Mutual Fund-to-ETF Conversions: The Wave of the Future in Four Charts

This article was originally published on ETFTrends.com.

By John Hyland

Since its beginning almost 30 years ago the ETF industry sees a new trend or product emerge every few years. From sector funds to commodity funds to fixed income funds to active funds to thematic funds and to non-fully transparent portfolios, something new comes along like clockwork. Each innovation raises the question of if the newest thing will gain traction? Will it become huge? Or will it fizzle out? 2021 was no exception. We saw for the first time the conversion of a mutual fund into an ETF.

Although it has been less than two years since this newest feature on the ETF landscape, there is reason to believe this may well be a major shift. Since March of 2021, 33 mutual funds, with almost $60 billion in AUM, converted themselves into ETFs. Against the background of an almost $7 trillion-dollar US-based ETF universe, $60 billion may seem fairly small. However, much of this money came from fund firms that were not previously ETF issuers. This new influx in well under two full years is actually impressive.

The advantages of an ETF over a mutual fund for the investor are of course fairly well known. ETFs are generally more tax efficient, offer greater transparency, and are often, although not always, a bit cheaper than the alternative mutual fund. Especially if the funds are actively managed.

However, just because an ETF offers certain advantages to the investor does not completely explain why the mutual fund CEO would undertake the conversion. They need their own compelling business reason to do so. Particularly if they are going to be lowering fees. What could that reason be? There is a good chance the reason is actually fear.

Since the Global Financial Crisis of 2008-2009, flows of new money into mutual funds have definitely taken a turn for the worse. Especially compared to new money flows into ETFs. The first chart below compares annual flows of new money into equity mutual funds versus equity ETFs from 2010 to 2022. Clearly flows of money into equity mutual funds, both active and passive, have been negative for most of the last 12 years and the trend is getting worse. Meanwhile flows into equity ETFs have been positive every year and have been trending up.

If you are the CEO of a purely mutual fund company, and you look at this chart and the trend, it should certainly send shivers down your spine. Sure, your sales and distribution team may be raising $10 billion in a year in new sales, but if you have $20 billion in redemptions, and you see the gap is rising year by year, it is too easy to imagine where you will be in 10 more years.

