Pantries Under Pressure: Lessons for Brands to Overcome Supply Chain Challenges

Click here to read the full article.

The coronavirus panic has reached the pantry as consumers start to operate irrationally and sink into hoarding mode. Store shelves are being wiped clean of staples like toilet paper, bottled water, and canned and boxed goods. So, consumers are now turning to online shopping options in droves, putting unprecedented pressure on product supply and online supply chains.

The virus clearly is affecting demand for a broad swath of food and grocery categories. This chart demonstrates the hockey stick sales effect on Amazon.com — with some shelf-stable and sanitation product categories recording sales jumps of two-times or more starting in late February (versus average weekly sales in January).

More from WWD

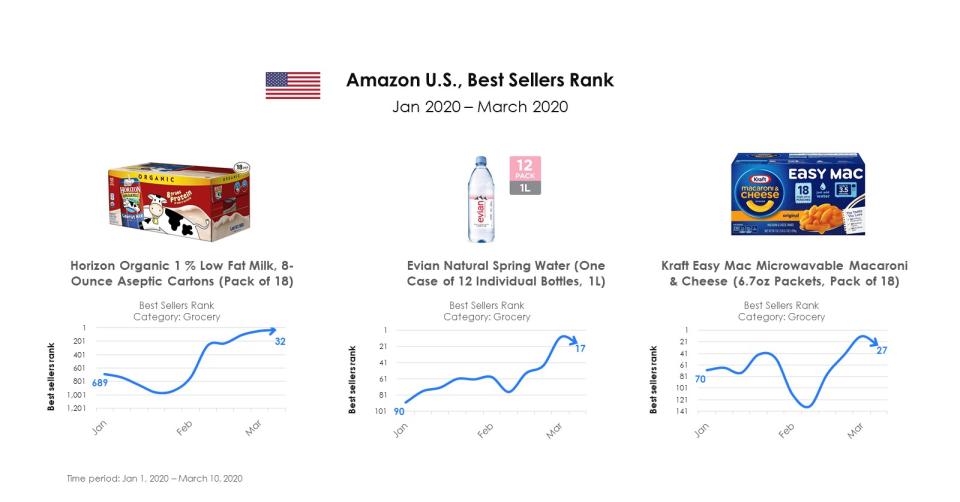

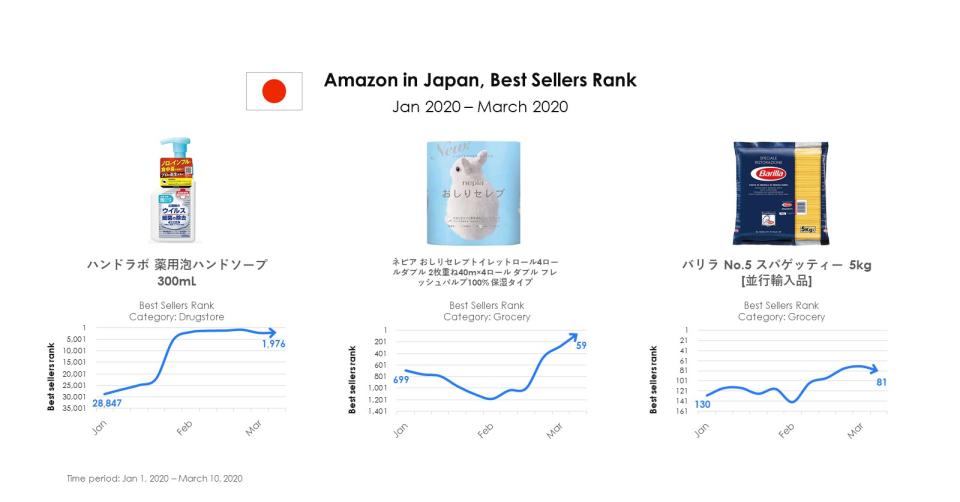

The charts below illustrate just how quickly some “pandemic pantry” products are propelling up Amazon’s bestseller ranks, putting undue stress on the online infrastructure (i.e., supply chain).

All brands, regardless of what categories your products fall into, must take heed and mobilize. If you haven’t developed a coronavirus e-commerce strategy yet, then you should. Here are seven tips that can help brands better manage their supply and digital strategy amid the unusual uptick in demand due to coronavirus.

1. Monitor your stock levels but expect that you are going to run out. No matter how hard you try, demand will outpace supply. It’s important to know the scope and scale of your out-of-stock issues by monitoring outages across every retailer, and even understanding at a regional level where the biggest outages are. This will help you prioritize where to allocate new inventory once it’s available.

Also, think outside-the-box to capture demand even when stock levels run low. Take, for example, the creative approach being deployed by niche brand Touchland. The company is building a pre-order list (exceeding 10,000 orders and counting), with the anticipation of getting product back in stock by the end of March. Instead of losing customers due to out-of-stocks, it’s capitalizing by encouraging people to sign up on the pre-order list.

2. Work with retailers to implement temporary policies to manage supply. Retailers and brands must work together to manage short supply scenarios, like late or insufficient quantities of high-demand items. Instituting policies for allocating limited stock and putting order maximums in place could help keep panic buying at bay. In the U.S., Kroger and Target are among retailers limiting purchases of virus-related products, both in-store and online.

3. Push pause on promotions. Be careful with running promotions during times of high demand — e.g., specific to the coronavirus, the high demand is already there, and you may just expedite running out of stock.

4. Selectively invest in sponsored advertising. Sponsored advertising is a good way to make sure you (and not your competitors) own top position for key search terms, but more importantly your own brands. But be smart and selective in your use of sponsored advertising during times of uncertainty and unusually high demand because what you don’t want to do is run out of stock. For some brands, scaling back ad spending may be the appropriate path.

5. Optimize content for keywords that matter. Consumers are changing their product search behaviors to a different mode, increasingly searching on keywords like “coronavirus,” “shelf-stable food,” and “disaster planning.” Brands confident in their product supply should be researching new search patterns to incorporate relevant keywords into their product content (titles, description, bullets) to maximize search.

6. Keep close tabs on 3P (third-party sellers) activity. You need to pay careful attention to price activity, especially large spikes that can be driven by 3P sellers. Under “normal” circumstances, brands worry about 3P sellers underpricing their products and selling below the Minimum Advertised Price (MAP) set by the manufacturer. Now under “coronavirus” circumstances, it’s just the opposite. You need to be concerned of prices going up too much. No brand wants to be perceived as profiteering.

Amazon has taken measures to minimize price-gouging during the coronavirus crisis by blocking or removing tens of thousands of deals by 3P sellers deemed to be contributing to unfair pricing. But it’s good to set up tracking tools to watch for giant price jumps.

7. Monitor negative reviews for any fallout. Brands should be diligent in monitoring any fallout related to the price-gouging by 3P sellers. Negative reviews left by consumers can cause significant damage to brand equity.

Events such as the coronavirus crisis highlight the need for every brand to be ready for rapid response. The massive demand spikes and cross-category product outages certainly are putting brand readiness, agility and responsiveness to the test. Certain areas of weakness, e.g., the supply chain, are being exposed — a signpost that perhaps e-commerce isn’t as mature as we’d like to think, and much work remains to be done.

Keith Anderson is senior vice president of strategy and insights at Profitero.

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.