14 Money Tips For First-Time Parents That I Learned From A Mom Who's Also A Finance Pro

True story: I'm a first-time pregnant lady and have no idea what I'm doing — especially when it comes to financially preparing for this change.

MTV / Via Giphy / giphy.com

I've seen the numbers — $233,610 for food, shelter, and other necessities to raise a child through age 17 — but it's hard to translate that big, scary number into daily life. Part of me is terrified, and part of me is simply avoiding the money debacle (aren't I smart?!).

In an effort to face reality, I chatted with Chantel Bonneau at Northwestern Mutual, who is not only a finance expert but also a mom herself.

Netflix / Via Giphy / giphy.com

Here's her advice to new and seasoned parents alike who are trying to do right by their kids. Of course, financial advice isn't one-size-fits-all. Definitely take your circumstances and needs into account before making any money moves.

1.Bonneau says that before your baby comes (or, better yet, before you start trying), you need to get real about what your life will look like post-baby.

NBC / Via Giphy / giphy.com

One of the financial pitfalls Bonneau says many parents face is not being realistic about the added cost of adding a new family member and not foreseeing changes to their cash flow.

"Will you have childcare costs? Diapers, formula, and more diapers? A reduction in household income if a parent plans to step back from working? The best thing you can do is plan ahead so that you can be proactive before the baby arrives," she says.

2.Turns out I need to take time NOW to clean up my finances.

This is a big one. Bonneau says, "Having a baby is a major life event and will help motivate you to think about the relationship you have with money and the priorities you want to achieve!"

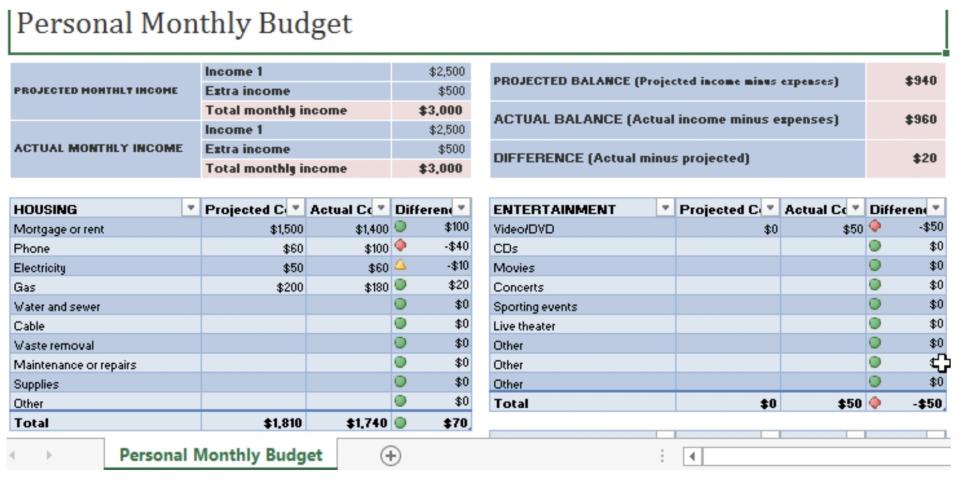

So if you've never budgeted before, now's the time to compare your monthly income with your monthly costs and see where you've been overspending (like too many dinners out, shopping sprees, hefty grocery bills). If you get used to following a budget now, it will be easier to do so once you have a new (pricey) baby around. Not sure where to start? Here are eight pretty simple budgeting methods you might want to check out.

"The best tip is to block off time when you are not exhausted (the end of the day) and take an objective approach to reviewing your costs, starting with fixed expenses," says Bonneau.

3.Bonneau notes that if finances aren't your cup of tea, you can seek out a financial adviser to help you budget and plan for your new addition.

Talking about money (especially with a partner) is never fun, but Bonneau says it's essential.

She suggests, "If budgeting is a sore subject, seek an adviser to walk you through the process to help manage the tension and responsibility of budgeting." In fact, they'll be able to give you customized, professional advice based on your income, expenses, and personal situation. Not sure where to go? SoFi offers free financial planning appointments to all their members, and the nonprofit Operation HOPE has free education and planners available for people with low to middle incomes.

4.I learned that now is also the time to talk about estate planning and beneficiaries.