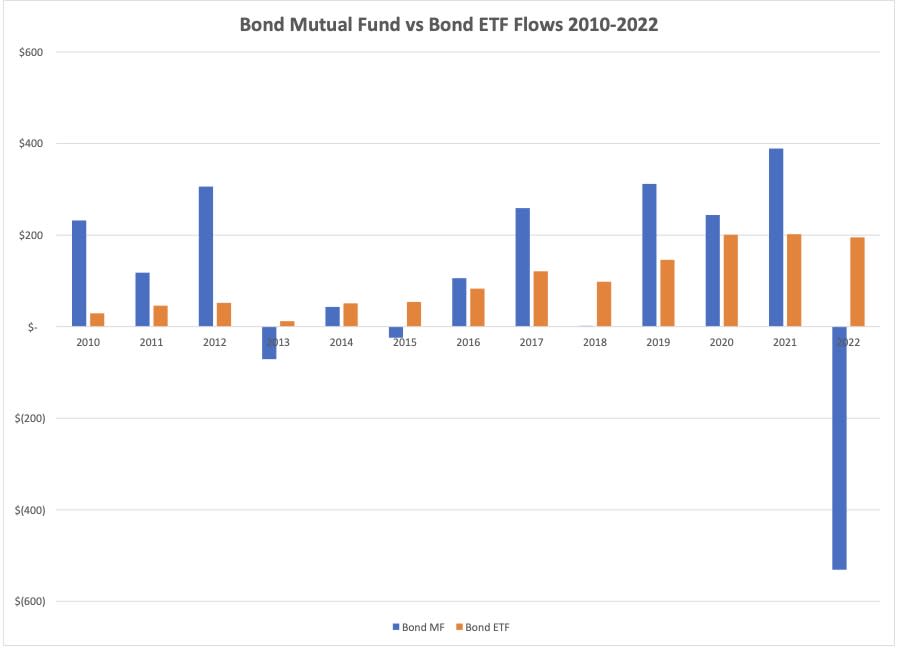

For a while the flows in bond mutual funds looked less grim. The chart below is flows into fixed income mutual funds and ETFs over the same 2010-2022 period. Three things jump out from the data. First, the trends do not appear as bad as for equity mutual funds as bond mutual funds seemed to have done fine for most of this time period helped no doubt by a search for yield in a low interest rate environment. However, two trends suggest that mutual fund CEOs should be less sanguine even here. First, it is apparent that bond ETF flows are rapidly catching up with bond mutual fund flows in good years. In 2010 flows into bond ETFs were only 13% of the flows in bond mutual funds. In recent years flows into bond ETFs have average more like 50%-80%. Not a good trend for mutual funds, but it gets worse. In years where bond mutual funds have negative flows bond ETFs still have positive new cash flow. This has been particularly true in 2022, a year where bond funds of both wrappers have seen negative returns. Yet bond ETFs still are seeing new flows while bond mutual funds are seeing major outflows.

One possible explanation for the bond flow trends, as well as the equity flows, is that when many investors sell mutual funds, either to reinvest in a different strategy or simply to engage in tax loss harvesting, they sooner or later put the money back into the market. However, these trends might suggest they buy their new holding as an ETF and not as a mutual fund. If true than if you repeat this pattern over the course of several bull and bear markets the impact on mutual fund flows would be enormous.

To address this issue, we asked a longtime ETF sales and distribution veteran how much of a factor he thought this sort of switching between wrappers was at present. His response was there is plenty of anecdotal evidence to suggest that the tax loss harvesting move from mutual fund to ETF is a very real trend.

Where will this take us in the near future? If you look at the two pie charts below you can see that compared that the share of the asset pie held by ETFs has risen a great deal since 2010 compared to mutual funds. The charts are all assets held by both mutual funds and ETFs (excluding money market funds). ETFs share of the total has risen from 10% to 26%. In absolute dollars both slices rose a great deal driven by the long bull market of the last decade, but ETFs were helped by new investment flows while the mutual fund slice was negatively impacted.

Of course, the trend shown above was done with essentially no contribution from the conversions. If conversions become a major factor the ETF slice could essentially just eat up the mutual fund slice.

Looking at these trends this raises a very good question. Why, as a matter of business strategy, don’t mutual fund CEOs just plan to convert more, or most, of their mutual funds into the wrapper that seems to be getting all the flows? Is it just stubbornness or are there practical reasons to hold off on pulling the trigger on major conversions?

To address this issue, we asked Vettafi’s well known ETF guru Dave Nadig what might be stopping a mutual fund exec staring down into the abyss why they would NOT make a switch?

“If you’re sitting on a passel of well-known active mutual funds, you have a real conundrum. If you convert everything into ETFs, chances are you have to do that at the lowest available price for each strategy. Still selling some 1% A-Shares with a load? Sorry, that’s not going to fly, you’re going to end up using that 60bps “cleanshare” as the benchmark for your ETF pricing, or you’re not going to gain assets. So that can mean a direct short term hit to revenue. That can be a hard pill to swallow.

It gets worse though. Chances are a lot of your assets come from defined contribution plans. You basically can’t convert those shares at all, because most mutual funds in DC plans pay a 12b1 fee to offset recordkeeping (nearly unheard of in ETFs). Also, those recordkeepers are likely not interested in your whole-ETF shares, they’re designed to track the easily fractionated mutual fund shares.

These two dynamics – pricing and fractional shares – are why you’ve seen many of the true conversions in tax-aware strategies (e.g. DFAs conversions), and why others, like Fidelity, have been forced to create clones of popular strategies rather than convert (e.g. FMAG).”

Clearly there are reasons for a CEO to not move all of their mutual funds into ETFs. Or at least reasons to not do so right away. According to the Investment Company Institute data 17% of mutual fund assets are in 401(k) plans. The other 83% is presumably held in accounts that could more easily just use an ETF in replacement of a mutual fund. But 17% is an average. For some mutual fund families their percentage of AUM in 401(k)s might be well below 10%, making the decision to convert much easier. Others will be over 25%, making the decision much tougher.

Finally, this raises the question of if many mutual funds only firms, or firms whose mutual fund business dwarfs their ETF business, are currently looking at doing conversions. Firms like Fidelity have all already announced or filed to do such conversions. Is this just the tip of the iceberg? We go back to our veteran ETF capital markets director. “If you talk to the folks at the stock exchanges and at the custodian banks, they will tell you the telephone is ringing off the hook with calls from mutual fund firms. Calls are coming in faster than they can respond.”

For more news, information, and analysis, visit the ETF Education Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM