Home Depot and small business — What you need to know on Tuesday

American small business and one of its biggest material suppliers will be in focus on Tuesday.

Earnings out of Home Depot (HD) will serve as a corporate highlight with the home-improvement retailer expected to report earnings per share of $1.82 on revenue of $24.5 billion with same-store sales expected to rise 5.7%, according to data from Bloomberg.

TJ Maxx parent company TJX (TJX) is also set to report earnings on Tuesday.

The main economic highlight will be the NFIB’s latest reading on small business optimism, which has been one of the strongest economic readings since President Donald Trump’s surprise election win last November.

Investors will also keep an eye on shares of Buffalo Wild Wings (BWLD) on Tuesday as the stock was trading higher by 28% in after hours action on Monday after The Wall Street Journal reported that private equity firm Roark Capital made a bid to buy the company for over $150 per share, or more than $2.3 billion.

Buffalo Wild Wings shares closed at $117.25 on Monday.

Blockbuster earnings for FAAMG

One of the market’s predominant themes this year has been the performance of big-cap tech companies.

Since CNBC’s Jim Cramer coined the moniker for the FANG stocks — Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOGL) — back in 2015, these tech giants have been market leaders and the subject of investor fascination bordering on obsession.

In 2017, these stocks have accounted for about a quarter of the S&P’s overall advance (the same percentage as these stocks have accounted for over the last three years).

Earlier this year, we noted that analysts at Goldman Sachs (GS) had re-branded the FANG stocks as the FAAMG stocks, swapping in Apple (AAPL) and Microsoft (MSFT), with these companies having between them over $3 trillion in market cap.

With each of these companies having reported third quarter earnings, Goldman’s David Kostin and the equity strategy team looked at the actual results these companies have turned in. And the results should, perhaps, calm investors who see the market as being overly invested in just a few big tech names.

Kostin and his team note that the S&P 500’s information technology sector, which houses all of the FAAMG names but Amazon (which is classified as a consumer discretionary stock), has contributed to almost 90% of the index’s overall earnings beats relative to consensus expectations. And the four-largest tech stocks — Apple, Alphabet, Microsoft, and Facebook — accounted for 50% of this beat. In other words, good earnings have been all about tech names, and good tech earnings have been powered by these giants.

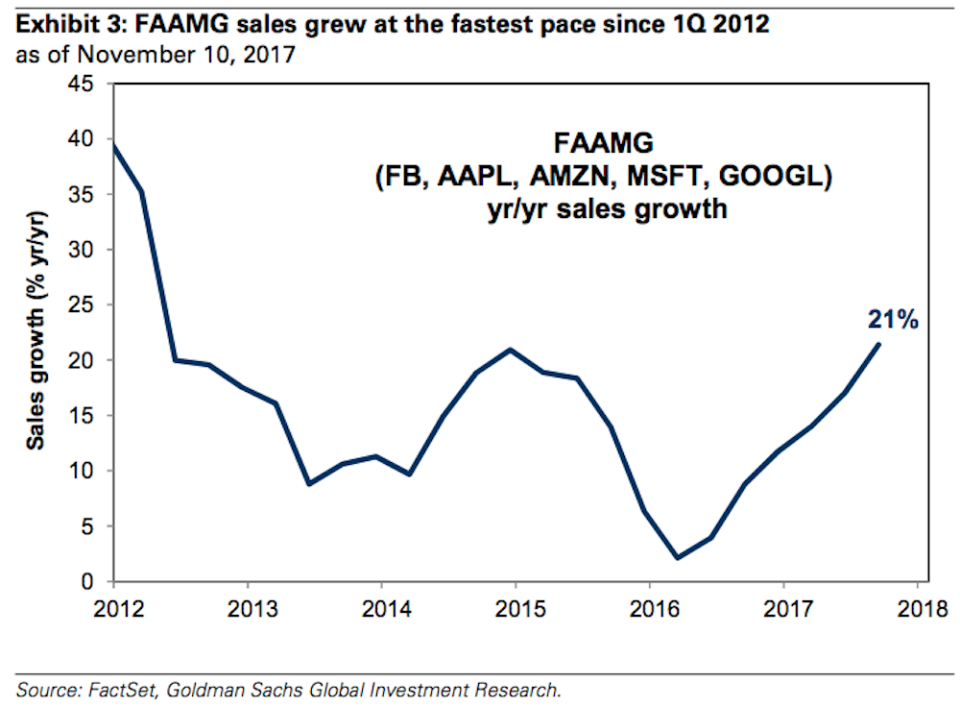

Add in Amazon, and the FAAMG stocks have seen sales growth of 21% in the third quarter, the best year-on-year growth rate since the first quarter of 2012. And considering where each of these companies is in its life-cycle — really only Facebook is anything like its developmental years — this kind of sales growth indicates that as a whole, this group’s performance is at a collective all-time high.

Goldman notes that recent conversations with clients have, “focused on the sustainability of sales growth, the potential for government regulation, and valuations given the stocks’ 45% YTD rally.” Investors, in short, are worried that something will go wrong in markets if something goes wrong with the FAAMNG stocks.

Kostin notes that these stocks current trade at an enterprise value-to-sales ratio that is double that of the S&P at large, which is in-line with the 10-year average. Which means, basically, these names are about as richly valued relative to the rest of the market as they’ve been over the last decade.

So talking about FANG or FAAMG might seem like a gimmick, and it may seem that investors are getting themselves too worked up about just a few stocks. And this may be true. But that obsession, at least right now, does not appear to be leading to valuations outside of recent historical norms.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: