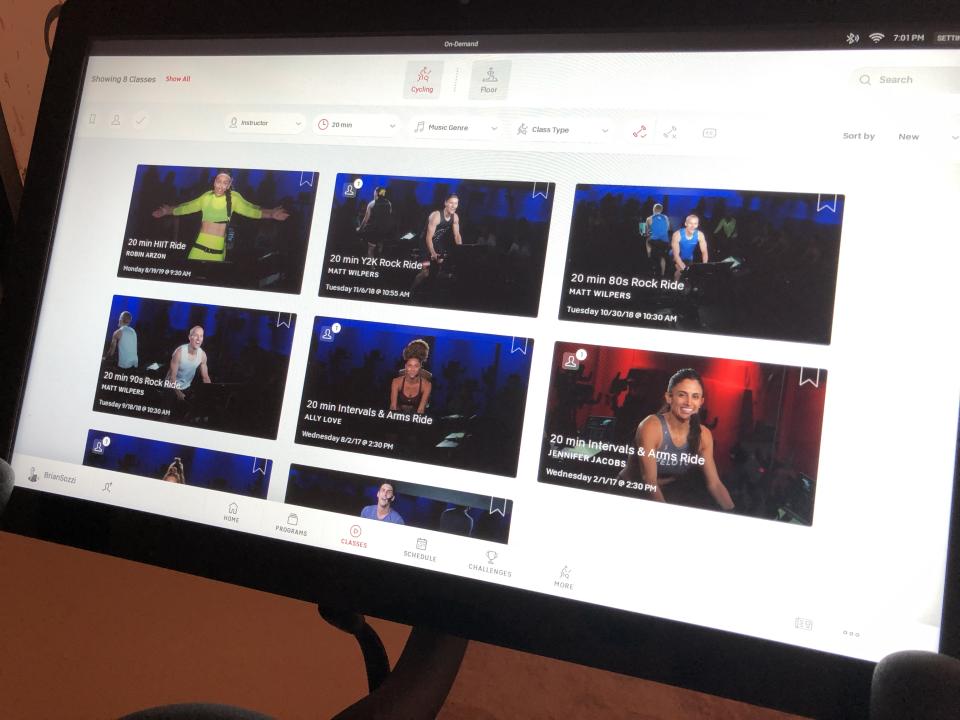

Yes, it does exist. It comes in the form of a sleek $2,700 at-home stationary exercise bike with a giant Android-powered touchscreen monitor attached that live-streams a gazillion (actually 950 a month, according to Peloton’s S-1 filing) workout classes each month. There is an app that will kick your ass (thank you, bootcamp class) on Monday and serve you up a mental re-centering by Sunday (thank you, meditation class).

Peloton Interactive — or simply Peloton more informally — is that shepherd of the fountain of youth. And shortly, you will be able to invest in the fountain of youth that brought me back to an energetic 21-year-old except stronger, fitter and a hell of a lot smarter. My story is similar to many others in the “Peloton Family.”

Laugh if you must now. But it’s all so true.

Here’s the deal on Peloton

Peloton has generally been crapped on by countless venture capitalists and financial commentators for years. Founded by veteran tech exec John Foley in 2014 after he was having trouble getting in workouts amidst his growing family, Peloton had trouble raising capital for close to three years among the VC crowd.

This cohort of usually fit individuals toting around $15 green juice drinks after a $75 spin class in San Francisco somehow was unable to be convinced on Peloton’s addressable market. Bizarre. An argument could be made that the VCs also didn’t fully understand the business model: Is Peloton a hardware company like one selling free weights to New York Sports Club (low margin) or a software provider similar to Netflix (NFLX) (high margin).

Note: Peloton went on to raise millions by influential VC firms TCV, Kleiner Perkins Caufield & Byers, Tiger Global Management and GGV Capital and was last valued at more than $4.1 billion. So some number crunchers have grasped the model (finally).

Financial pundits, on the other hand, have railed against Peloton’s infamous spin bike as nothing more than a wonderful place to hang dirty underwear on. Or that the bike is too expensive (note: according to Peloton’s S-1 filing, its fastest sales growth is coming from those under the age of 35 earning less than $75,000 a year... so much for that argument, said pundits) and will never catch on in the mass way that brings consistent profits to Peloton and a richer public market valuation.

All these claims boarder on ludicrous. Although I must admit to agreeing with some of them while watching Peloton climb toward its public market listing over the past year.

Then, four weeks ago on a whim I decided to pull the trigger on a Peloton bike after exhaustive research into consumer feedback. Sure the bike’s price point froze me for a little while. But the reviews playing up the health benefits ultimately won me over.

And three weeks following installation by two friendly young people clad in Peloton gear and who rode off in a nice van with the corporate name on it, I can say there are zero regrets on the purchase. If anything, I regret listening to the Peloton haters out there for so long and not buying one sooner.

Here are some of my early observations:

Addiction ensues: I’m fully addicted to the Peloton experience. The extremely energetic instructors are first rate, the classes kick your ass and there is this bizarre feeling that while in class you are being transported to another land (maybe it’s the nicely crafted playlists and inspirational sayings by the instructors, I am unsure at this point). That feeling of a true escape is great when navigating high pressure situations at work each day.

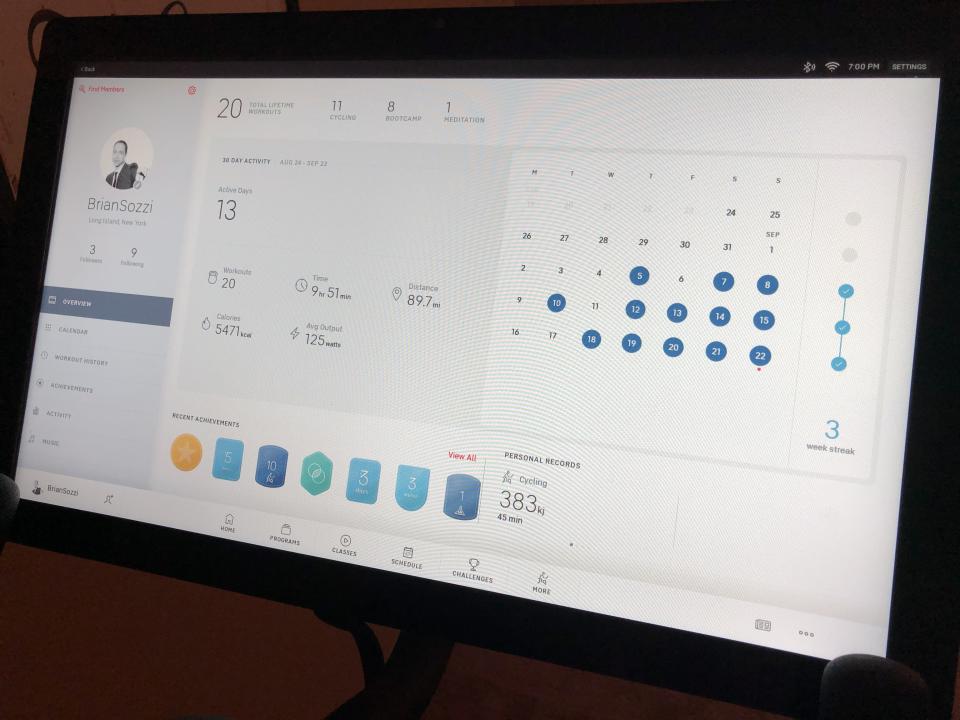

Data please: It’s fun to tinker with all the data that Peloton provides on your performance and progression. From the live-class leaderboard to stats showing monthly performance to the ability to easily connect with friends and join classes together, the whole damn platform just works really well and effortless.

The app: The Peloton app is under appreciated by naysayers. For $39 a month, I am now getting boutique-level workout classes (that can go for $50-plus more per class). Plus, access to the live and on-demand cycling classes. The whole package is akin to hiring a personal trainer for $39 a month and adding him/her to your pocket.

What has been interesting (besides the epic calorie burn per class) is my propensity to tell everyone at the office how awesome Peloton is at moment’s notice. Others seem to be doing the same thing. According to Peloton’s S-1, its marketing is mostly fueled by word of mouth.

And that word of mouth from everyone I have talked with here at Yahoo Finance has been very pro Peloton.

For instance...

Erin Fuchs, deputy managing editor at Yahoo Finance

“It's [Peloton] amazing because I can feel like I'm at a spin class while my daughter is sleeping in the next room.

Even if you don't have kids, it's a thousand times easier to roll out of bed and onto a bike than to get yourself to the gym.

Biggest problems - In an ideal world, I'd do most of my exercise either outside where I can enjoy nature or at an actual class where the teacher can correct my form.”

Jennifer Sherwood, head of talent and booking at Yahoo Finance

“Peloton is a game changer for its ease in accessibility, flexibility on class times and instructors, a true elevated class experience in the comfort of your own home.”

I am now in training to take on the legendary Yahoo Finance marathoner Fuchs in a Peloton spin class. I estimate I am at least three months away — based on my current training trajectory — from giving her a real run for her money.

But Peloton still has a lot to prove

Obviously Peloton is still an emerging growth company, as duly noted in its S-1 filing, and will have a lot to prove early on as a public company.

Peloton hauled in $915.9 million in sales for the fiscal year ended June 30. But it lost a whopping $202 million as it ramped up marketing costs to attract new users beyond simple word of mouth and product development. The company is also building out showrooms for its products around the world, entering new markets and expanding its live programming (a new 35,000-square-foot facility, in New York City’s West Side, dedicated to content creation will open in 2020).

All of that comes at a cost — so much so that Peloton acknowledges in the filing it may never turn a profit.

The steep loss in the fiscal year arrives despite Peloton seeing impressive 108% growth in the number of subscribers to its digitally-connected fitness products. The number of subscribers has increased five-fold since fiscal 2017.

That said, I feel fitter, stronger and have my mental swagger back. I have that feeling of invincibility back again, and love every damn minute of it. Bye-bye sluggishness and boring free weight workouts compliments of random fitness apps.

This feeling of more energy and a better operating mind is what you are getting for $2,700 (bike) or $4,000 (treadmill), excluding a beyond reasonable $39 a month fee for app/class access. The naysayers don’t understand that — this feeling that you can run through a wall like the Incredible Hulk is almost priceless.

I suspect this group will be eating crow when Peloton puts up profits within three years (they aren’t WeWork...) or gets acquired by Apple (AAPL). By then, this fella will be fully engulfed by the fountain of youth maintained by Peloton Interactive.

My win, my rivals’ loss.

Full disclosure: I know this is a glowing review of Peloton. You should know that 1) I do not own any shares of Peloton; 2) I have no intention of buying shares of Peloton.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read the latest financial and business news from Yahoo Finance