Ingersoll Rand (IR) to Buy Pedro Gil, To Boost Spanish Base

Ingersoll Rand Inc. IR recently announced that it will acquire Pedro Gil Construcciones Mecánicas, S.L., a manufacturer of positive displacement blowers, pumps and vacuum systems in the Spanish market. Pedro Gil generates annual revenues of approximately $15 million.

The buyout of Pedro Gil will expand IR’s Spanish footprint. Post completion of the acquisition, Pedro Gill will be integrated into IR’s Industrial Technologies and Services segment. Subject to regulatory approvals, the transaction of Pedro Gil is expected to close in the fourth quarter of 2022.

Apart from the takeover deal, Ingersoll Rand announced the completion of the acquisition of Westwood Technical Limited for approximately $30 million in cash. Based in the United Kingdom, Westwood Technical is a control and instrumentation specialist with distinctive Industrial Internet of Things (IIoT) capabilities.

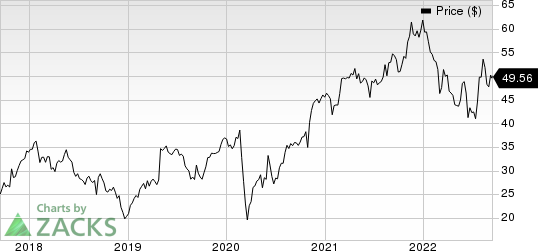

Ingersoll Rand Inc. Price

Ingersoll Rand Inc. price | Ingersoll Rand Inc. Quote

The acquisition expands IR’s IIoT offerings with Westwood Technical’s Aircom product line. It is worth noting that the Aircom product line complements Ingersoll Rand’s YZ Systems business. The acquired business will be added to IR’s Precision and Science Technologies segment. IR closed this acquisition on Sep 1, 2022.

Stocks to Consider

Ingersoll Rand carries a Zacks Rank #3 (Hold), currently. Some better-ranked companies from the Industrial Products sector are discussed below:

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). AIT delivered a trailing four-quarter earnings surprise of 22.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

AIT’s earnings estimates have increased 6.7% for fiscal 2023 (ending June 2023) in the past 60 days. Its shares have rallied 2.8% in the past six months.

Greif, Inc. GEF presently has a Zacks Rank #2 (Buy). GEF delivered a trailing four-quarter earnings surprise of 22.4%, on average.

GEF’s earnings estimates have increased 4.6% for fiscal 2022 (ending October 2022) in the past 60 days. Its shares have risen 12.8% in the past six months.

Valmont Industries, Inc. VMI presently has a Zacks Rank of 2. VMI’s earnings surprise in the last four quarters was 13.7%, on average.

In the past 60 days, Valmont’s earnings estimates have increased 3.8% for 2022. The stock has rallied 22.3% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research