NBC / Via Giphy / giphy.com

I know, I know, estate planning sounds like something you do when you're 70, but everyone should have a plan for what will happen to their assets (home, car, savings, etc.) when they die. This is also when you'll want to name beneficiaries for these things. Both elements are extra important now that you're a parent (or about to be one).

"It is important to update beneficiaries and have important estate planning conversations. A will or trust and naming a guardian can offer protection for your family in the event of an emergency, and this is one of the items you can check off of your list before baby arrives," Bonneau says. Not sure where to start? Look up the guidelines for writing a will in your state or seek the help of a pro.

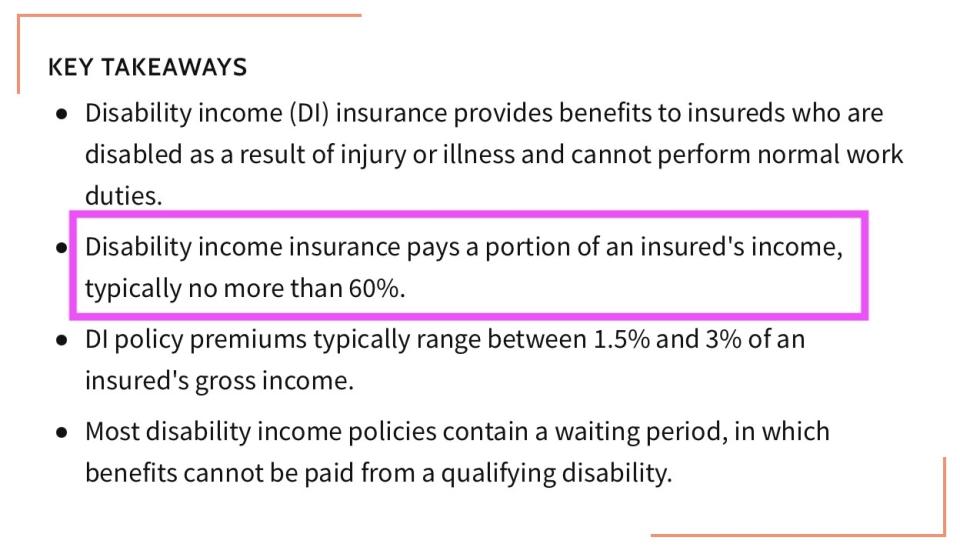

5.If you don't already have it (I don't!), Bonneau says, you should consider buying life and disability insurance.

While historically it might have been only you (and maybe your partner) you were responsible for, you now you have a little life relying on you for everything from school supplies to lunch money.

To avoid the costly fallout from a disability or death, it may pay to sign up for life and disability insurance. The former will ensure your family receives a chunk of money if you die, while the latter provides supplementary income if an illness or accident results in a disability that prevents you from working.

"Your employer may offer life and disability insurance coverage, and if that’s not enough to meet your needs, you also can purchase additional coverage through an insurance provider. Even if a parent isn’t working, they are fulfilling a role that is incredibly valuable and expensive to replace," says Bonneau.

6.I learned that in addition to looking into the distant future, I need to keep the near future in mind. Most notably, coming up with a plan to pay for the birth.

NBC / Via Giphy / giphy.com

Data from a recent Health Care Cost Institute report found that the average cost of childbirth for a person with employer-sponsored insurance in the US was $13,811, but the out-of-pocket spending ranged from about $1,000 in Washington, DC, to approximately $2,500 in South Carolina.

Of course, where you live and how you give birth can shift these numbers wildly. Cesareans are notoriously expensive, and hospitals are usually more expensive than birth centers or home births.

To avoid any surprises, Bonneau suggests "reviewing your medical plan details" in advance, noting that "many offer estimates for childbirth specifically."

7.Bonneau says you should also have an idea of how much you can afford to spend on baby stuff, then stay within that budget.

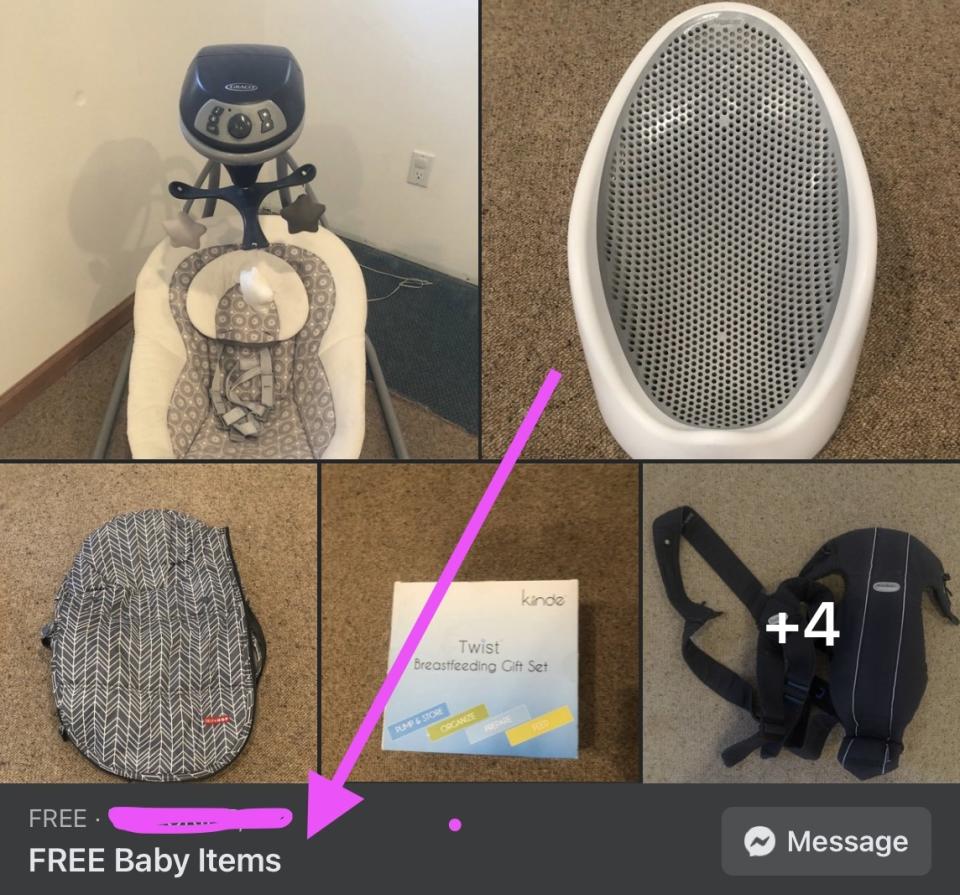

There is an entire industry around having a baby. If you wanted, you could literally spend thousands of dollars just getting your newborn set up for the first three months of their life. Or you could do it practically for free.

"If you purchase top-of-the-line products across the board, you could have a $10,000 outflow before baby even arrives," Bonneau warns, noting that "if your budget is lower, ask friends, family, or community resale groups or apps for lightly used items. ... Start with a clear budget and prioritize what you need, like a car seat, over other items that may be unnecessary, such as the 15th fancy outfit for a 6-week-old!"

8.And she says to ask your company about parental leave.

CBC / Via Giphy / giphy.com

Some companies have great parental benefits (including paid leave for moms and dads), but as a base requirement, the Family and Medical Leave Act (FMLA) promises just 12 weeks of unpaid, job-protected leave per year in the US.

Note, FMLA is unpaid. So really, unless your company is amazing, you'll need to factor into your early baby budget any decrease in work or time off that you plan to take.

"Do your due diligence up front so that you are not surprised. If your income will be short during parental leave, try to plan ahead to save in advance or prepare for what you can cut back on during that period of time," Bonneau says.

9.Keep in mind that one of the biggest costs of having kids is childcare (or quitting your job to provide care).

Fox / Via Giphy / giphy.com

You might live down the street from your retired parents or in-laws (lucky you!), but for most people, childcare can be a real, hefty cost that has to be factored into the new monthly budget.

Bonneau estimates that childcare can be as much as $5,000 a month if you want a full-time, dedicated nanny, but she notes there are plenty of less expensive options too.

"Many families will find nanny shares where two or more families work together to pay a nanny to watch several children. Some local schools offer affordable daycare programs; or in-home, accredited daycares can be more cost effective. Explore a DCFSA (dependent care flexible spending account) if your employer offers it to allow a deduction for the funds you can contribute for some childcare costs," she says.

10.If money is tight, don't stress it. There are always ways you can cut back in other areas to make room for this new cost.

Here's the deal: Having a baby will be an added cost for the next 18 years (at least), but there are ways to go about parenthood that don't include $600 strollers and a kitted-out nursery.

"Look for deals on used baby items or ask for hand-me-downs. People love seeing the stroller they overspent on going to use," says Bonneau, who notes that, baby items aside, "Many parents find savings in reducing their dining-out costs."

And, of course, you could say au revoir to that daily coffee habit.

11.Based on the anticipated monthly cost of the new addition, I'll need to reconfigure my emergency fund.

Your emergency fund should cover you financially for a few months if something goes awry: job loss, medical emergency, car or home repairs, etc. But now that you have a new addition, your monthly costs will be higher and you'll likely need to add a bit more cash to your fund.

Bonneau confirms that "when you have children, costs usually go up; therefore, the extra items that may come up can create a need to tap into that emergency fund. Generally, having three to six months of expenses [covered] allows you to withstand unexpected financial circumstances."

12.And Bonneau reminds new parents that once your babe arrives, you'll need to add them to your health insurance plan.

Now that your family has expanded, you'll need to add your little one to your health insurance policy. Because the birth or adoption of a child is an official qualifying life event, you can make this change anytime — although you'll want to do it shortly after they're born to ensure coverage.

"There is typically a 30-day window to add a child to a medical plan at work after a life event. Verify with your benefits if you have other options to consider as well," says Bonneau.

13.Plus, she says you might also consider buying your new baby life insurance.

Apatow Productions / Via Giphy / giphy.com

As you might remember, life insurance benefits the family in case of a death. While no one wants to think about death after experiencing new life, it is a reality.

Bonneau explains, "One of the benefits of child life insurance policies is that they typically include or offer a guaranteed purchase option, which allows the right to buy a certain amount of insurance at a locked-in health classification in the future."

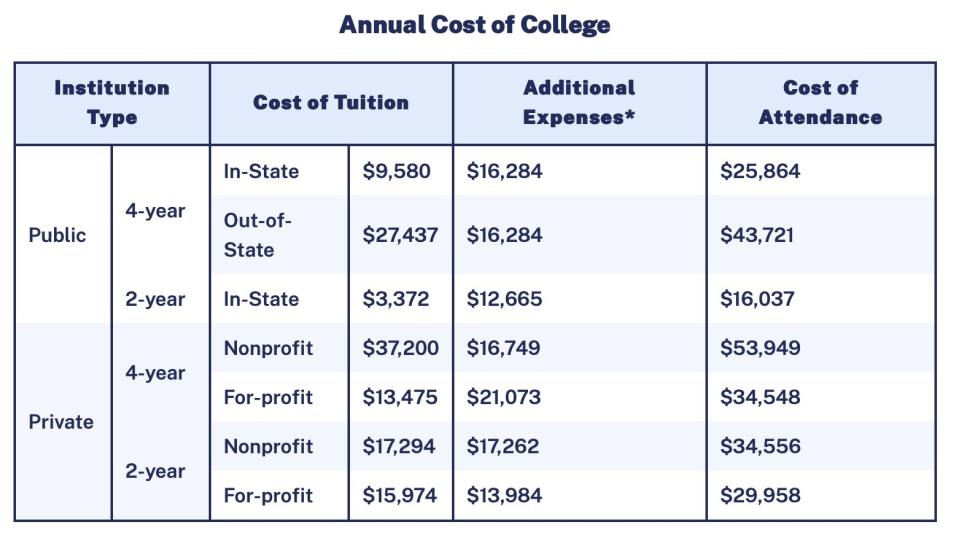

14.And finally, I learned that if there's any money left over, I should consider putting cash aside for my kid's college fund.

College is pricey. In fact, according to a 2021 report from EducationData.org, the average cost of college for each student in the US is $35,720 per year. Ouch.

Of course, your child may be a genius or über-talented, but on the off chance that they're not (sorry!), you may want to start thinking about starting a college fund.

"If saving for future college expenses is important and within budget, the earlier a family begins saving, the better. By working with a financial adviser, you can determine how much you’re able to save and learn if your state has beneficial tax deductions for the local state 529 plan [which is also tax-deductible]," says Bonneau.

Any seasoned parents out there up for sharing their financial tips? Some of us (ahem, me) could use all the help we can get.

And for more money tips and tricks, check out the rest of our personal finance posts.