Here’s How Much You Need to Earn to Own a Home in a Major U.S. Metro Area

Mortgage payments have increased by roughly 70 percent since February 2020.

Buying a home in the United States is part of the long-promised American Dream, but for some—especially those living in proximity to a major city—a dream it will remain.

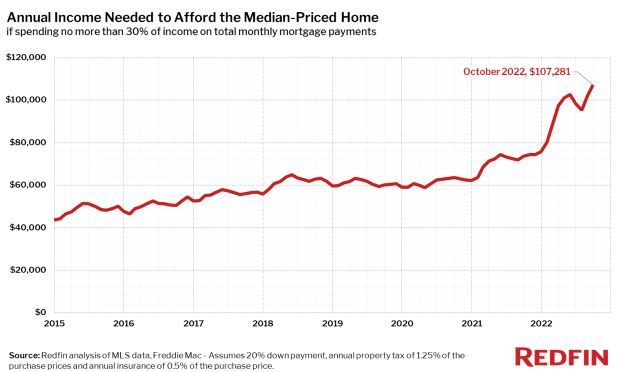

According to new data from Redfin, a homebuyer must earn $107,281 to afford the $2,682 monthly mortgage payment on the typical U.S. home. That number, the company said, was up 45.6 percent from $73,668 just one year ago.

The company also revealed that homebuyers must earn at least $100,000 annually to buy a home in nearly half (45) of the metros in its analysis—up from 16 cities a year ago.

And supply chain issues can't be blamed for this post-pandemic recovery foul.

The fact that mortgage rates have more than doubled over the last 12 months, as home prices continued to sit at boosted levels, coupled with inflation and slow wage growth, has caused the cost of purchasing a home in the U.S. to nearly double, according to Redfin.

The data suggested that from February 2020 to October 2022, the monthly payment for an American family buying a median-priced home increased by roughly 70 percent. And prospective homebuyers in some states are feeling the burn more than others–specifically those in Sun Belt destinations like New Orleans, Palm Springs, San Diego, Orlando, Phoenix, Los Angeles, and Myrtle Beach.

Buyers in North Port, Florida—a city just southeast of Sarasota—have seen the biggest percentage increase of any major U.S. metro. They need to earn at least $131,535 annually to afford the metro area’s typical monthly mortgage payment of $3,288. Redfin said that’s up 73.9 percent from $75,659 a year earlier.

The other cities that have become increasingly expensive include Miami, where homebuyers need to earn $128,892, up 63.7 percent year-over-year. El Paso, Texas ($64,580, up 63.6 percent), Tampa ($101,682, up 62.4 percent), and Cape Coral, Florida ($104,943, up 60.6 percent). The company said it still doesn't know how the aftermath of Hurricane Ian will affect Florida's housing market, as the number of sales in the region sharply decreased.

Chicago and the Bay Area saw the smallest uptick in necessary income, as they're the only parts of the country where home prices are falling year-over-year. However, homebuyers still need to earn 30 to 50 percent more this year than they did last year to afford to live in any one of the 93 cities in these areas.

Lake County, Illinois–located outside of Chicago–had the smallest gain in income necessary to afford the median-priced home, though buyers still needed 33.5 percent more than a year ago.

The Bay Area also had smaller-than-average increases, but the income necessary to buy there is still enormous. Buyers need to earn $402,821 to afford San Francisco’s typical $10,071 monthly mortgage payment, which is up 33.6 percent from a year ago—followed by San Jose ($363,265, up 36.1 percent), Oakland ($247,559, up 36.2 percent), Anaheim, California ($254,286, up 42.1 percent), and Los Angeles ($221,592, up 40.7 percent).

Detroit requires the lowest income to afford the area’s median-priced home ($48,435), but that’s still up 42.3 percent from a year ago. It’s followed by Dayton, Ohio ($51,126, up 46.1 percent), Cleveland ($53,817, up 45.7 percent), Rochester, New York ($56,508, up 56.2 percent), and Pittsburgh ($57,853, up 41.7 percent).

These increases aren't just bad for buyers, but sellers, too—as Redfin blamed affordability issues for the "dramatic slow-down" in home sales.

“High rates are making buyers rethink their priorities, as many of them can no longer afford the home they want in the location they want,” Washington, D.C. Redfin agent Chelsea Traylor stated in the release. “If you had a $900,000 budget a few months ago, rising rates mean it’s now around $700,000–and sellers aren’t dropping their prices enough to make up for the change. So buyers are searching further away from the city in more affordable areas or waiting for prices and/or rates to come down before making a move.”

Traylor continued: “I’m encouraging buyers to think long term; prices are unlikely to fall drastically in the long run, so buying a home now–if you can afford the monthly payment–will still help you build wealth over time, especially if you plan to live in it for several years. Even though rates are high, another advantage of buying now is the lack of competition and opportunity to negotiate with sellers.”

For the full breakdown of the cost of buying a home in the U.S., click here.

More News: