Jobs report, 4th of July — What you need to know for the week ahead

The first half of the year is over.

After a rocky start to 2018, the Dow was the only one of the major U.S. indexes to actually lose ground in the first six months of this year, while the S&P 500 is up over 2% and the Nasdaq has gained over 9%.

Around the world, however, the first half of this year was choppy, with Bloomberg’s Michael Regan noting Friday that global market caps have lost about $10 trillion since peaking in late January.

And so many investors will be eager to leave the first half of this year — which saw the fervor around stock and bitcoin peak almost in unison — in the rearview mirror.

The week ahead will bring investors the beginning of July, the third quarter, and the second half of the year. It will also be a shortened week for investors, with U.S. equity markets open for a half day on Tuesday and closed on Wednesday for the 4th of July holiday.

The economics calendar, however, will still be quite busy with the monthly jobs report set for release on Friday, while key readings on the manufacturing sector and the minutes from the Federal Reserve’s latest meeting also set for release.

The June jobs report is expected to show another strong month of job creation for the U.S. economy with the unemployment rate set to hold steady at an 18-year low of 3.8%.

The earnings calendar, however, will be quite barren with no S&P 500 companies set to report results.

Economic calendar

Monday: Markit U.S. manufacturing PMI, June (54.7 expected; 54.6 previously); ISM manufacturing PMI, June (58.3 expected; 58.7 previously)

Tuesday: Factory orders, May (+0% expected; -0.8% previously); Auto sales, June (17 million vehicle pace annualized expected; 16.81 million vehicle pace previously)

Wednesday: Markets closed for July 4th holiday

Thursday: ADP private payrolls, June (+190,000 expected; +178,000 previously); Initial jobless claims (225,000 expected; 227,000 previously); Markit U.S. services PMI, June (56.5 expected; 56.5 previously); ISM non-manufacturing PMI, June (58.2 expected; 58.6 previously); FOMC Minutes, June 13 meeting

Friday: Nonfarm payrolls, June (+198,000 expected; +223,000 previously); Unemployment rate, June (3.8% expected; 3.8% previously); Average hourly earnings, month-on-month, June (+0.3% expected; +0.3% previously); Average hourly earnings, year-on-year, June (+2.8% expected; +2.7% previously); Trade balance, May (-$43.8 billion expected; -$46.2 billion previously)

A turbulent first half in the books

The first half of 2018 is officially over.

And for some investors, the end of a choppy start to the year will be welcome.

When markets closed Friday, the Dow was the only major index in the red for the first half of the year, falling about 1%, while the S&P 500 was up over 2% and the tech-heavy Nasdaq gained more than 9%.

But the road to these returns was a trip quite unlike the smooth sailing that investors saw for so much of 2017.

U.S. stocks hit an all-time high in late January as the market rose so quickly to start the year Wall Street strategists couldn’t re-write their expectations fast enough. The Dow topped 26,000 and some strategists called for the Nasdaq to reach 8,000 by the end of the first quarter.

But the late-January peak was followed by the Dow logging a 1,000 point daily loss twice in one week as financial markets went from expressing exuberance over lower corporate taxes in the U.S. and a synchronized global economic expansion to near panic.

The first quarter’s record highs were accompanied by record inflows to global stocks in the first quarter, according to analysts at Jefferies. In the second quarter, however, $14 billion was taken out of global stocks as stock markets in Europe lagged their U.S. counterparts, Chinese stocks entered a bear market, and emerging markets got drilled, losing 10% in the second quarter.

And then came trade.

In late February, President Donald Trump announced tariffs on the import of steel and aluminum, the first of what has become a series of tariffs and counter-tariffs announced by the White House and America’s major trading partners.

As the first half of the year drew to a close, this past week saw Trump scold Harley-Davidson (HOG), an American manufacturing icon, for announcing that they would make more motorcycles overseas to avoid tariffs for exports to the EU.

His argument to them? Be more patient and wait for the U.S. to win this trade war. After all, Trump says they are easy to win.

So as we enter the second half of the year, we know that workers and consumers remain confident in the economic expansion as do economists. Changing trade dynamics, of course, could further complicate the economic outlook.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote this week that economic growth has accelerated this year and things augur well for the second half of the year. Businesses are confident, interest rates are still relatively low, credit is available, and a lack of labor is requiring companies to increase investment and boost productivity.

The labor market is also still demanding more workers than are available, and with productivity likely increasing from more investment, wages appear set to accelerate. The Federal Reserve’s moves for the remainder of this year — an additional interest rate hike in both September and December — are now the base case for markets, but how the central bank responds to rising wages and inflation presents a risk to the economy next year, in Shepherdson’s view.

Also expect markets to keep an eye firmly trained on the Treasury yield curve, where the difference between short and long-term Treasury yields is now at a more than 10-year low. Short-term rates exceeding longer-term rates, or an inversion of the yield curve, has tended to precede recessions by about two years.

With the economic backdrop remaining constructive for investors, the stock market set up for investors still remains mixed.

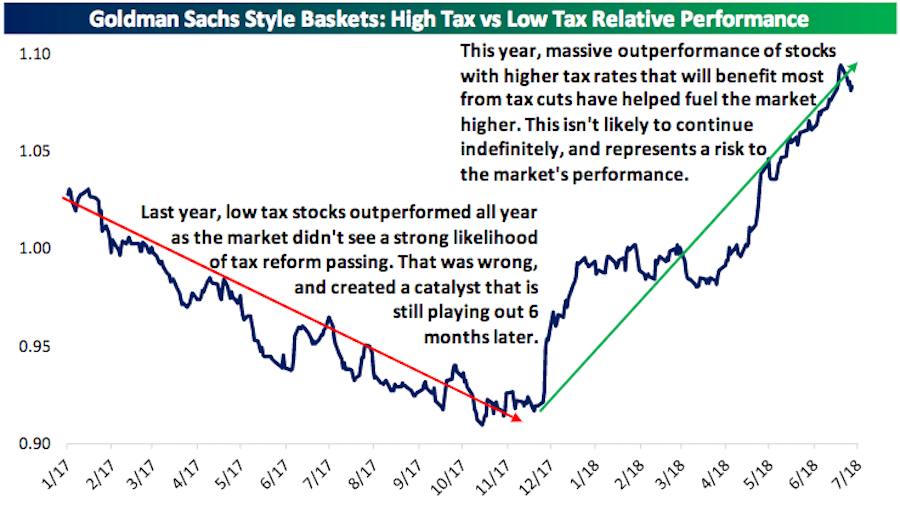

In 2017, markets reacted to a positive boost in business sentiment after Trump’s win, synchronized global economic growth, and the potential for tax cuts. With tax cuts passing, Bespoke Investment Group notes that high tax companies have been huge outperformers this year, a trend unlikely to continue. Not great news for the market going forward.

The midterm elections this November also pose a risk to markets, as Democrats taking control of one or both houses of Congress would stymie some parts of Trump’s agenda in the final years of his presidential term. Trade, we’d note, has largely been an area where Trump can act without Congressional support.

And looking at the market’s technical setup, it is kind of a mess right now.

“2017 was characterized by slow and steady gains with rarely any down days, which resulted in one of the most beautiful uptrending chart patterns you’ll ever see,” Bespoke wrote in a note to clients on Friday.

“If 2017 was beautiful, the market does not want to look at itself in the mirror in 2018,” the firm adds.

“While the uptrending pattern continued in January, since the S&P’s peak on January 26th, we’ve generally seen downward or sideways action. As we end the first half, the S&P is still struggling to find its way. From a purely technical perspective, investors do not have a particularly bullish set-up right now, although it’s not bearish either.”

Not bullish. Not bearish. Good luck in the second half of the year.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland